“Overall, the energy sector remains stressed,” said Irina Baron, Associate Director at Moody’s Analytics. Baron was the third and final panellist discussing new dynamics in the handling of financial risk management in the energy sector at a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017.

Based on expected default frequency (EDF), 75 percent of US publicly-traded companies in the energy sector are not investment-grade risks.

“Agency ratings give us a sense of which firms are more likely to default,” she noted. The drawback is that the realized default rate cannot be forecast. However, the expected default frequency is a reasonable stand-in. The average EDF “significantly leads” the rate of default of US speculative grade debt.

“Differentiating between ‘good’ and ‘bad’ loans has never been more important,” Baron said, noting that the gap between healthy and weak firms is the widest it has been in 15 years. “We need to pay attention to what is happening in the riskiest percentile.”

A big problem is how to treat calculation of the probability of default consistently, between publicly traded firms and private equity. “We need apples-to-apples comparison.” Moody’s has collected information on past defaults of both types of firm.

Baron covered the use of EDFs in practice for purposes of stress testing. These involve choosing different macroeconomic scenarios such as low GDP growth or recession or stagflation and inputting the relevant economic parameters. A company checks to see if it is prepared for best-case and worst-case scenarios.

A company also wants to identify which of the counterparties will be most affected by the scenario. EDFs can be strong early warning indicators.

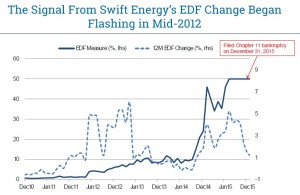

Baron presented the case of Swift Energy, whose “EDF changes began flashing in mid-2012.” Swift Energy began to underperform its industry median 43 months prior to default. [Ed. Note: Swift Energy has recently renamed itself SilverBow Resources.]

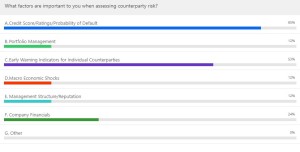

Baron concluded her segment of the webinar by polling the audience: “What factors are important to you when assessing counterparty risk?”

The answer (shown here), head and shoulders above other categories was: “credit score, ratings or probability of default.” ª

Click here to read about the first panellist’s presentation.

Click here to read about the second panellist’s presentation.

Click here to view the 3-panellist, 50-minute GARP Webcast- New Dynamics in the Energy Sector: Best Practices for Managing Risk in a Volatile Business Environment

The first two figures appear in the presentation (permission pending).