3. What allowed non-standard transaction date to persist and what was your response?

I had spent my whole career in various sectors of finance and as an advisor to many financial institutions as a consulting Partner with PwC, responsible for the Financial Services sector. I saw the same sets of transaction data described differently in each firm, even though they would need to match perfectly between firms in order to confirm the transaction with the counterparty and either receive payment or pay for it. This disorder was managed by delaying the payment until all the details were reconciled, first by manual inspection when securities were delivered physically, then later by semi-automated means when securities were immobilized in depositories at the end of the 1970s. Automation of financial transaction flows depends on each firm maintaining lists of proprietary codes, hundreds of them, to be mapped (matched) one to the other to identify the same specific counterparty or supply chain participant. They receive information from hundreds of financial supply chain participants, each using their own proprietary formats, codes and unique identity schemes. They also must respond in kind to supply information back to each.

When Lehman collapsed and the issue of non-standardized transaction data came to the fore, the global financial system had been living with incremental improvement in the reconciliation of matched transactions, avoiding dealing with the fundamental issue of non-standardized reference data. Systems efforts were focused on the revenue side of the business, adding new trading and product functionality, not on re-engineering the back office.

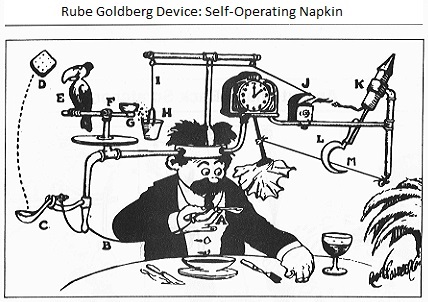

Over the decades of avoiding the issue many Rube Goldberg or Heath Robinson contrivances were created. Elaborate giant mapping tables of proprietary identifier codes were maintained within each firm. Shared infrastructure utilities mapped transaction data between firms. The reconciliation times between firms was reduced from weeks to days. The reconciliation work-flow processes within each firm were streamlined and automated. These all added significant infrastructure costs and additional risks while preventing the achievement of the long-sought goal of straight-through-processing (STP).

4. Your paper states “after six decades of automation there are no global standards for the identity of financial market participants.” What is the biggest barrier to creating “barcodes of finance”: technology, process, or enforcement?

In 2006, I and colleagues published a paper which laid out the decades-long problem: Operational Risk and Reference Data: Exploring Costs, Capital Requirements and Risk Mitigation.

I then engaged with the Enterprise Data Management Council and together we brought the issue to the banking and securities regulators here in the US. Later, I formed the Global Data and Standards Alliance consisting of internationally active financial institutions and their professional overseers, standards bodies, trade associations and data and technology companies and brought the issue to international regulators. Finally, when the issue was recognized through the financial collapse of Lehman and its financial crisis aftermath, I participated in the US government’s dialogue on how to fix the problem.

We responded to consultations at that time, by the SEC, the CFTC and the newly established Office of Financial Research of the US Treasury. They wanted input on how to create a unique, universal, and unambiguous identification system that could be used initially for derivatives but ideally to supplant all proprietary coding schemes in the global financial supply chain.

With prodding from us and others the issue was subsequently recognized as a global one. In 2010 the G20 established the Financial Stability Board (FSB) to oversee stabilizing the financial system. The FSB chose as one of its first initiatives the development of a legal entity identifier (LEI), and later a series of projects to develop unique data identities for derivatives [the unique transaction identifier (UTI) and the unique product identifier (UPI)].