“Will the greater intensity of climate change expected in Canada produce a greater impact on Canadian financial institutions, and firms that hold a greater proportion of exposure to Canada in its portfolio?” This was the question posed by Robert Thomas, risk consultant to the non-profit organization Ontario Conservation Now as part of a round table held at the Toronto Public Library on April 18, 2019.

A report[1] tabled earlier this month by Environment Canada says that climate change will have a greater effect on Canada than on most countries. The report, Canada’s Changing Climate Report 2019 (CCCR2019), looked at observed changes and modeled future patterns of change.

“Emissions of greenhouse gases, particularly carbon dioxide, will drive the magnitude of climate change. Two scenarios were considered,” Thomas said, describing the simulations.[2] “The low emission kept average warming to 1 degree Celsius; the high emission assumed average warming of 3.7 degrees.”

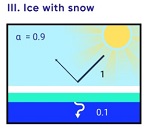

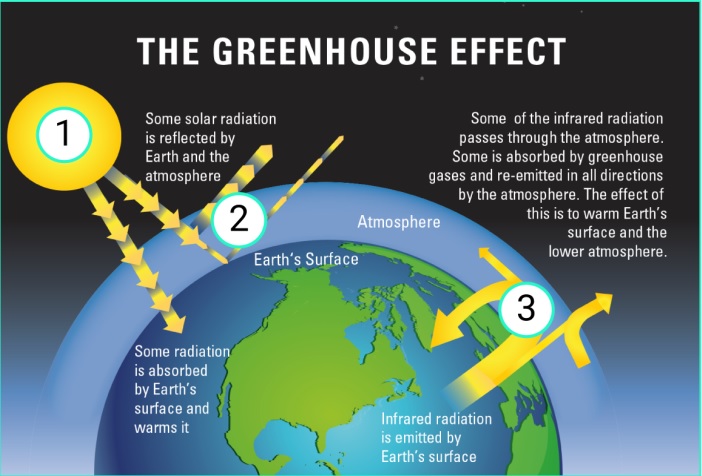

Three main factors affect climate, as shown in the diagram: (1) incoming solar radiation (2) the reflectivity (albedo) of the Earth’s surface (3) the dissipation of heat by the Earth goes into space. The third factor refers to the phenomenon of heat getting trapped by the Earth’s atmosphere. The gases that trap the infrared energy are referred to as greenhouse gases.

Thomas outlined the major findings from the CCCR 2019 report:

- Canada’s climate has warmed and will warm further in the future, driven by human influence.

- Both past and future warming in Canada is, on average, about double the magnitude of global warming.

- Oceans surrounding Canada have warmed, become more acidic, and less oxygenated, consistent with observed global ocean changes over the past century.

- The effects of widespread warming are evident in many parts of Canada and are projected to intensify in the future.

- Precipitation is projected to increase for most of Canada, on average, although summer rainfall may decrease in some areas.

- The seasonal availability of freshwater is changing, with an increased risk of water supply shortages in summer.

- A warmer climate will intensify some weather extremes in the future.

- Canadian areas of the Arctic and Atlantic Oceans have experienced longer and more widespread sea-ice-free conditions.

- Coastal flooding is expected to increase in many areas of Canada due to local sea level rise.

- The rate and magnitude of climate change under high versus low greenhouse gas emission scenarios project two very different futures for Canada.

“The most worrisome aspect is the finding that future warming in Canada is projected to be about double the magnitude of global warming,” Thomas said. “I don’t know if banks are stress testing for such conditions.”

The faster warming “is due to the loss of ice in Arctic areas,” he explained. Research shows the Canadian Arctic has a rate of warming about three times the global rate. The climate phenomenon known as Arctic amplification occurs when “loss of ice destroys the reflective capability of land mass.”

The financial community is concerned about climate change. For example, the report, Climate Change: Managing A New Financial Risk, by consultancy firm Oliver Wyman in February 2019 outlines the financial implications of climate change.

Jointly authored by John Colas, Ilya Khaykin, and Alban Pyanet, the report posed the question, “With the growing recognition of the financial stakes, rising external pressures, and upcoming regulations, how should banks and specifically their risk management teams manage climate risks?”

The authors reached two conclusions: (1) Banks should treat climate risk as a financial risk, not just as a reputational one (2) Banks should integrate climate considerations into financial risk management.

The Oliver Wyman report looks at the operational risk (which they call “physical risk”) of weather events—as well as what they call “transition risks.”

“Transition risks are the risks associated with the transition to a low-carbon economy,” the report states. According to the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD), transition risks “may entail extensive policy, legal, technology, and market changes to address mitigation and adaptation requirements related to climate change.”

Firms will also face regulatory risk and will have to ramp up stress testing for climate change risk.

In the question period, Thomas said that, although “the outcomes are not yet known,” members of the investment community should “brace themselves” for climate change to have a greater impact on Canadian financial institutions. “Firms that hold a greater proportion of exposure to Canada in its portfolio may find themselves at a disadvantage.”♠️

Click here to access the PDF version of the Environment Canada report: Canada’s Changing Climate Report 2019 (CCCR2019). The diagrams of the greenhouse effect and the effect of ice on albedo are from Chapter 2 of the report.

Click here to view the full online version of the report: www.ChangingClimate.ca/CCCR2019

Click here to access the Oliver Wyman report: Climate Change: Managing a New Financial Risk.

[1] Bush, E. and Lemmen, D.S., editors (2019): Canada’s Changing Climate Report; Government of Canada, Ottawa, ON. 444 p.

[2] Flato, G., Gillett, N., Arora, V., Cannon, A. and Anstey, J. (2019): Modelling Future Climate Change; Chapter 3 in Canada’s Changing Climate Report, (ed.) E. Bush and D.S. Lemmen; Government of Canada, Ottawa, Ontario, p. 74–111.