Constructing an accurate financial model for the Current Expected Credit Loss (CECL) may present problems to some banks. Possibly a bank is collecting data for annualized charge-off rates. However, that would overlook the question: “how would that inform someone as to the loss rate over the lifetime of the portfolio?” asked Michael Gullette, SVP, Tax and Accounting at the American Bankers Association.

The question boils down to whether a bank has enough data of the right kind to see trends and relationships. “And if you have the data, what is the quality?” Gullette said. He was part of a round-table discussion about the transition to CECL that was webcast by the Global Association of Risk Professionals (GARP) held on January 10, 2018.

Different scenarios have different probabilities of occurrence. “Some say probability weighting is not part of CECL, but banks will want to pay attention. It will become a critical part of the process.” He said that Financial Accounting Standards Board (FASB) did not explicitly mention weighting in the standard, but it is still an important component.

CECL requires you to measure credit risk over the lifetime of the portfolio. “Pricing and underwriting are part of that, creating a holistic view from Day 1,” Gullette said.

There are challenges to the modelling of CECL. The standard is not prescriptive. “From a risk management perspective, there must be an agreed-upon model that everybody coalesces around. That will help communicate to the board and investors what the changes are,” he noted. Such a model is capable of automation, and people would understand it better the more they used it.

Gullette cautioned against rushing to fill the need for CECL estimates using an ad hoc model. Ultimately, “such an approach results in much more work,” he said.

The whole process of estimating credit risk “usually takes a few methods,” he said. “Certain methods do not consider all aspects of credit risk, for example, the vintage analysis of charge-offs.”

During the Q&A session, Gullette remarked on the disadvantages faced by smaller financial institutions. “The credit risk evaluation has to be done, whether they have the data or not.” They have more volatility and “a lack of critical mass for operational costs.”

There is talk of zero loss given default (LGD) in some instances. “Take that [zero] with a lot of caution,” he advised. Loans are normally grouped by loan characteristics. “From a practical perspective, LGD is usually above zero. You need to understand and really test the likelihood of zero LGD.”

“You will have questions and you must be able to answer them,” he said. “Whether you have vintage analysis or other models, be prepared for these questions.” He suggested that medium-sized banks not go in with one method and try to fit everything to it. “Look at transition models versus vintage analysis versus other models.”

Adopting the new CECL guidelines will play a big part in strategy planning and decision-making among firms. ª

Click here to view the one-hour GARP Webcast- The Transition to CECL: Implementation and Strategic Considerations: http://bit.ly/2BoTGgX

Click here to read a summary of comments by the panel member Masha Muzyka, from Moody’s Analytics.

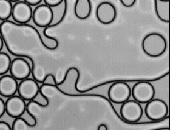

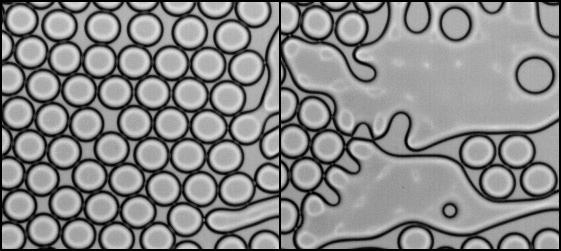

The image of coalescence is from the research website of Nicolas Bremond https://www.lcmd.espci.fr/people/NicolasBremond/Home.html Permission pending.