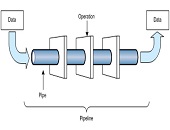

The Data Pipeline

The new guidelines on credit impairment at U.S. banks regulate the estimation and reporting of the current expected credit loss (CECL). But what are they really about? “CECL is all about setting up a data pipeline,” said Krish Ray, CECL Implementation Lead at SAS. He was the second of three speakers at a webinar panel titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. Ray categorized the key challenges of CECL implementation as: models, data, business, governance, and sustainability. Smaller banks might lack modelling expertise and “may have to turn to vendor models.” […]

Shifting Energy Markets

How are strategic priorities in energy markets shifting? What are the risk management implications? “Geopolitical risks have worsened and technological innovation is causing more disruption,” said Medy Agami, senior partner and vice-chairman at Ben-Roz and Associates and co-founder of the consulting firm Opimas. He was the sole presenter of the webinar “Energy Market Strategy and Risk Playbook: How to prosper amid a wave of disruptive innovation, geopolitical uncertainty, market volatility & exponentially growing risk landscape in 2018 & beyond” sponsored by the Global Association of Risk Professionals (GARP) on August 7, 2018. “There are five main forces acting on fundamentally shifting markets,” […]

A Tale of Two Funds

There are helpful and unhelpful models for determining risk-based profit attribution, according to Michael B. Miller, founder and CEO, Northstar Risk. This is part 2 of his explanation about how to attribute financial performance, given at a webinar sponsored by the Global Association of Risk Professionals on June 20, 2018. Miller gave an example of two funds. Fund A contains both long and short assets, is market neutral and generates positive alpha. Fund B is a macro fund that is market dependent and whose manager is correct 54 percent of the time. The returns of Funds A and B look very […]

Risk-Based Profit Attribution

“Even the best portfolio managers have bad years due to macroeconomic factors beyond their control,” said Michael B. Miller, founder and CEO, Northstar Risk, to an audience of financial risk professionals. This is Part 1 of his talk about how to attribute performance for financial management at a webinar sponsored by the Global Association of Risk Professionals on June 20, 2018. “We tend to view measurement of risk and performance as separate tasks, but performance can only be fully understood by taking risk into account,” Miller said. Performance is always evaluated relative to something else, such as “the market”—which commonly taken […]

Extracting Value from CECL 2

To meet the new for current expected credit losses (CECL) requirements, “you will need a lot of data,” said Thomas Caragher, Senior Product Manager of Financial & Risk Management Solutions at Fiserv, a US provider of financial services technology. Seven to ten years of data is not unreasonable. The payoff to massive data-gathering is that “you will be able to build strategy more effectively if you have information.” But what to do with the reams of data? First, you have to make some sense of it. “Start by correlating the data,” he said. Oil production might be correlated with loan demand […]

Extracting Value from CECL 1

“Turn the pain of compliance into the benefit of strategy,” said Thomas Caragher, Senior Product Manager of Financial & Risk Management Solutions at Fiserv, a US provider of financial services technology. He was speaking about the approaching deadline to implement new guidelines for current expected credit losses (CECL) at a webinar sponsored by the Global Association of Risk Professionals on April 11, 2018. CECL is the new impairment standard for credit impairment under the Financial Accounting Standards Board (FASB). Since it affects accounting, the effect of CECL will be felt “in department stores, cell phone companies, municipalities”—throughout the U.S. The purpose of business intelligence is […]

As Fast as You Can

The implementation window for the new Current Expected Credit Loss (CECL) standard may seem plenty big enough, but there are loads of decisions to be made, such as “how will we calculate this?” “Decide on methodology and start implementing as fast as you can,” advised Masha Muzyka, Senior Director, Regulatory and Accounting Solutions at Moody’s Analytics. She was part of a round-table discussion, held on January 10, 2018, about the transition to CECL. The webcast was organized by the Global Association of Risk Professionals (GARP). The new CECL standard will bring significant changes, such as a spike in earnings volatility. […]

Challenges to modelling

Constructing an accurate financial model for the Current Expected Credit Loss (CECL) may present problems to some banks. Possibly a bank is collecting data for annualized charge-off rates. However, that would overlook the question: “how would that inform someone as to the loss rate over the lifetime of the portfolio?” asked Michael Gullette, SVP, Tax and Accounting at the American Bankers Association. The question boils down to whether a bank has enough data of the right kind to see trends and relationships. “And if you have the data, what is the quality?” Gullette said. He was part of a round-table discussion […]

Never too early to start

The “reasonable and supportable” clause of the new Current Expected Credit Loss (CECL) standard “is the most hotly debated part” of the regulation, according to Cristian deRitis, Senior Director, Consumer Credit Analytics at Moody’s Analytics. He was part of a round-table discussion about the transition to CECL that was webcast by the Global Association of Risk Professionals (GARP) on January 10, 2018. CECL is the new credit impairment standard under Financial Accounting Standards Board (FASB). “Auditors are grappling with what ‘reasonable and supportable’ means, too,” he added. For best practice in terms of modelling credit risk, the phrase boils down to whether […]

Myths of CECL

The time for proper accounting of credit impairment is running out. How prepared is your team? Do you even know what the biggest concern of the auditors will be? This was the call to action voiced by Tom Caragher, Senior Product Manager of Risk and Performance at Fiserv, a US provider of financial services technology on October 26, 2017. He spoke about implementation of current expected credit losses (CECL) at a webinar sponsored by the Global Association of Risk Professionals. (Note that CECL is the impairment standard under Financial Accounting Standards Board (FASB).) “When it comes to CECL, there are many […]