Stressed Interest Rates: ‘Simple’ Not Good Enough

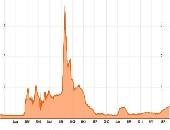

“It’s difficult to apply historical down-shocks to the current low interest rate environment,” said Will Doerner, “and models have problems in the low interest rate environments of today.” Doerner is Senior Economist at the Federal Housing Finance Agency (“Agency”), and was the first presenter at a GARP webinar on how to generate historically-based interest rate shocks, which was held October 28, 2014. An accurate estimation of market risk helps financial institutions determine the amount of capital needed to withstand adverse market events. Interest rate changes represent a key factor for institutions with large fixed income portfolios. As such, when stress […]

Monetary Policy and Treasury Risk Premia: Part 2

After giving an overview (see Part 1), Paul Whelan, of the Imperial College London and formerly the European Central Bank, walked the audience through the mechanics of an award-winning paper on monetary policy at a webinar on January 16, 2014 sponsored by GARP. A shock, by its very nature, is non-routine. Therefore, “a good measure of monetary policy shocks should exclude systematic components,” Whelan said. Another challenge was to “distinguish between quantity of risk versus price of risk channels.” Use of the Taylor rule allowed the researchers to isolate the exogenous dynamics of monetary policy. The trio was able to […]

Monetary Policy and Treasury Risk Premia: Part 1

“Monetary policy makers want to control the long end of the yield curve,” said Paul Whelan at a webinar on January 16, 2014 sponsored by the Global Association of Risk Professionals. Whelan co-authored an article that won the 2013 GARP Award for best paper in financial risk management. “Monetary Policy and Treasury Risk Premia”, by Andrea Buraschi, Andrea Carnelli, and Paul Whelan, provides a quantitative analysis of the effect of monetary policy shocks on future bond returns. Buraschi is at the University of Chicago Booth School of Business and Imperial College London; Carnelli is at Imperial College London; and Paul […]

Eye on Credit Markets. Part 2: Spreads Hit Floor

“The central bank stimulus has been significant—what will happen as it’s withdrawn?” asked Seth Rooder, Global Credit Derivatives Product Manager at Bloomberg. He was the second of two speakers to consider the effects of tapering in a GARP webinar presentation on November 21, 2013. A key question is: “when will the Fed taper?” Rooder said not soon, because with unemployment still above 6.5 percent, Vice-Chair of the Fed Janet Yellen will have unwillingness to taper. Currently, the Fed is pumping money into the system by buying $40 billion in mortgage-backed securities and $45 billion in Treasury bills per month. He […]

Basel III and Beyond: Capital Management and Funding Strategies

“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III. Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about […]

Libor Fallout: Part 3. A Muted Valuation Effect

On December 20, 2012, the third presenter at the GARP webinar on the LIBOR scandal was Robert Maxim, director of Complex Asset Solutions at Duff & Phelps. He spoke about the valuation implications of incorrect LIBOR rates. The cash flow of many financial instruments is indexed to LIBOR, he said, for big companies as well as small, and even for individual consumers such as those holding private student loans. Maxim considered an interest rate swap example in which the floating leg is tied to LIBOR. The valuation is always computed on the difference between the fixed and floating leg. “The […]

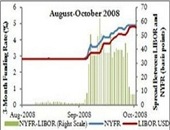

Libor Fallout: Part 2. Whistling Past the Graveyard

On December 20, 2012, the second presenter at the GARP webinar on the LIBOR scandal was Cliff Rossi, Executive-in-Residence, Center for Financial Policy, University of Maryland. He described the risk implications arising from the Wheatley Review of LIBOR. Rossi noted that some market participants were “still feeling PTSD from the financial crisis of 2008”—and then they got hit with the LIBOR scandal. Rossi succinctly described what went wrong: Low volume in interbank lending in unsecured transactions created an over-reliance on “expert judgement” hence the rate was subject to manipulation. Part of the problem, Rossi said, is that LIBOR reporting was […]

Libor Fallout: Part 1. The Stomach Ache During the Heart Attack

The emerging scandal around the setting of LIBOR (the London Interbank Offered Rate) prompted GARP (the Global Association of Risk Professionals) to convene a panel of three experts to inform its members about the background and implications of the LIBOR fraud. On December 20, 2012, the first presenter at the GARP webinar was Amy Poster, Strategic Adviser at Iron Harbor Capital Management. She described the background and key facts. Calling it the “$800 trillion scandal,” Poster said that these events touched many derivatives markets, various consumer debt instruments such as credit card loans, and 100 percent of the sub-prime market. […]

Zombie Banks Part 2. A Call for Change

Given the current high coolness quotient of anything “zombie,” a webinar about “zombie banks” is guaranteed to pique the interest of even the non-bankers out there. (Kudos to the non-financial types who made it through Part 1 and the discussion of interest rates.) But really, “zombie” is nothing more than a highly picturesque way to refer to something that is kept in motion or presumed viable long after it normally would have expired. “Zombie yogurt,” anyone?To recap Yalman Onaran’s definition in Part 1 of this posting, a zombie bank is a financial institution that continues to exist “even though the […]