“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III.

Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about near-term global prospects. In all, the regulatory changes are coming at an inopportune moment.

“Tomorrow’s banks must become more client-centric by leveraging sophisticated insights to improve risk management, pricing, channel performance and client satisfaction,” said Onorato, quoting the conclusion from a recent IBM global survey of banks. He pointed out that, perhaps surprisingly, systemic risk has increased in the wake of preparations for higher capital requirements such as those in Basel III. This is because the top 30 banks are building up their capital and now have larger asset sizes.

The main expected business model change, Onorato said, is an improvement in risk management techniques by eliminating operational silos. [Ed. Note: See recent 3-part posting on breaking risk management silos.] “Banks must take a holistic risk management view. Banks must restructure their business model to reduce complexity.”

Information systems capabilities within the banks must improve. They must be, or become, extensively interactive and available in real-time to enable business end-user focus for “what-if” strategizing. Onorato said that banks must go from “deleveraging” to “de-risking.” Furthermore, they must go from an “enterprise-wide” to a “legal entity” business model.

“It’s important to hedge macro-economic uncertainty” at a time of high market volatility, said Onorato.

He drew a distinction between direct costs and opportunity costs when it comes to liquidity and capital funding. For example, there is the direct cost of banking book products compared to the opportunity cost of funding the liquidity buffer.

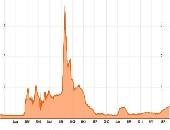

Another example of opportunity funding cost, relating to derivatives, was summarized in a five slides on the funding value adjustment (FVA). The calculation depends on the LIBOR-OIS spread. (See accompanying figure, with the well-known September 2008 spike.)

Basel III will have an impact on pricing and performance, especially given new accounting adjustments which are not uniform between international accounting bodies and the Basel III regulations, Onorato pointed out.

He gave a worked example of the impact of Basel III in which he, looked at equity and a bond portfolio. He compared risk capital calculated under new regulations against the risk-adjusted return on capital (RAROC) hurdle rate for the portfolio and concluded that the rankings would change in the new regime.

Simultaneous enterprise-wide stress testing will “break all silos,” said Onorato. In June 2011, the US Treasury issued new guidelines for stress testing by big banks. Two new requirements are reverse stress testing and enterprise-wide stress testing. The best stress testing, he said, should include a range of deterministic and stochastic frameworks, and a range of financial and non-financial risk factors. He covered an example in which stress on collateral affected credit risk and market risk, thereby increasing the liquidity risk.

Strategic business model implications discovered through stress testing can be far-reaching. Onorato showed a 6-slide case study of a bank affected by the Eurozone instability, to the point where it caused a breach in Tier 1 capital ratios. Risk managers—and decision makers—at the bank wanted the capability to drill down to the specific components of the portfolio that were failing.

All in all, banks can and should continue to prepare for Basel III, even if there is a lack of guidance on some details such as the countercyclical buffer, Onorato said. “The dialogue will continue to be heavy… and I expect changes.” ª

Click here for a summary of Onorato’s presentation in October 2012. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=642568&s=1&k=E4F90C6299234DA3C21D4F8792A730A4