From pandemic to protectionism, global events and trends are having an impact on the private equity (PE) markets. From a Canadian perspective, what effect are these issues having on the alignment between PE investors and PE fund managers?

In Toronto on July 9, 2020, Helen Pham welcomed three panellists to the webinar titled, “Private Market Trends: Improving Alignment Between Investors and Managers.” The webinar was organized by the institutional asset management committee of the CFA Society Toronto.

The panellists shared their thoughts on how investors should view effects of the global pandemic on private equity markets and the associated risks and opportunities. They were interviewed by Neetesh Kumar, Partner, Spruceview Capital Partners, whose questions are summarized in boldface below.

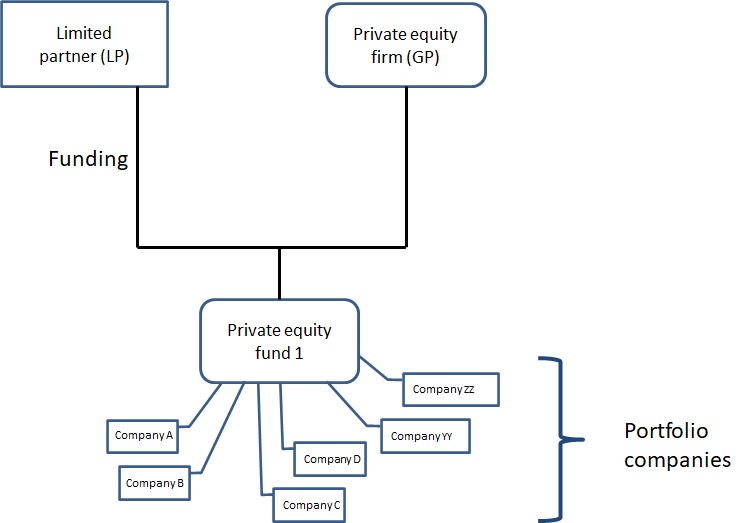

By investor we mean the limited partner (LP) who signs an agreement with the manager, or general partner (GP), to create a PE fund which makes a series of PE investments in portfolio companies as shown in the diagram below.

Neetesh Kumar: How have GPs and LPs been responding to the “new normal”?

“The new normal has not existed for very long, it’s more like a blip in the system,” said André Bourbonnais, Managing Director, Global Head of Long-Term Private Capital, Blackrock. “We’ve focussed on funds and portfolio companies, making sure to focus on winners, to provide liquidity and restructure debt, where needed.”

“We are below target in PE allocation,” said Adam Buzanis, Portfolio Manager, CAAT Pension Plan. He said they had only begun PE investing in 2009.

“There was a tremendous surge in capital calls in March and April,” said Jennifer Choi, Managing Director, Industry Affairs, Institutional Limited Partners Association (ILPA). A capital call occurs when a PE fund demands a portion of the money promised to it by an investor.

“LPs are being thoughtful about liquidity challenges – they’re taking a rational approach because they lived through [financial turmoil] a decade ago.”

Choi expressed surprise that ILPA was not hearing concern over the denominator effect. The “denominator effect” happens when an investor’s private equity allocation grows as a percentage of the portfolio because value of public markets is declining. Investors have a greater proportion of private equity in their portfolio, often forcing them to rebalance.

Kumar: When working with portfolio companies, what are the main issues?

Bourbonnais said that, at the moment, he has only one company in the portfolio, although a transaction in Europe is soon to close, giving a second portfolio company. The pandemic has forced his team to look at priorities. “The license to brand is more important than paying rent.” He spoke of trying to provide the company with liquidity “to benefit from carnage.”

With about 55, 60 fund investments, chiefly concentrated in software, Buzanis said the liquidity “seems okay” at CAAT Pension Plan, although there were some capital calls for subscription lines of credit (SLC).

He noted they are “in preparation for a prolonged slowdown.” New opportunities might present themselves, “special situations” or “restructuring that requires capital injection.”

Kumar: Where are the investment opportunities?

Buzanis deflected the question with a bigger question: “Will we see a second wave of Covid?” Industry sectors of greatest interest to the CAAT Pension Plan are: healthcare, financial services, and software.

He mentioned opportunities in “rescue financing,” private equity secondary markets, “select sectors” and leveraged buyouts.

Bourbonnais said his fund is focused on control and shared control. In general, there are three priorities for investment: founder-led companies; family-run companies; and corporate divestitures.

Kumar: In the time of pandemic, how do you conduct due diligence?

“We are hearing a lot about relaxed regulations for on-site visits,” Choi said.

Buzanis said that his employer did not have a firm policy that mandated on-site visits before making an investment. He was pleased that Q2 had been so active. “We conducted many on-sites prior to mid-March.” A lot of follow-up meetings have now become virtual but “it’s hard to get the same feel for organizational culture,” he said, comparing virtual to physical visits.

“For fund raising, nobody has committed without on-site visit,” said Bourbonnais. The exceptions might be “busted auctions.” This refers to a situation after a company has been put up for sale, but has failed to find a buyer, and thus must continue to run the business without a wealthy new owner.

Kumar: Are you expecting PE returns to decrease? Will there be additional pressure for alignment to occur between GPs and LPs?

Kumar and panellists first spoke briefly of the “billionaire factory,” referring to a recent paper by Ludovic Phalippou, professor from University of Oxford. His exhaustive research shows investors have paid high fees to private equity managers over decades, creating PE billionaires — but for more than a decade, private equity returns have not been any better than those an investor would have received by investing in publicly traded stocks.

“Alignment is where I’m spending the bulk of my time,” said Choi. “Costs are being increasingly borne by LPs.”

She cited as one outstanding issue the subscription line of credit controversy. “Internal rate of return is so easily gamified. We’re not seeing the necessary transparency.”

“We’re relying on an effective clawback,” Choi said. A clawback refers to the money GPs must refund to LPs when a fund overcharges. “It would be incredibly helpful if LPs had more visibility into things.”

“ILPA is doing very good work,” Bourbonnais said. “The GP is very clever at divide-and-conquer tactics.” He noted, “Gains for LPs are cyclical, and they keep getting chipped away.”

Kumar: What are some future trends to bear in mind?

Regarding “ILPA 3.0,” the new best practices being promoted for PE, we should expect more GP-led secondary private equity arrangements, Choi predicted. “It’s becoming more mainstream.”

“I expect fewer IPOs than last year,” Buzanis said. “I expect 9 or 10 percent returns.”

“Every year I hear that PE returns are coming down,” Bourbonnais said. “I say: it’s all about vintages.”

In any given year, because of fluctuations in the business cycle, the conditions for setting up a fund are “just so.” A wise investor will diversify across vintages to eliminate vintage risk.

Kumar: Regarding diversity and inclusion, what specific steps are being taken at your workplace?

At ILPA, the Diversity and Inclusion council has been in place since 2017, Choi responded. “They have created a metric for gender and race/ethnicity.” ILPA has prepared the Diversity and Inclusion Roadmap that lays out specifics with respect to retention and building a pipeline for talent. “We feel a poignant need to do more for social justice and equality.”

“ESG considerations are becoming a bigger focus,” said Buzanis, “however, we don’t want to limit out universe.” ESG refers to the environmental, social and corporate governance aspects of companies.

“Diversity and inclusion is a huge initiative at Blackrock,” Bourbonnais said. “We’re very vocal about that.”

Kumar: Is there more or less interest in evergreen funds?

Evergreen funds refer to the incremental addition of money into a business according to an established schedule (or as the need for funds arises) so that the startup company will not grow too fast and fall apart.

“This is still a new form of raising capital,” Bourbonnais said.

“Although there are certain benefits,” Buzanis said, “there are liquidity concerns, especially for exit.”

Kumar: Given the US-China situation, and the move to greater protectionism around the world, what are your predictions regarding investments in emerging markets?

Bourbonnais said his team focuses solely on North America and Western Europe.

“All our Asian managers are pan-Asian,” Buzanis said. “We are active there, but we stay aware of the political system and how it’s changing.” ♠️