When it comes to financial debt in the Euro Zone, “deleveraging has barely begun,” said Daniel Wagner, author and risk consultant. “It’s a long and winding road.”

On August 7, 2012, Daniel Wagner, CEO of Country Risk Solutions, a US-based cross-border risk management consulting firm, addressed a Global Association of Risk Professionals (GARP) audience about the Eurozone crisis. Wagner, author of Political Risk Insurance Guide, and Managing Country Risk, published in 2012, spoke on a range of related topics. Wagner’s talk was far-ranging and comprehensive (78 slides in 45 minutes). He spoke about the impact of debt: in particular, the effect of the Euro Zone crisis on the developing world.

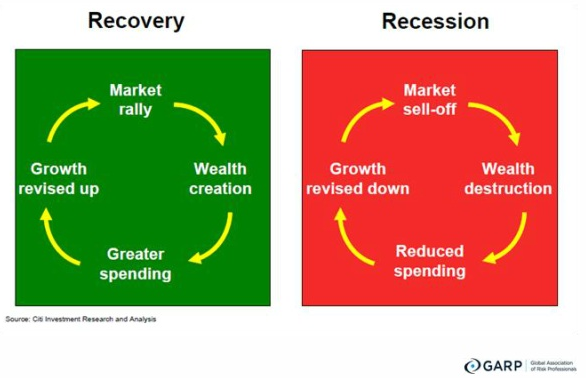

Wagner described the impact of rising debt and rising protectionism, and touched briefly on some trends that would be having an impact on the global economic landscape in the long-term. Although Greece has a gross domestic product (GDP) of only $303 billion, which is less than 2 percent of the EU GDP of $17.6 trillion, Wagner cautioned that a default would “have a big impact because of the psychology involved.” On the theme of market psychology, he pointed out that “risk can be a self-reinforcing behaviour,” whether it is for the ‘risk on’ or ‘risk off’ trade, as shown in the accompanying figure (reprinted with permission).  Public debt as a percentage of the GDP is high for the developed world. Japan, the US, PIIGS, and other countries will have high public debt continuing into 2015, at least.

Public debt as a percentage of the GDP is high for the developed world. Japan, the US, PIIGS, and other countries will have high public debt continuing into 2015, at least.

The Euro Zone crisis has had a profound effect on the developing world, with their credit lines being cut or delayed, and foreign aid having been slashed since 2009. EU austerity has decreased demand for exports from developing countries. Burundi and Uganda, for example, used to send over thirty percent of their exports to the EU. Cross-border lending from EU financial institutions has grown flat. Wagner spent some minutes particularizing the remittance flows to developing nations. The upshot was simple: “When economies are dependent on remittances, [the decrease in flow] can have devastating impact.” The fiscal balance in low-income countries has gone from excess to deficit within a few years. The low-income countries are most vulnerable to the Euro Zone crisis.

Wagner compared inward FDI (Foreign Direct Investment) around the world. Among the BRIC countries, he said that FDI has grown from 2007 to 2010 only for Brazil and China. Country after country in Europe and Africa has experienced an FDI decrease, he showed. Only resource-rich countries such as Indonesia and Viet Nam have reported an FDI increase over that period.

The policy implications are significant. For one, developing countries must stimulate domestic demand or double their efforts to promote south-south trade. Many countries will be forced (or well advised) to loosen their trade and investment policies and creating an atmosphere friendlier to foreign traders and investors.

Wagner launched into a description of trade protectionism, which is on the rise, with the G20 being “the worst offenders.” During this part of the talk, he referred extensively to research carried out by the London-based organization Global Trade Alert, which has identified over 1700 protectionist measures implemented since 2008. “Today’s trade restrictions are not aimed at fighting the temporary effects of the global crisis,” he said. Rather, they are “intended to stimulate recovery.” Of the sectors most affected by discriminatory measures, the top four are in the financial, agricultural, basic metals, and basic chemicals industries.

In one of the few positive trends noted, Wagner pointed out that economic inequality is falling globally, with a decrease in the Gini coefficient over the past forty years. Wagner said that inequality is rising among developed countries however. Poverty levels are decreasing in China but rising in the US.

Commodity prices have risen dramatically since the financial crisis. Wagner then demonstrated how some countries, such as China, are implementing fiscal and monetary policies out of synch with food prices and the consumer price index, in an effort to stimulate the economy with loose monetary policies–even though food inflation may dictate otherwise.

“Rising grocery bills lead to political unrest,” said Wagner. He challenged the audience to imagine a US citizen, who currently spends about 7 percent of disposable income on groceries, having to contend with what the average Pakistani faces: a whopping 45 percent spent on groceries. “There would be riots in the street if that were the case in the US,” he said.

Quarterly world exports of manufactured goods have been declining lately. The Baltic Dry Index has fallen below the 2009 lows. “Most of the world’s states are poorly equipped to deliver essential functions to their people,” said Wagner. The weakened US leadership is facing a host of issues, and the weakness in the Chinese economy is behind the decrease in commodity prices. The near-term WTO forecast is for a slowdown in trade volume growth (3.7 percent in 2012, a weighted average of 2.0 percent in developed countries and 5.6 percent in developing). The longer-term forecast is for a deeper recession in the Eurozone.

The Euro Zone crisis is likely to last three to five years, predicted Wagner, because “risk aversion will continue to result in delayed or reduced trade and investment flows.” The Eurozone crisis initially prompted many investors to invest in emerging markets, but the Euro Zone problems will have a negative impact on emerging markets going forward. The countries that will pay the highest price are those with the fewest natural resources, small domestic markets, and poorly diversified exports. To reiterate a point made early in his talk, the Euro Zone and the world are so interconnected, there will not be a controlled explosion. ª

The webinar presentation can be found at: http://www.garp.org/risk-news-and-resources/webcasts/on-demand-webcasts.aspx

Daniel Wagner’s latest book can be found at: Managing Country Risk.com

Check out other resources available at Country Risk Solutions: www.countryrisksolutions.com