When it comes to financial data for stress testing, there’s a good news-bad news aspect. The good news may be that a bank did not suffer severe financial stress but the bad news is that it will be harder for the bank to model “bad events” if it does not have such data. And banks “will get written up if [the regulators] don’t believe their bad events,” said Tara Heusé Skinner, Manager at SAS Risk Research & Quantitative Solutions, and co-author of The Bank Executive’s Guide to Enterprise Risk Management. She was the first presenter of two at the May 19, 2015, webinar on Stress Testing Modeling sponsored by the Global Association of Risk Professionals.

When it comes to financial data for stress testing, there’s a good news-bad news aspect. The good news may be that a bank did not suffer severe financial stress but the bad news is that it will be harder for the bank to model “bad events” if it does not have such data. And banks “will get written up if [the regulators] don’t believe their bad events,” said Tara Heusé Skinner, Manager at SAS Risk Research & Quantitative Solutions, and co-author of The Bank Executive’s Guide to Enterprise Risk Management. She was the first presenter of two at the May 19, 2015, webinar on Stress Testing Modeling sponsored by the Global Association of Risk Professionals.

Skinner said stress testing has risen to prominence in financial risk management because it is required by both the Dodd-Frank Act Stress Tests (DFAST) and the Comprehensive Capital Analysis and Review (CCAR) regulations. More models are required; improved models are required; and the models must be managed and their results appropriately interpreted.

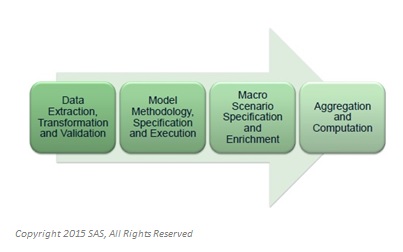

She presented a modular four-step view of stress testing, as shown in Figure 1. These steps are: data extraction and validation; model input and development; macroeconomic scenario specification; and finally, aggregation and computation.

Skinner emphasized that each step was an iterative process. For example, during data extraction, the data has to be collected from a variety of sources, must be reconciled and validated, and might require further clean-up during the extraction. Some banks use consortium data to fill the need for data about adverse economic times.

Another example of iteration is when data input occurs. The models, as they are being used, might require further adaptation, and thus would require the data to be input again.

“We’re told the regulators are just as concerned about the documentation of the stress testing process as they are about the results of stress testing,” said Skinner. They are “very interested in not only the what but the how.”

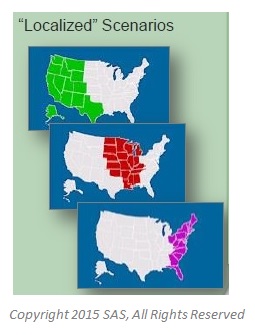

Each year, banks receive broad outlines of the stressed macroeconomic scenarios from the regulators, but need to enrich the scenarios with more granular detail in order to run sophisticated models. The baseline, adverse scenario, and severely adverse scenarios are supplemented with “localized” scenarios (see sample geographies in Figure 2). The scenarios are segmented by business unit (e.g. commercial lending; investment banking; retail banking) and by industry.

In the final stage, aggregation and computation involve “an incredible amount of moving parts,” said Skinner. Computations are done, models are tweaked, and computations are re-done. She said, “those who are able to automate stress testing in an end-to-end continuum will have less pain.”

Having described the modular components to dynamic stress testing, Skinner turned the floor over to the second speaker, who presented a real-life case. When Skinner resumed, she had a three-point summary of “best practices” stress testing. It must have good design, good governance, and solid infrastructure. ª

Click here to view the webinar. Skinner’s portion covers slides 4 to 10 and slide 20.

Click here to read about the second presentation.

More extensive research papers are available for download from SAS. Click on CCAR: An Appraisal of Current Practices

All figures are used with permission from Skinner’s webinar.