Access to Alternatives

Alternative assets are an important part of modern portfolios—but how can you gain access to them? Do investors and investment advisors know what alternative investment options exist, and what platforms provide them? Do advisors know how to use modern investment platforms to differentiate their offering and provide unique opportunities? How can this type of access on the new platforms enhance the business asset managers? Four panellists convened on October 26, 2021, to discuss these aspects of alternative assets, in a webinar sponsored by the Canadian Association of Alternative Strategies & Assets (CAASA), a trade association representing alternative investment managers, service providers, and investors. The […]

Taking Stock

As the covid-19 vaccines continue to be rolled out across the world, how can central banks best counteract the impact of the pandemic? Now might be a good time to pause and reflect on the economic response in Europe. Zanny Minton Beddoes, the editor-in-chief of the magazine the Economist, sat down for an interview with Christine Lagarde, President of the European Central Bank (ECB) on February 10, 2021, to reflect on the challenges Europe faces as it tries to restart its economy while protecting the health of citizens. Lagarde noted the ECB was praised for its quick response in the early […]

The Achilles Heel of Banking

After last decade’s financial crisis, regulators introduced several new measures to reduce systemic risk in the financial system. How are the new safeguards working? What are the implications for future balance sheet structure? The CFA Society Toronto convened a panel of three experts on November 25, 2020, to discuss the new regulatory capital and liquidity frameworks and how they are reshaping the way Canadian banks approach the market. The webinar, including a Q&A session, was moderated by Nigel D’Souza, Investment Analyst, Veritas Investment Research. “There’s no doubt the financial crisis changed balance sheets,” said Bruce Choy, Managing Director (Former Risk […]

Private Equity in “the new normal”

From pandemic to protectionism, global events and trends are having an impact on the private equity (PE) markets. From a Canadian perspective, what effect are these issues having on the alignment between PE investors and PE fund managers? In Toronto on July 9, 2020, Helen Pham welcomed three panellists to the webinar titled, “Private Market Trends: Improving Alignment Between Investors and Managers.” The webinar was organized by the institutional asset management committee of the CFA Society Toronto. The panellists shared their thoughts on how investors should view effects of the global pandemic on private equity markets and the associated risks […]

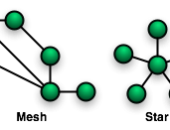

Central Clearing Design

If you had to design a central clearinghouse for transactions in financial markets, what size of guarantees should be offered? And what percentage fees should be charged? “The central clearing modifies the market,” said Andreea Minca, “because the old network structure [of one-to-one] is changing to a new ‘star’ structure.” Minca is Assistant Professor at the School of Operations Research and Information Engineering at Cornell University and was the sole presenter at the December 6, 2016, webinar on systemic risk and central clearing design to members of the Global Association of Risk Professionals (GARP). Under new US legislation, all over-the-counter […]

“Deal With It”

When it comes to technology advances in the fixed income markets in Canada, “peer-to-peer still needs some work,” said Robert Pemberton, Head of Fixed Income at TD Asset Management. His company’s client base “runs the gamut from retail right through to large investors.” Approximately two and a half million are mutual fund clients. He was the third of three panellists at a September 18, 2015, luncheon sponsored by the CFA Society Toronto, and held at the Toronto Board of Trade. Participants were commenting on regulatory changes in the fixed income markets announced the day before. Canadian Securities Administrators (CSA) will […]

“A Step in the Right Direction”

“The new regulation is a solid step in the right direction,” said Steve Thom, Managing Director at RBC Capital Markets, referring to the September 17 announcement by Canadian Securities Administrators (CSA) on a new reporting system. “The new regulation will increase price transparency, which is important for investors to be able to make more informed decisions. This is a good thing,” said Thom, “but the big thing is size.” He was the second of three panellists at a luncheon, sponsored by the CFA Society Toronto on September 18, 2015, to discuss changes in the fixed income markets. However, “full size transparency would […]

Fairness in Fixed-Income Markets

What are the essential building blocks of market integrity? Information, and fair access to that information. Transparency, but not onerous transparency. “There was a lack of fixed-income data, and large investors had better access to data,” said Ruxandra Smith, Senior Accountant at the Ontario Securities Commission (OSC), the first of three speakers at a luncheon sponsored by the CFA Society Toronto on changes in the fixed income markets in Canada. The event was held at the Toronto Board of Trade on September 18, 2015. Smith was referring to hot-button issues identified in the April 2015 report on the Canadian fixed […]

Is it OpRisk? or Business Risk?

Operational risk has figured prominently in the business news this summer: a lightning storm destroyed cloud data stored by Google, and a cyber-hack of dating website Ashley Madison breached confidentiality of 33 million accounts. Are companies addressing operational risk the best way possible? What is called operational risk may in fact have its roots in business risk, according to Mike Finlay, Chief Executive of RiskBusiness International. He was the first of two speakers at a webinar on operational risk held on August 27, 2015, sponsored by the Global Association of Risk Professionals. For example, the 2011 Fukushima Daiichi disaster in […]