Steering the Ship

“Board involvement is pivotal… It’s so much easier to get climate risk capability embedded,” said Jo Paisley, President of the Global Association of Risk Professionals (GARP). “Our survey found the vast majority of boards have oversight of climate-related risks and opportunities.” She was referring to the report titled Third Annual Global Survey of Climate Risk Management at Financial Firms available from the GARP website since September 2021. Paisley and two other panel members were part of the July 12, 2022, webinar to mark the publication of a joint report from GARP and the United Nations Environment Programme Finance Initiative (UNEP FI). […]

Climate Risk Survey

Investors continue to ask for more investment strategies that target environment and sustainability. When it comes to capability to manage financial risks due to climate change, how far along are firms in addressing the issues? The second annual global survey of climate risk management at financial firms, sponsored by the Global Association of Risk Professionals (GARP), was presented in a webinar on September 22, 2020. The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP. Paisley began by taking a quick poll of the audience, chiefly GARP members. “Why are you interested in the […]

A Good I.M. is Hard to Find

How does an investor stay on good terms with its investment manager firm (I.M.)? In the first half of his talk, Sidney Hardee, Managing Partner of Hardee Brothers, LLC., spoke about hiring and firing. In this, the second half, he comments on the search, fees, taxes, and complexity. He was the sole presenter at the one-hour webinar “Hiring and Firing Investment Managers” sponsored by the Chartered Financial Analysts Institute on January 15, 2020. Search Hardee distilled the search for the correct I.M. down into four questions. How will I identify good investment managers? How much will it cost to gain exposure? […]

Grown-ups in strategic positions

How does an investor approach the problems of hiring and firing the investment manager firm (I.M.)? “In general, the first thing is to understand who you are as a business,” advises Sidney Hardee, Managing Partner of Hardee Brothers, LLC. “You must understand this thoroughly before engaging an investment manager.” He was the sole presenter of the one-hour webinar “Hiring and Firing Investment Managers” sponsored by the Chartered Financial Analysts Institute on January 15, 2020. Characteristics of the I.M. What are the characteristics of a good investment manager firm? Organizational stability is key, Hardee said. “What is the structure of this organization, […]

A Good Start…

Financial risks due to climate change are receiving more attention of late, particularly for investors and regulators, but how far along are firms in addressing the issues? A report on climate risk management at financial firms tabled on June 28, 2019, sponsored by the Global Association of Risk Professionals (GARP), answers the question with its subtitle: “A Good Start, But More Work to Do.” The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP. “Our sample covered 20 banks and seven other financial institutions … from across the globe. These firms have a global […]

Mega-Platforms, Mega Risk

There’s a world of difference between innovation and disruption. “Think of innovation as doing more, in the same old way,” said Haydn Shaughnessy, innovation specialist and author of Platform Disruption Wave: How the Platform Economy is Changing the World. He presented a GARP webinar on “The Rise of Mega-Platforms and the Risks to Banking” on May 25, 2016. In the first part of his talk, he described mega-platforms. He referred to the thesis of The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail by Clayton Christensen. This book argues that successful companies get so caught up in meeting […]

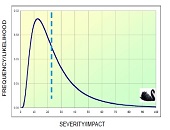

Watch Out for Hippos

Is your company managing risk well enough to make the most of opportunities as they appear? Or does it suffer from risk paralysis? As a company matures, it moves from trying to identify all possible risks (and mitigating them), to saying “what risks will give me the chance to pursue an opportunity,” said Martin Pergler, Founder and Principal of Balanced Risk Strategies, Ltd. He was the first of two panellists at the webinar titled Explore Your Opportunity Landscape by Harnessing Your Risks, sponsored by the Global Association of Risk Professionals on November 18, 2015. Pergler began by making a memorable […]

Harnessing Your Risks

Before your company undertakes economic risks, what systems should be firmly in place? “Good risk management allows us to take risks we wouldn’t normally do,” said Brenda Boultwood , Senior Vice President of GRC Solutions at MetricStream. (GRC is the acronym for governance, risk management and compliance.) She was the second of two panellists at the webinar titled Explore Your Opportunity Landscape by Harnessing Your Risks, sponsored by the Global Association of Risk Professionals on November 18, 2015. A company needs superior risk intelligence in order to understand the risks they plan to harness. Technology can be leveraged to capitalize […]

Aligning Risk Appetite. Part 2

To succeed, a company must take risk, but how can it keep a close enough watch to make sure the risks do not demolish its very existence? After Chris Mandel described the risk appetite framework in part 1 of this posting, Brenda Boultwood, Senior Vice President of Industry Solutions at MetricStream, took the floor to describe how technology can make it happen. She was the second of two presenters at the webinar “Aligning Risk Appetite with ERM Governance” sponsored by the Global Association of Risk Professionals on March 17, 2015. Boultwood said that risk assessment can be a “unifying call” […]

Aligning Risk Appetite. Part 1

“How can you manage risk without understanding risk appetite?” asked Chris Mandel, SVP Strategic Solutions at Sedgwick, Inc. He was the first of two presenters at the webinar “Aligning Risk Appetite with ERM Governance” sponsored by the Global Association of Risk Professionals on March 17, 2015. “Some people ask why do I have to go through a bureaucratic exercise,” Mandel said, pointing out that there are real advantages to developing a risk appetite framework (RAF). Risk appetite management is expected more and more often by regulators, credit rating agencies, institutional investors, and internal auditors. “Missing the connection between risk and […]