What is Key to Integrating Op Risk?

“It’s critical to unite multiple perspectives on risk,” said Brenda Boultwood, Senior Vice President at MetricStream, “even though approaches to risk and compliance can be very different” throughout an organization. Boultwood was the second of two speakers at a webinar on operational risk held on August 27, 2015, sponsored by the Global Association of Risk Professionals. A common framework will require standard taxonomies, common definitions, and consistent risk assessment across a company, said Boultwood. She sketched out an integrated enterprise risk management (ERM) framework, in which all types of risk share a common hierarchy, common business processes, and a common […]

Is it OpRisk? or Business Risk?

Operational risk has figured prominently in the business news this summer: a lightning storm destroyed cloud data stored by Google, and a cyber-hack of dating website Ashley Madison breached confidentiality of 33 million accounts. Are companies addressing operational risk the best way possible? What is called operational risk may in fact have its roots in business risk, according to Mike Finlay, Chief Executive of RiskBusiness International. He was the first of two speakers at a webinar on operational risk held on August 27, 2015, sponsored by the Global Association of Risk Professionals. For example, the 2011 Fukushima Daiichi disaster in […]

Most Valuable Skill for Risk Managers?

In terms of marketable expertise for financial risk managers, what counts more: quantitative skills, or the ability to communicate and interpret the results of calculations? “The biggest surprise of our in-depth study is that communication ranked above quant skills,” said Christopher Donohue, Managing Director of Research and Educational Programs at the Global Association of Risk Professionals. On June 30, 2015, he reported on the results of the 2015 Job Task Analysis of GARP members. Survey Design The goal of the survey and analysis was to identify knowledge and skills necessary to support competent performance of tasks and responsibilities that are […]

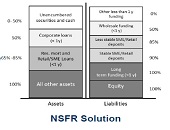

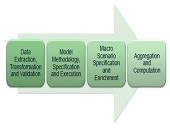

3 Steps to Liquidity Compliance

Are you scrambling to adjust to new reporting expectations for liquidity risk? Getting good data is key, but “you have to get it right and on time,” said Pierre Mesnard, Director Solutions Specialist at Moody’s Analytics. He was the third of three presenters on liquidity risk compliance at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals. Once you have the data, there are three steps to delivering integrated liquidity compliance and business management, said Mesnard. First, you must ensure all financial instruments at your bank can be adequately modelled in order to generate realistic […]

Liquidity: A Change in Governance

Have you noticed that financial risk managers talk and think differently about liquidity risk, compared to pre-crisis days? The 2007-08 financial crisis was a watershed in the evolution of liquidity management, according to Nicolas Kunghehian, Director Solutions Specialist at Moody’s Analytics. He was the second of three presenters on liquidity risk compliance at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals. “Before the crisis, there was only one team dedicated to monitoring and managing liquidity,” Kunghehian said. Liquidity risk was assumed to be small, and the Treasury department was chiefly fine-tuning the profit and […]

An Opportunity To Get Things Right

When it comes to forecasting liquidity risk, does your bank follow best practices? It might be tough to do so, because of a “data conundrum,” said Gudni Adalsteinsson, author of The Liquidity Risk Management Guide – from Policy to Pitfalls. Banks carry out a “retrospective analysis” on data that is “not forward looking.” Adalsteinsson, Head of Global Liquidity, Group Treasury at Legal & General Group Plc, was the first of three presenters on liquidity risk compliance, at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals. He praised the Basel III regulation on liquidity risk. […]

Effective Risk Reporting

Effective risk reporting means “having the intelligence at your fingertips but exercising the judgment to report only what your company needs,” said Elizabeth Abraham, Director of Professional Services at MetricStream, and the second of two presenters at the June 16, 2015, webinar on Effective Risk Reporting sponsored by the Global Association of Risk Professionals. “Lack of clarity about the reporting objective” is a common barrier to effective enterprise risk management reporting, she said. Make sure you understand what level of information the audience wants. “Data model inconsistencies can lead to an inability to aggregate” the risk estimates, and that’s another […]

One Size Does Not Fit All

When it comes to risk reporting, do you ever feel that you are trying to push a square peg into a round hole? According to Gordon Goodman, that may happen rather often for companies that are not in the finance industry. Goodman, Director of Governance and Enterprise Risk Management at NRG Energy, was the first of two presenters at the June 16, 2015, webinar on Effective Risk Reporting sponsored by the Global Association of Risk Professionals. According to Goodman, there has been a push by banks to “bring their metrics to the marketplace, but this has created problems” for non-financial […]

Four Lessons from Stress Testing Exercise

“It very quickly became apparent that this was not a one- or two-month exercise,” said Charyn Faenza, Vice President, Manager of Corporate Business Intelligence Systems at First National Bank, the largest subsidiary of the largest subsidiary of FNB Corporation. She was the second of two presenters at the May 19, 2015, webinar on Stress Testing Modeling sponsored by the Global Association of Risk Professionals. Faenza was referring to her bank’s experience as an example of a “DFAST 10-50” bank that is required to conduct an annual stress test. She drew four important lessons from the exercise. Good Modeling Requires Good […]

“Not Only The What But The How”

When it comes to financial data for stress testing, there’s a good news-bad news aspect. The good news may be that a bank did not suffer severe financial stress but the bad news is that it will be harder for the bank to model “bad events” if it does not have such data. And banks “will get written up if [the regulators] don’t believe their bad events,” said Tara Heusé Skinner, Manager at SAS Risk Research & Quantitative Solutions, and co-author of The Bank Executive’s Guide to Enterprise Risk Management. She was the first presenter of two at the May […]