There are helpful and unhelpful models for determining risk-based profit attribution, according to Michael B. Miller, founder and CEO, Northstar Risk. This is part 2 of his explanation about how to attribute financial performance, given at a webinar sponsored by the Global Association of Risk Professionals on June 20, 2018.

Miller gave an example of two funds. Fund A contains both long and short assets, is market neutral and generates positive alpha. Fund B is a macro fund that is market dependent and whose manager is correct 54 percent of the time. The returns of Funds A and B look very similar over the long run, and their correlation is 0 percent. However, in the case of a sudden market downturn, Fund A sails along (it is market-independent) whereas Fund B has a very big movement.

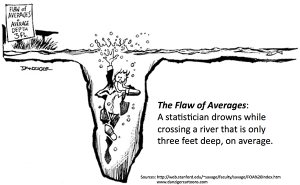

The interesting thing is that, depending on the model chosen, you can tell the two funds apart—or not. “Both funds will look the same in the Ex-post model,” he noted, but that is not the case if looked at using the Ex-ante model. “This is like the story of drowning in a river that is, on average, only a foot deep,” he said.

Ultimately, only the Ex-ante model, or risk-based performance attribution, can differentiate between Fund A and Fund B.

Miller went on to consider two real-world examples; these will be seen in the link to the recording of the webinar (see below).

In the examples he gives, he has country and industry sector split out as risk factors. “Any risk factor you come up with can be used in profit attribution,” he said. “Also, risk-based performance attribution is granular and can be calculated for just one day.”

In summary, the Ex-ante model, known as risk-based performance attribution, accurately reflects the source of profit and loss. Alpha can be calculated on a daily basis, and it can be determined right at the level of the individual security. It’s related to risk factor analysis.

Challenges remain, however: multicollinearity, market timing attribution, illiquid securities, and the effect of trading. ª

Click here to view the GARP Webcast presentation (approx. 60 min): Risk-Based Profit Attribution

Thumbnail image is from http://frontierbushcraft.com/2012/08/28/how-to-wade-across-a-river/

Click here to view a summary of Part 1 of the presentation.