Barcodes of Finance 2

3. What allowed non-standard transaction date to persist and what was your response? I had spent my whole career in various sectors of finance and as an advisor to many financial institutions as a consulting Partner with PwC, responsible for the Financial Services sector. I saw the same sets of transaction data described differently in each firm, even though they would need to match perfectly between firms in order to confirm the transaction with the counterparty and either receive payment or pay for it. This disorder was managed by delaying the payment until all the details were reconciled, first by […]

Barcodes of Finance 1

After the holidays, Morty was bragging he’d been out to a new, very swanky seafood restaurant. “The maître d’ said they’re planning to bring in seafood barcodes.” I immediately pictured a slab of fish on Styrofoam with the price barcode sticker on it—straight from my local supermarket. “And this is at a high-end place?” I said skeptically. “Yeah, but it’s an identifier code, not a price sticker. It’s so the customer can verify they’re getting what they’re paying for,” he said. “Apparently there’s a big push to identify species, and make the information available.” Talking about fish barcodes reminded me […]

Central Clearing Design

If you had to design a central clearinghouse for transactions in financial markets, what size of guarantees should be offered? And what percentage fees should be charged? “The central clearing modifies the market,” said Andreea Minca, “because the old network structure [of one-to-one] is changing to a new ‘star’ structure.” Minca is Assistant Professor at the School of Operations Research and Information Engineering at Cornell University and was the sole presenter at the December 6, 2016, webinar on systemic risk and central clearing design to members of the Global Association of Risk Professionals (GARP). Under new US legislation, all over-the-counter […]

Mega-Platforms, Mega Risk

There’s a world of difference between innovation and disruption. “Think of innovation as doing more, in the same old way,” said Haydn Shaughnessy, innovation specialist and author of Platform Disruption Wave: How the Platform Economy is Changing the World. He presented a GARP webinar on “The Rise of Mega-Platforms and the Risks to Banking” on May 25, 2016. In the first part of his talk, he described mega-platforms. He referred to the thesis of The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail by Clayton Christensen. This book argues that successful companies get so caught up in meeting […]

Platform of the Future

What will be the ideal modelling platform of future bankers? It will need to contain key functionalities in model execution, scenario management, and a “risk engine” that will deliver answers for multiple horizons at the loan level. Furthermore, it should implement the most advanced modelling suites, reduce the quants’ time to develop models, and contain simulation capabilities for stress testing and beyond. This bold vision of the future was presented by Martim Rocha, Advisory Business Solution Manager at SAS. He was the second of two presenters at the February 25, 2016, webinar offered by the Global Association of Risk Professionals […]

Towards Reducing Systemic Risk

Have the risks posed by financial derivatives in the context of the current, still evolving, regulatory landscape been properly addressed? Michael Piracci, Director of PCB Compliance at Barclays, said that nowadays he has “a lot of interactions day-to-day with the clearinghouse” and overall, “it makes me feel a little more comfortable there’s a good system in place.” Piracci was the first of four presenters at a webinar titled Derivatives Regulatory Update held on March 31, 2015, sponsored by the Global Association of Risk Professionals. Piracci began by explaining the role of the Central Counterparty (CCP) and the Futures Commission Merchants […]

Challenges to Risk Data Aggregation: Overview

Will financial institutions be able to respond to new challenges of risk data aggregation, reporting and record-keeping? Peter J. Green, Partner of Morrison & Foerster LLP, opened the four-panellist webinar organized by GARP on July 22, 2014, to discuss new risk data aggregation, risk reporting and recordkeeping principles. He indicated that the recent financial crisis had caused regulators to see many gaps in risk reporting and aggregation due to deficiencies in banks’ IT and data architecture. The Financial Stability Board (FSB) gave a mandate to the Basel Committee on Banking Supervision (BCBS) “to develop principles for effective risk data aggregation […]

Counterparty Credit Risk 1. Regulatory Landscape

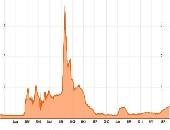

“Things got out of control very quickly” during the collapse of Lehman Brothers, said Cady North, Senior Finance Analyst for Bloomberg Government, as she compared counterparty credit risk analysis before and after Dodd-Frank legislation was enacted. North was the first of three speakers at a webinar held on May 20, 2014, sponsored by the Global Association of Risk Professionals. The webinar attracted a record number of registrants. Prior to the financial crisis of 2007, “no regulatory reporting was going on for counterparty risk on a regular basis,” North said. There was lack of a common legal entity identifier for Lehman […]

OTC Market 1. “It was a busy 15 months…”

Over the past fifteen months, “the biggest paradigm shift that we’ve seen in the last twenty years” has occurred, said Nathan Jenner, Chief Operating Officer at Bloomberg Electronic Trading. He was the first of two speakers at a GARP-sponsored webinar, held on April 15, 2014, about changes to the over-the-counter (OTC) market. Jenner put the changes in context: the new legislation driving the changes arose from the 2009 G20 summit in Pittsburgh that occurred on the heels of the 2008 financial crisis. There were three areas the signatory nations wanted to focus on, he said: “reducing systemic risk, improving transparency, […]

Basel III and Beyond: Capital Management and Funding Strategies

“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III. Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about […]