Basel, the Big Picture: Tackling Risk Aggregation & Reporting. Part 1

“It’s a quality piece of work that lays out the road ahead,” said Donna Howe, professor of finance at Brandeis International Business School. She was the first of two speakers at a webinar to discuss the 2013 Basel paper, Principles for Effective Aggregation and Reporting of Risk Data. The webinar was sponsored by the Global Association of Risk Professionals. Besides governance, Howe noted the 14 principles described in the paper expressed four main themes: completeness, accuracy, timeliness, and adaptability. Completeness of risk reporting is necessary, but “it becomes very easy to lose the nuance” when the data are too numerous […]

Americans Among Us. Part 2.

When it comes to US-Canada cross-border tax planning, a suggested rule of thumb is “to plan as if the US spouse is the spender and the Canadian spouse is the one saving assets,” said Christine Perry, lawyer at Keel Cotrelle LLP, during the second half of a seminar at the CFA Society Toronto offices on October 29, 2013. Perry identified eight common issues in cross-border tax planning that she encounters. Her list began with wills that are drafted in contemplation of “only” Canadian law, “which I see two or three times a month,” and moved on to issues involving gifts, […]

Americans Among Us. Part 1.

“Know your client” is fundamental to managing issues that might arise in tax and estate planning, according to Christine Perry, lawyer at Keel Cotrelle LLP and specialist on cross-border tax and estate planning solutions for high net worth individuals. She led an afternoon seminar titled “Americans Among Us: US Issue Identification” at the CFA Society Toronto downtown offices on October 29, 2013. “Sometimes a client does not even realize he has to make a US tax filing,” said Perry, citing as an example someone born out of wedlock, not in the US, but whose mother is a US citizen. She […]

Risk Data Aggregation & Risk Reporting. Part 1

During the throes of the last financial crisis, banks and regulators alike “struggled” to get good quality information. “The infrastructure was not there,” said James Dennison, CFA, Managing Director, Operational Risk Division, Office of the Superintendent of Financial Institutions (OSFI). To enhance banks’ risk management infrastructure, the Basel Committee on Banking Supervision (BCBS) released a set of Principles for Effective Risk Data Aggregation & Risk Reporting in January 2013. Dennison was first to speak on the evening of September 19, 2013 at the Toronto chapter meeting of the Global Association of Risk Professionals (GARP). It was convened at First Canadian Place to allow […]

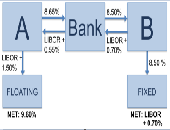

Evolution of the OTC Swaps Markets. Part 1: “Futurization” of Swaps

Recent reforms to the swaps market can be thought of as “the futurization of swaps,” said Nathan Jenner, COO Fixed Income E-Trading at Bloomberg. He was addressing a webinar audience on May 14, 2013 as the first speaker in a panel organized by the Global Association of Risk Professionals (GARP) on the evolution of the market for over-the-counter (OTC) swaps. Five years ago, “derivatives were perceived as a catalyst in precipitating” the financial crisis of 2007-08, said Jenner. For example, it wasn’t immediately apparent who were all the counterparties to the AIG swaps. Pricing was “murky,” he said, and risk […]

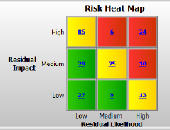

Measuring the ROI of GRC. Part 2: Solutions to “Absorb Regulatory Demands”

An unprecedented amount of new regulations “has led to risk assessment fatigue,” said John Kelly, Market Segment Manager in Business Analytics at IBM. He was the second of two speakers who addressed a GARP webinar audience on March 28, 2013 on the topic of the return on investment (ROI) on governance, risk assessment, and compliance (GRC). Most of the presentation referred to the study “Guidebook: Understanding the Financial Value of GRC Management” released in October 2012 by Nucleus Research that was talked about by Hyoun Park in the first part of the presentation. When it comes to regulation, there is […]

Measuring the ROI of GRC. Part 1: “Your Mileage May Vary”

When looking at the return on investment (ROI), “it’s not about getting the highest number—it’s what is most defensible,” said Hyoun Park, Principal Analyst at Nucleus Research. Park was speaking on March 28, 2013 to a webinar audience on the topic of how to quantitatively measure the ROI on governance, risk assessment, and compliance (GRC). The two-speaker panel, convened by the Global Association of Risk Professionals (GARP), based their remarks on a study released in October 2012 by Nucleus Research (cover shown here). The report states “this research was conducted in context of the usage of IBM OpenPages, a software […]

Global Challenges in Chemicals & Energy: Standardizing & Accelerating R&D

“The iPhone of experimental chemistry” standardizes and simplifies experimental chemistry in a paradigm-shifting manner, according to Michael Schneider, SVP of Chemspeed Technologies, and the holder and author of more than 30 publications and patents. He was delivering a presentation on March 19, 2013, through a webinar organized by Chemical & Engineering News (C&EN). “The iPhone of experimental chemistry” is based on a sleek desk-sized compartment that apportions chemicals in ”1-2-5” money analogously staggered (but in mmoles instead of cents) , ready-to-apply formats. It dramatically simplifies the experimental work in a multitude of “applications” in traditional experimental lab work and/or as […]

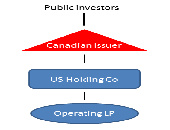

Foreign Asset Income Trusts

“Income trusts should be viewed as a story in capital markets innovation,” said Jon Northup of Goodmans LLP. He was speaking at a luncheon at the National Club in Toronto, sponsored by the Chartered Financial Analysts (CFA) Society Toronto on March 5, 2013. The introduction of SIFT (Specified Investment Flow-Through) rules by the Canadian government in October 2006, “effectively eliminated Canadian income trusts,” Northup said. There are two exceptions: (1) a trust that does not involve Canadian real estate, immovable or resource properties used in carrying on a business and (2) a trust that qualifies as a REIT (real estate […]

The Fed, Foreign Banks and Basel III: Part 3. Necessary Complexity?

As the US moves to adopt Basel III, there are regulatory initiatives that are expected to be implemented, said Peter Went, VP, Banking Risk Management Programs, GARP, on February 14, 2013. The Basel Committee has several proposals that are issued for consultation and discussion, including ones that affect liquidity rules, the securitization framework, trading book review, and consistency of risk-weighted assets. Went was the second speaker at a webinar organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. (This continues […]