Stressed Interest Rates: Battle of the Models

For generating shocked interest rate curves, such as a sudden economic stress might engender, “a three-factor parameterization solves many problems—but issues remain,” said Alexander Bogin, Senior Economist at the Federal Housing Finance Agency, and the second presenter at a webinar on modelling interest rate shocks held October 28, 2014, and sponsored by the Global Association of Risk Professionals. To develop an improved yield curve approximation, Bogin showed three variants of non-linear Laguerre functions of time to maturity. These were the Nelson-Siegel model (which has 3 factors); the Svensson model (4 factors); and the Björk-Christensen model (5 factors). Over a two-year […]

Stressed Interest Rates: ‘Simple’ Not Good Enough

“It’s difficult to apply historical down-shocks to the current low interest rate environment,” said Will Doerner, “and models have problems in the low interest rate environments of today.” Doerner is Senior Economist at the Federal Housing Finance Agency (“Agency”), and was the first presenter at a GARP webinar on how to generate historically-based interest rate shocks, which was held October 28, 2014. An accurate estimation of market risk helps financial institutions determine the amount of capital needed to withstand adverse market events. Interest rate changes represent a key factor for institutions with large fixed income portfolios. As such, when stress […]

OTC Market 2. A New Paradigm

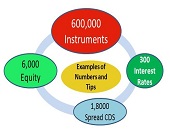

“How will errors be handled? That’s the biggest area of discussion with SEFs,” said Bis Chatterjee, Global Head of E-Trading and New Business Development, Credit Markets, at Citigroup Global. SEF refers to a Swap Execution Facility. He was the second of two speakers at a GARP-sponsored webinar, about changes to the over-the-counter (OTC) credit default swaps (CDS) market, held on April 15, 2014. “The market had less time than it would have liked to review various rules of the new guideline,” Chatterjee said, referring to the flurry of market response to the new regulations brought in by the US Commodities Futures […]

OTC Market 1. “It was a busy 15 months…”

Over the past fifteen months, “the biggest paradigm shift that we’ve seen in the last twenty years” has occurred, said Nathan Jenner, Chief Operating Officer at Bloomberg Electronic Trading. He was the first of two speakers at a GARP-sponsored webinar, held on April 15, 2014, about changes to the over-the-counter (OTC) market. Jenner put the changes in context: the new legislation driving the changes arose from the 2009 G20 summit in Pittsburgh that occurred on the heels of the 2008 financial crisis. There were three areas the signatory nations wanted to focus on, he said: “reducing systemic risk, improving transparency, […]

Volcker Rule Implementation 2. Proprietary Trading

The provisions of the Volcker Rule mean that banks are “turning their attention to difficult decisions that must be made,” said Anna Pinedo, Partner at Morrison & Foerster and the second of two speakers during a GARP webinar on April 1, 2014. The Volcker Rule defines proprietary trading as a bank “engaging as principal for” its own “trading account” in a “purchase or sale of one or more financial instruments,” including derivatives, noted Pinedo. Pinedo reviewed the financial instruments that must be assessed for compliance with the new rule. “A lot of our clients itemized and inventoried products to determine […]

Basel III and Beyond: Part 1. Optimization with On-Demand Risk Insights

“The capital consumption of credit counterparty risk has become an issue for banks,” said Rita Gnutti, Head of Internal Model Market and Counterparty Risk at Intesa Sanpaolo. She was the first of two speakers addressing the impact of regulatory developments on counterparty risk assessment. She spoke to a webinar audience arranged by the Global Association of Risk Professionals on June 27, 2013. Gnutti first outlined the new Basel III regulatory framework of credit counterparty risk (CCR), then she described its calculation using internal model methodology (IMM), and third she described the computing and back-testing of CCR carried out by her […]

How New Regulations Are Breaking Down Silos. Part 3: Interconnection Needed

The biggest hurdle to breaking down silos “is organizational in nature,” according to Amit Gupta, Partner in Risk Management Practice at the consulting firm Accenture. “The heads of Risk, Finance, Operations are all different people and this introduces a level of complexity.” However, “organizational interconnection at high levels is starting to happen.” Gupta was the third panellist to weigh in at the GARP webinar on May 21, 2013 on how new financial regulations (Dodd-Frank and Basel III) are breaking down silos in risk management. Regulators are pushing for greater consistency in reporting. As an example, Gupta pointed to new requirements […]