Tailoring Risk Model to Investment Strategy

Due to the growing complexity of measuring financial risk, “risk has become a patchwork” of different models, said Phil Jacob, Senior Director at Axioma Risk Research. He was the sole presenter in a webinar about tailoring the right risk model to your investment strategy held on March 4, 2015, and sponsored by the Global Association of Risk Professionals (GARP). Jacob identified four inherent challenges. “There are operational issues stemming from existing rigid approaches,” leading to “difficulty in aggregating risk.” There is a lack of consistency in modeling portfolios, which can run the gamut from very simple proxies all the way […]

Tracking the Elusive Black Swan

Enterprise risk management (ERM) requires a “robust framework design and collaborative approach to capture a black swan event before its occurrence,” said Brenda Boultwood, Senior Vice President of Industry Solutions at MetricStream. She was the second of two speakers at the GARP-sponsored webinar on Black Swans and Reputational Risk held on August 26, 2014. Black swan events are “close to impossible to estimate impact and likelihood,” such as the Japan 2011 tsunami, or Hurricane Katrina. The complexity of these types of risk “requires that we focus on what is most important” in strategic risk management, said Boultwood, naming four principal areas: […]

“They Kill Things!”

Enterprise risk management (ERM) should aim to fill the strategic advisor role, which is the most valuable role, said Jim Fitzmaurice, Executive Advisor at Corporate Executive Board (CEB), because “the strategic advisor focuses on improving risk-informed strategic decisions.” Fitzmaurice, who advises both CEB Audit Leadership Council and CEB Risk Management Leadership Council, was the first of two speakers at the August 26, 2014 webinar on Black Swans and Reputational Risk sponsored by the Global Association of Risk Professionals. Fitzmaurice began by showing how the evolution of ERM has been a progression in the prominence of its role and a concomitant […]

A Successful Operational Risk Program 1. Framework

“A clear strategic direction of your company should help formulate clear business objectives, understood by all stakeholders, including employees,” said Brenda Boultwood, SVP, Industry Solutions at MetricStream. An operational risk may be seen as something, together with credit or market risks, which impedes “achieving those business objectives” and includes IT risk, HR risk, and reputation risk. MetricStream is a provider of Governance, Risk, Compliance (GRC) management software and consulting. Boultwood was the first of two presenters at a GARP-sponsored webinar on April 8, 2014 that attracted about 2,000 registrants. Operational risk has evolved from conceptual to strategic, and is now […]

Pension Plan Risk, Old and New

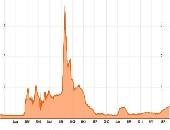

“It’s not about volatility of returns; it’s about volatility of funded status,” said William da Silva, Senior Partner at AON Hewitt, a multinational company specializing in risk management and human resources. He was referring to financial risk management in the face of the developing pension crisis. He was the second of two speakers on the evening of January 30, 2014 at the GARP Toronto Chapter meeting held at First Canadian Place at King & Bay, Toronto. “It’s been a decade of pain,” da Silva said, noting that the median solvency ratio of pension plans had gone from a healthy 110 percent funded […]

Stress Testing, Part 2: Data, the River

A common theme throughout contemporary financial stress testing is “data, the risky river,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group. He was the second of two speakers to address issues around data in stress testing in a webinar organized by GARP on January 28, 2014. The recent financial crisis has permanently altered the relationship between the central bank and all other financial institutions, said O’Connell. The central bank is now looking at them as potential customers for a line of credit, and thus must carry out due diligence including asking for proof that the financial […]

Stress Testing, Part 1: The Data Mountain

Demands by regulators for increased frequency of reporting and more granularity of data in financial stress testing “are creating a data mountain,” said Jon Asprey, VP Strategic Consulting, Trillium Software. He was the first of two speakers to address the issue of data in stress testing in a webinar organized by the Global Association of Risk Professionals on January 28, 2014. He contrasted the new demands with early (pre-financial crisis) days of Basel reporting, when the summary level was sufficient. The data mountain has a significant impact on financial institutions, creating “the month-end panic,” Asprey said, since reporting at most […]

Risk Data Aggregation & Risk Reporting. Part 2

“Not everything that can be counted counts,” said Mike Donovan, VP, Strategic Risk Analytics & Credit Portfolio Management at Canadian Imperial Bank of Commerce (CIBC). He was the second speaker to address the September 19, 2013 evening meeting of the Toronto chapter of GARP regarding the set of Principles for Effective Risk Data Aggregation & Risk Reporting released by the Basel Committee in January 2013. CIBC, like other Canadian banks, is adapting to the heightened risk management data requirements and building the foundation for future sustainable growth. Donovan used the opening quote by Einstein to remind the audience that big […]

Basel III and Beyond: Capital Management and Funding Strategies

“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III. Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about […]

Risk Intelligence for Value Creation: Part 1. The Levers in the Cockpit

The strategic focus of financial executives and institutional investors must be risk intelligence, not just risk management, according to Leo Tilman, President of Tilman & Company, author, and adjunct professor of finance at Columbia University. He was the first speaker on May 28, 2013 at a webinar organized by the Global Association of Risk Professionals (GARP). In the words of Peter Drucker, institutional investors must understand “the future that has already happened.” Tilman said investors need to have a vision for growth and relevance in the low growth, low return environment post-2007. “Does a firm have a holistic framework for […]