Avoid Jekyll and Hyde

Accurate price determination for commodities means that data must be gathered, processed and analyzed. What, then, are current best practices for data management? “Organizations are beginning to recognize their current solutions are no longer meeting current needs,” said Michal Peliwo, Vice President of Business Solutions at ZE PowerGroup. He was the third and final speaker at a webinar on August 24, 2016, sponsored by the Global Association of Risk Professionals, titled “The Price is Right? Strategies for Market Discovery & Optimum Pricing Challenges.” Peliwo described the fragmented world of data management as it exists at most companies. “MS Excel is […]

Optimum Price a Moving Target

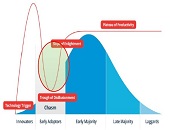

How was risk-taking originally priced, and has this changed over time? Centuries ago, mercantile economies used to pool risk for the trading ships that were sent out. Over time, this “big chunk risk” has given way to increasingly more precise ways of determining risk, and is now down to individual financial transactions. “Pricing is the centre of gravity of this operation,” said Robin Bloor, Chief Analyst at The Bloor Group. “For every product theoretically there is an optimum price.” Beginning with this historical comparison, he was the first of three speakers at a webinar on August 24, 2016, sponsored by […]

Data Science 2. The Roadmap

“The core concept for data science is hypothesis testing,” said Nima Safaian, team lead for Trading Analytics at Cenovus Energy. The data scientist must identify trends, generate hypotheses, and test, test test. The scientist’s bent toward hypothesis testing should be even stronger than their math skills. Safaian was speaking at the Data Science webinar on August 2, 2016, sponsored by the Global Association of Risk Professionals (GARP). “Attitude is everything,” Safaian said. “Think like a startup. Have an agile mindset,” he urged, referring to the books The Lean Startup by Eric Ries and The Lean Enterprise by Humble, Molesky, and […]

Data Science 1. Trading Analytics

At the end of the day, what do you produce? If you are a knowledge worker, your “product” could be something as intangible and significant as decisions. That is the thinking behind the “decision factories” discussed in Roger Martin’s seminal Harvard Business Review article. If we labour in decision factories, then we are decision engineers, and our chief raw material is data, according to Nima Safaian, team lead for Trading Analytics at Cenovus Energy. “We need the capacity to produce many good decisions,” he said at the webinar on August 2, 2016, sponsored by the Global Association of Risk Professionals […]

Catch a Falling Knife. Part 1

Who is taking advantage of the downturn in crude oil prices? “Most E&P assets are no longer economic to drill at today’s commodity prices,” said Curtis Flood, Vice President at the investment banking firm Evercore. He was the first of two speakers at a webinar “Catch a Falling Knife: Financial Repercussions of Current Crude Oil Prices” sponsored by the Global Association of Risk Professionals on June 7, 2016. (E&P refers to exploration & production, also known as the upstream petroleum industry.) The downturn in oil & gas prices is “the result of simple economics” caused by the “shale revolution” leading […]

Platform of the Future

What will be the ideal modelling platform of future bankers? It will need to contain key functionalities in model execution, scenario management, and a “risk engine” that will deliver answers for multiple horizons at the loan level. Furthermore, it should implement the most advanced modelling suites, reduce the quants’ time to develop models, and contain simulation capabilities for stress testing and beyond. This bold vision of the future was presented by Martim Rocha, Advisory Business Solution Manager at SAS. He was the second of two presenters at the February 25, 2016, webinar offered by the Global Association of Risk Professionals […]

Integrated Data and Modelling

How can today’s bankers prepare for tomorrow’s challenges? Consider the financial models built using available data. Data collection and financial modelling used to be conducted in each different silos of the bank, with credit separate from market, which was separate from treasury and other groups). Then data became “managed” and modelling was moved to “platforms” which did not mix well between the various silos. A few brave souls began to integrate the data management for different groups of the bank. Other brave souls tried to integrate the modelling. This was the phase of integration achieved through batch calculations. Now, the […]

Three-Way Damage

Do you remember that cute VW video, “The Force”? The one where the little boy, dressed up as Darth Vader, can’t get a reaction from anyone or anything, even his dog, when he tries his super-powers on them? Then, Dad drives up in his VW Passat and the Vader-wannabe is, magically, able to get the lights to flash. The camera pans to parents looking out the window. Dad gives a conspiratorial grin as he clicks the remote control. On September 18, 2015, world markets were rocked by news that Volkswagen had knowingly falsified its emissions of toxic nitrogen oxides. The […]

Watch Out for Hippos

Is your company managing risk well enough to make the most of opportunities as they appear? Or does it suffer from risk paralysis? As a company matures, it moves from trying to identify all possible risks (and mitigating them), to saying “what risks will give me the chance to pursue an opportunity,” said Martin Pergler, Founder and Principal of Balanced Risk Strategies, Ltd. He was the first of two panellists at the webinar titled Explore Your Opportunity Landscape by Harnessing Your Risks, sponsored by the Global Association of Risk Professionals on November 18, 2015. Pergler began by making a memorable […]

Harnessing Your Risks

Before your company undertakes economic risks, what systems should be firmly in place? “Good risk management allows us to take risks we wouldn’t normally do,” said Brenda Boultwood , Senior Vice President of GRC Solutions at MetricStream. (GRC is the acronym for governance, risk management and compliance.) She was the second of two panellists at the webinar titled Explore Your Opportunity Landscape by Harnessing Your Risks, sponsored by the Global Association of Risk Professionals on November 18, 2015. A company needs superior risk intelligence in order to understand the risks they plan to harness. Technology can be leveraged to capitalize […]