Managing Risk Beyond Asset Class Diversification

“The ‘new normal’ in asset allocation must be forward-looking and driven by macroeconomics, said Sébastien Page, Global Head of Client Analytics, Executive Vice-President at PIMCO. He was addressing a CFA Society Toronto luncheon on October 15, 2012 in Toronto’s historic National Club. Traditionally, asset allocation focussed on diversifying according to asset class. In the ‘new normal,’ Page recommends diversifying across risk factors. “Think of asset class as simply a container of risk factors,” he suggested. He gave another metaphor in line with the luncheon crowd. “Think of risk factors as components like proteins, carbohydrates, and fats. An asset class would […]

Risk-Adjusted Performance Measurement. Part 2: Everything But the Kitchen Sink

The risk measures, both ex post and ex ante, that formed the hands-on component of the one-day workshop on risk-adjusted performance measurement at the CFA Society Toronto offices, are covered in greater detail by the book Practical Portfolio Performance Measurement & Attribution. The author (and workshop leader), Carl Bacon, gave the workshop participants a whirlwind tour on September 17, 2012. This continues a recap of the highlights begun in Part 1 of this posting. Simple risk measures are “stand-alone” for a given portfolio (e.g., variability and Sharpe Ratio), or they are calculated in conjunction with another benchmark or portfolio (e.g., […]

Risk-Adjusted Performance Measurement. Part 1: Mind the Expectations

“The guiding principles for risk control,” said Carl Bacon, CIPM, Chairman of Statpro, and former Director of Risk Control and Performance at F&C Investment Management Ltd, “are integration and confidence in data.” Bacon was in Toronto on September 17, 2012 to deliver a one-day workshop on risk-adjusted performance measurement to about a dozen members of the CFA Society Toronto as part of the Society’s continuing education program. He is the author of Practical Portfolio Performance Measurement & Attribution, which went into its second edition in 2008. Performance measurement is the calculation of portfolio return for purposes of comparison against a […]

ETFs: Liquidity, Trading & Portfolio Implementation Strategies

When the CFA Society Toronto decides to hold an ETFs seminar in Toronto’s Hockey Hall of Fame, such as it did on the balmy evening of Sept 13, 2012, there is a competition for attention. The venue is full of items of interest to the die-hard fan, such as the shower sandals used by Alexander Ovechkin during the 2011 All-Star game. The lesser fan might stand there, equally transfixed, wondering what the secondary market for used shower sandals could be, even those of Alexander Ovechkin. The ETFs seminar had panel discussions covering three areas: market making, liquidity and trading; utilizing […]

Impact of Basel III on Capital Instruments. Part 2: Football vs. Soccer

On August 16, 2012, speaking at a webinar hosted by the Global Association of Risk Professionals (GARP), three panellists gave a perspective on the changes Basel III would wreak on capital instruments. Click here for Part 1. The second speaker, April Frazer, Director of Client Solutions Group at Wells Fargo, gave an overview of the impact of the US Basel III proposal on market dynamics. Due to regulatory limitations that she is subject to as a member of a financial institution, her talk is not reported on here. Steve Sahara, Global Head of DCM Solutions and Hybrid Capital, Crédit Agricole […]

Implications of the Euro Zone Crisis

When it comes to financial debt in the Euro Zone, “deleveraging has barely begun,” said Daniel Wagner, author and risk consultant. “It’s a long and winding road.” On August 7, 2012, Daniel Wagner, CEO of Country Risk Solutions, a US-based cross-border risk management consulting firm, addressed a Global Association of Risk Professionals (GARP) audience about the Eurozone crisis. Wagner, author of Political Risk Insurance Guide, and Managing Country Risk, published in 2012, spoke on a range of related topics. Wagner’s talk was far-ranging and comprehensive (78 slides in 45 minutes). He spoke about the impact of debt: in particular, the effect […]

US Implementation of Basel III. Part 2: The GPS for the Journey

On July 24, 2012, Peter Went, VP Banking Risk Management Programs at GARP, summarized the changing landscape of Basel III from a US perspective. First he outlined the deadlines and proposed changes; Part 1 of this posting covers these for the standardized approach. Financial institutions adhering to the advanced approach, Went said, must follow the Basel III counterparty credit risk rules. In some cases, correlations between asset values must be increased. A distinction will be made between securitization and resecuritization. [Ed. Note: To this, we say, “high time.” See, for example, Hull & White’s award-winning article in Financial Analysts Journal, […]

US Implementation of Basel III. Part 1: A Long and Winding Journey

The long and winding US route to Basel implementation has been more difficult and circuitous than the route for European banks. Peter Went, VP Banking Risk Management Programs at GARP, delivered a webinar update on the Basel III leg of the journey on July 24, 2012. First, Went summarized the deadlines. Several sequential proposals have been issued by the US prudential agencies: the OCC, FRB, and the FDIC, with an expected implementation date beginning January 1, 2013, and a series of milestones thereafter. [Note: by mid-December 2012, the implementation dates for most of the Basel III proposals have been delayed […]

Risk-Based Capital Requirements under Basel III: Part 2. The More Capital, the More Stability

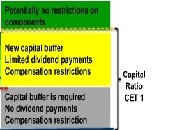

On July 17, 2012 Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), addressed a webinar audience on the significant changes to capital requirements under the new Basel III rules, as was reported in the Part 1 posting. According to the survey of the Basel Committee Basel III Monitoring Exercise, many banks have embarked on aggressive campaigns to raise capital. In addition to increasing existing capital requirements, Basel III proposes two new charges: the capital conservation buffer, which may require banks to maintain an additional 2.5 percent, and the countercyclical buffer (shown in the […]

Risk-Based Capital Requirements under Basel III. Part 1: The Trillion-Dollar Tweak

The friendly and ever-so-precise tones of Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), have been moderating a cavalcade of panellists over the past couple years. When the chance arose to attend his solo webinar on July 17, 2012, we leapt at the opportunity. Went, co-author of five books on financial risk management, spoke about risk-based capital requirements and how the Basel III Accord redefines and increases the quality and quantity of these requirements. His presentation was divided into three parts: capital under Basel III, US implementation of Basel III capital rules, and […]