“It very quickly became apparent that this was not a one- or two-month exercise,” said Charyn Faenza, Vice President, Manager of Corporate Business Intelligence Systems at First National Bank, the largest subsidiary of the largest subsidiary of FNB Corporation. She was the second of two presenters at the May 19, 2015, webinar on Stress Testing Modeling sponsored by the Global Association of Risk Professionals.

Faenza was referring to her bank’s experience as an example of a “DFAST 10-50” bank that is required to conduct an annual stress test. She drew four important lessons from the exercise.

Good Modeling Requires Good Data – “How do you get a good model when you don’t have any [negative events] to model?” Faenza asked. For many banks, there’s a shortage of historical data and much of what is available is incomplete and/or unstructured data. The credit perspective is very different from the accounting perspective. There are many-to-many relationships. “Reconciling data becomes a very long and manual process,” she noted. If data are not available, the regulators usually permit a data supplement drawn from other, similar banks, “but banks must strive for better data.”

Data Warehousing – Collecting the data in central repositories of integrated data from one or more disparate sources “can help alleviate reconciliation problems,” she said, but the drawbacks to data warehousing are that it is “time-consuming, expensive, and vulnerable to scope creep.” She suggested banks implement data warehousing in stages.

Resources – Technical and Human – “A smaller bank must think about its technical resources,” Faenza said, “and none of this can be done without appropriate personnel,” especially the financial analysts and “modellers who will consume the data.”

Time Management – “It’s important to use time in the ‘off season’ wisely,” said Faenza. “Look at the model inventory and project planning,” and other activities that will come to the fore during the stress testing period.

To address the challenges of building a “best practice” stress testing process, Faenza recommends that a bank “create a cross-functional steering committee to bring business units together.” Also, she suggested using gap analysis.

Potential benefits to a good stress testing program are: “more consistent data management processes; improved modeling to support operational forecasting, and better data to support portfolio and customer analysis.:

Aiming for “best practice” stress testing can feel like an uphill struggle, especially if a bank is only in its second year of the program, but ultimately the bank will benefit. ª

Click here to view the webinar. Faenza’s portion covers slides 11 to 19.

Click here to read about the first presentation.

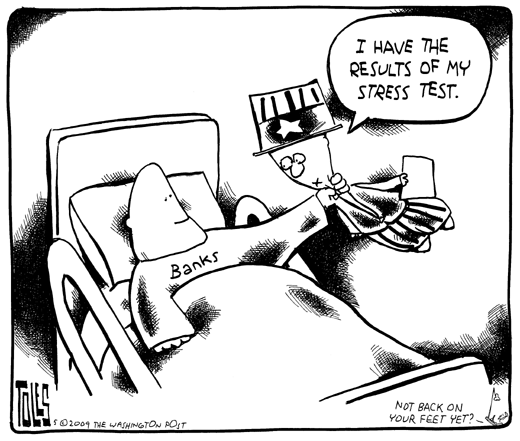

The graphic for this posting is from the website Economist’s View.

Further reading: Stress Testing for Mid-Sized Banks