Chemistry and the Economy

Risks are multiplying and becoming more complex. The chemical industry is intrinsically connected to the economy. Can chemistry help solve the biggest crises facing us today? On December 15, 2022, the American Chemical Society hosted a virtual webinar, “Chemistry and the Economy.” The moderator was Bill Carroll, principal of Carroll Applied Science, who spoke to Paul Hodges, chairman of the Swiss-based strategy consulting firm New Normal. In speaking about risks, Hodges does not beat around the bush. He began with what he called “the four horsemen of the apocalypse.” He stated, “First there was the pandemic and associated supply chain […]

Net-Zero Buildings

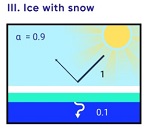

How do we build our homes and cities for a sustainable future? Climate change is such a huge, complex problem that tackling it can seem overwhelming. Fortunately, many organizations are addressing various parts of this colossal puzzle. One aspect is the “built environment.” Can existing buildings be modified to cope with climate change? Can buildings be redesigned to have net zero effect on the environment? On July 1, 2021, a panel of experts gave their thoughts on matters relating to climate change and buildings, as part of the New York Times Climate Hub series of webinars. This is the “Built […]

The Achilles Heel of Banking

After last decade’s financial crisis, regulators introduced several new measures to reduce systemic risk in the financial system. How are the new safeguards working? What are the implications for future balance sheet structure? The CFA Society Toronto convened a panel of three experts on November 25, 2020, to discuss the new regulatory capital and liquidity frameworks and how they are reshaping the way Canadian banks approach the market. The webinar, including a Q&A session, was moderated by Nigel D’Souza, Investment Analyst, Veritas Investment Research. “There’s no doubt the financial crisis changed balance sheets,” said Bruce Choy, Managing Director (Former Risk […]

Wanted: Rubber bands

It’s the time of pandemic. Given the order to “shelter in place” throughout most of the developed world, how can global networks cope when the majority of the workforce is working remotely? For many knowledge workers, working remotely is not a new concept. “I’ve been working from home for twenty of the past thirty years,” said Eric Kavanagh, CEO of the independent research firm Bloor Group. “How to handle surges in traffic has been a topic of discussion for more than twenty years.” Kavanagh was the first speaker for the webinar, “Cloud Native Data: The Foundation of Modern Business,” presented […]

A Good Start…

Financial risks due to climate change are receiving more attention of late, particularly for investors and regulators, but how far along are firms in addressing the issues? A report on climate risk management at financial firms tabled on June 28, 2019, sponsored by the Global Association of Risk Professionals (GARP), answers the question with its subtitle: “A Good Start, But More Work to Do.” The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP. “Our sample covered 20 banks and seven other financial institutions … from across the globe. These firms have a global […]

Winds of Change

“Will the greater intensity of climate change expected in Canada produce a greater impact on Canadian financial institutions, and firms that hold a greater proportion of exposure to Canada in its portfolio?” This was the question posed by Robert Thomas, risk consultant to the non-profit organization Ontario Conservation Now as part of a round table held at the Toronto Public Library on April 18, 2019. A report[1] tabled earlier this month by Environment Canada says that climate change will have a greater effect on Canada than on most countries. The report, Canada’s Changing Climate Report 2019 (CCCR2019), looked at observed […]

Clash of Titans

In the wake of the financial crisis, the two Titans that create accounting standards tried to hammer out agreement over how to account for impairment of loans. These bodies are the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB). “FASB and IASB share the same goal but unfortunately were not able to agree on the same standard,” said Emil Lopez, Director of Risk Measurement at Moody’s Analytics. FASB calls their impairment standard “current expected credit losses” (CECL) whereas IASB deals with impairment and expected losses in their International Financial Reporting Standards as IFRS 9. Lopez was […]

Move Beyond Spreadsheets

Is your firm ready? Financial institutions are seeking answers that will help them plan a roadmap for implementation of the new current expected credit losses (CECL) standard issued by the Financial Accounting Standards Board (FASB). “The runway looks long but firms need to start to prepare now,” said Anna Krayn, Team Lead for Impairment, Capital Planning and Stress Testing at Moody’s Analytics. She was the second of three panellists at the webinar “The Long Road to CECL” sponsored by the Global Association of Risk Professionals on September 8, 2016. “Now is the time to educate, organize and govern, quantify, and […]

Long Road, Many Challenges

Nothing like a financial crisis to show the rough spots in estimation of losses. “Credit losses weren’t being recognized on a timely basis,” and the impairment accounting models were complex and varied widely, according to Kevin Guckian, Partner, National Professional Practice at Ernst &Young. He was the first of three panellists at the webinar “The Long Road to CECL” sponsored by the Global Association of Risk Professionals on September 8, 2016. “FASB’s final standard should accelerate recognition of credit losses,” Guckian noted, referring to the current expected credit losses (CECL) standard newly adopted by the Financial Accounting Standards Board. He […]

Worst Case Analysis Made Easy

Can symbolic computing improve real-world design? Definitely yes, according to the product development team at the automotive firm Delphi. “Each time the circuits were changed, the electrical equations changed. We turned to symbolic computing so that we could quickly deal with design changes,” said Michael G. McDermott, Senior Development Engineer at Delphi. He was the second speaker in a webinar on May 25, 2016, titled “How Far Can Your Math Knowledge Go?” Lights, heating, movies for kids in the back to watch… Over time, vehicles have come to have more and more elaborate electronics. These can lead to unpredictable stresses […]