Private Equity in “the new normal”

From pandemic to protectionism, global events and trends are having an impact on the private equity (PE) markets. From a Canadian perspective, what effect are these issues having on the alignment between PE investors and PE fund managers? In Toronto on July 9, 2020, Helen Pham welcomed three panellists to the webinar titled, “Private Market Trends: Improving Alignment Between Investors and Managers.” The webinar was organized by the institutional asset management committee of the CFA Society Toronto. The panellists shared their thoughts on how investors should view effects of the global pandemic on private equity markets and the associated risks […]

Early Warning Signs

“Overall, the energy sector remains stressed,” said Irina Baron, Associate Director at Moody’s Analytics. Baron was the third and final panellist discussing new dynamics in the handling of financial risk management in the energy sector at a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. Based on expected default frequency (EDF), 75 percent of US publicly-traded companies in the energy sector are not investment-grade risks. “Agency ratings give us a sense of which firms are more likely to default,” she noted. The drawback is that the realized default rate cannot be forecast. However, the expected […]

Catch a Falling Knife. Part 1

Who is taking advantage of the downturn in crude oil prices? “Most E&P assets are no longer economic to drill at today’s commodity prices,” said Curtis Flood, Vice President at the investment banking firm Evercore. He was the first of two speakers at a webinar “Catch a Falling Knife: Financial Repercussions of Current Crude Oil Prices” sponsored by the Global Association of Risk Professionals on June 7, 2016. (E&P refers to exploration & production, also known as the upstream petroleum industry.) The downturn in oil & gas prices is “the result of simple economics” caused by the “shale revolution” leading […]

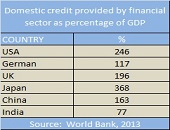

Public vs Private Banks in India and China

“Public sector banks perform worse than private banks In India whereas there is no significant performance difference for the two sectors in China,” said Dr. Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He gave an overview of operational performance and credit risk trends in Banking in Emerging Markets, and was the third of three webinar panellists on November 20, 2014, organized by the Global Association of Risk Professionals. For both countries, Singenellore compared government-owned banks with private sector banks. The terminology is different: India has public sector undertakings (PSU) banks whereas China has state-owned […]

“Lending Will Be Marketing Gimmick”

What will be the effect of Basel III on banks in emerging markets? “Commercial banks will become less interested in providing loans,” said Dr. Michael C. S. Wong, the first panellist in a webinar on Banking in Emerging Markets held November 20, 2014, and sponsored by the Global Association of Risk Professionals. He is Associate Professor of Finance at City University of Hong Kong, and Chairman at CTRISKS Rating. Wong summarized the challenges of the new Basel III regulatory regime, with its tougher capitalization and liquidity requirements. A global systemically important bank (G-SIB) will have additional capital and cash-holding requirements, he said, […]

Hedge Fund Fallacy

“If all the money that’s ever been invested in hedge funds had been put in treasury bills instead, the results would have been twice as good,” said Simon Lack, founder of SL Advisors, LLC, and author of The Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good to Be True. This statement was his opening volley in a webinar titled “The Hedge Fund Fallacy” on May 5, 2014, sponsored by the CFA Institute. Lack began with a “typical portrayal” of hedge fund returns: a 6 percent return over the period 1998 to 2013. Over the same […]

Volcker Rule Implementation 1. Assess Yourself

“The Volcker Rule is a negative rule, namely, you are guilty until you prove yourself innocent,” said Robert Lendino, Associate General Counsel at BB&T, and the first of two speakers during a webinar hosted by GARP on April 1, 2014. “And the proof must be furnished by the bank’s compliance group.” The Volcker Rule, drafted in the aftermath of the 2008 financial crisis and approved December 10, 2013, prohibits banking entities from engaging in proprietary trading, and from having ownership in, or acting as sponsors to, certain commodity pools, hedge funds, and private equity funds. [Note: for readability the remainder […]

Interview with Philippe Jorion: “Is There a Cost to Transparency?”

In early 2013 the CFA Institute announced Philippe Jorion and Rajesh K. Aggarwal won the Graham and Dodd scroll award from Financial Analysts Journal for their paper, “Is There a Cost to Transparency?” An in-depth interview with Professor Jorion appears in the June 2013 issue of The Analyst, the member bulletin of the CFA Society Toronto. Below are a few of the statements from the course of the interview. Q: What is your principal area of research? PJ: Ever since I discovered the field of finance, I have had long-standing interests in topics such as portfolio construction and risk management. […]

Volunteer Appreciation Night

National Volunteer Week is a time to recognize the efforts of volunteers across Canada. This year it took place April 21 to 27, 2013 and we dropped by “Volunteer Appreciation Night” hosted by CFA Society Toronto on April 25, 2013 to view some fine magic entertainment by Revel Magic (see magician with flaming business card below), and to hobnob with volunteers. CFA Society Toronto has 17 different committees, plus a board of directors, so there is ample opportunity for community-minded members to find an area to which they can donate their time and talent. Following are interviews with three members of CFAST […]

Managing Risk Beyond Asset Class Diversification

“The ‘new normal’ in asset allocation must be forward-looking and driven by macroeconomics, said Sébastien Page, Global Head of Client Analytics, Executive Vice-President at PIMCO. He was addressing a CFA Society Toronto luncheon on October 15, 2012 in Toronto’s historic National Club. Traditionally, asset allocation focussed on diversifying according to asset class. In the ‘new normal,’ Page recommends diversifying across risk factors. “Think of asset class as simply a container of risk factors,” he suggested. He gave another metaphor in line with the luncheon crowd. “Think of risk factors as components like proteins, carbohydrates, and fats. An asset class would […]