Transition & Stability

The increasing frequency of extreme weather events in Canada has caused the annual payouts for catastrophic insurance claims to skyrocket, according to a recent Statistics Canada report. This is but one small piece of a global picture emerging, where extreme weather events are causing homeowner insurance to increase at a rate higher than inflation. In the worst case, climate change will cause insurance companies to go bankrupt and homeowners will have nowhere to turn. “Transitions happen shock-wise and are systemic,” said Dirk Schoenmaker, Professor at the Rotterdam School of Management. “What can we do to reduce transition risk?” He was speaking at a webinar […]

Ask the Fed

“The Fed is trying to achieve price stability and maximum employment,” said Sylvain Leduc, Executive Vice President and Director of Research of the U.S. Federal Reserve Bank of San Francisco (FRBSF), known informally as “the Fed.” In terms of employment levels, “we are back to where we were pre-pandemic.” He was speaking on February 7, 2023, at a public briefing in which he outlined the FRBSF’s thinking on economic matters. He showed a graph of unemployment, which reached a peak at the start of the pandemic in early 2020. The monthly change in nonfarm payroll employment had a downward arc. “Job […]

Chemistry and the Economy

Risks are multiplying and becoming more complex. The chemical industry is intrinsically connected to the economy. Can chemistry help solve the biggest crises facing us today? On December 15, 2022, the American Chemical Society hosted a virtual webinar, “Chemistry and the Economy.” The moderator was Bill Carroll, principal of Carroll Applied Science, who spoke to Paul Hodges, chairman of the Swiss-based strategy consulting firm New Normal. In speaking about risks, Hodges does not beat around the bush. He began with what he called “the four horsemen of the apocalypse.” He stated, “First there was the pandemic and associated supply chain […]

The Future of Crypto

What’s been happening in the cryptocurrencies market? Is it all merely speculation or is crypto here to stay? What is the future of broader blockchain technologies? What could regulation mean for the world of decentralized finance (DeFi)? On February 24, 2022, Helen Joyce, Britain editor of the weekly magazine the Economist, posed questions to her colleagues: Alice Fulwood, Wall Street correspondent at the Economist, and Matthieu Favas, finance editor at the Economist, in order to explore the rise of cryptocurrency and its potential consequences. “Blockchain can be thought of as a database distributed across many nodes,” Alice Fulwood said, “one […]

The future of active management

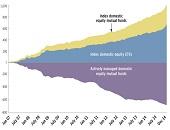

“Active portfolio management is futile,” say some who watch the progression of the financial industry. “Active managers only randomly outperform the stock market as a whole.” Is this true, or have the rumours of its demise been greatly exaggerated? On June 10, 2021, Philip Young, CFA, welcomed a webinar audience on behalf of the CFA Society of Toronto to consider this very question as they listened to Ronald Kahn, Managing Director, and Global Head of Systematic Equity Research at Blackrock, the world’s largest asset manager. He recently co-authored the book Advances in Active Portfolio Management: New Developments in Quantitative Investing. […]

Death of Fundamental Analysis?

Have you been following the market frenzy around stocks for GameStop, AMC and Bed Bath & Beyond? Or the news on Wall Street Bets and Robinhood? How disruptive are these events for traditional valuation methods? What new factors must be considered when investing and allocating capital? Recent shifts in market dynamics have altered the perception of capital markets in meaningful ways. On April 8, 2021, the Corporate Finance Committee of the CFA Society of Toronto convened a panel of experts to discuss the reasons market valuations are so out of synch with fundamental analysis. Moderator Stephen Foerster, Professor of Finance […]

“Disasters Everywhere”

What is the cost of a disaster? What is the cost of the business cycle? Economically speaking, how do business cycles compare with disasters? The cost of business cycles and the gain to be had from stabilization policy is a highly controversial topic in macroeconomics. Some believe the welfare gains from stabilizing the business cycle are extremely low and therefore not worth the effort. “Depression prevention and stabilization policies are central to the discipline of macroeconomics,” conclude the authors of recent research published by the Federal Reserve Bank of San Francisco. “Extreme and costly events are not the only reason […]

A Good I.M. is Hard to Find

How does an investor stay on good terms with its investment manager firm (I.M.)? In the first half of his talk, Sidney Hardee, Managing Partner of Hardee Brothers, LLC., spoke about hiring and firing. In this, the second half, he comments on the search, fees, taxes, and complexity. He was the sole presenter at the one-hour webinar “Hiring and Firing Investment Managers” sponsored by the Chartered Financial Analysts Institute on January 15, 2020. Search Hardee distilled the search for the correct I.M. down into four questions. How will I identify good investment managers? How much will it cost to gain exposure? […]

Grown-ups in strategic positions

How does an investor approach the problems of hiring and firing the investment manager firm (I.M.)? “In general, the first thing is to understand who you are as a business,” advises Sidney Hardee, Managing Partner of Hardee Brothers, LLC. “You must understand this thoroughly before engaging an investment manager.” He was the sole presenter of the one-hour webinar “Hiring and Firing Investment Managers” sponsored by the Chartered Financial Analysts Institute on January 15, 2020. Characteristics of the I.M. What are the characteristics of a good investment manager firm? Organizational stability is key, Hardee said. “What is the structure of this organization, […]

Shifting Energy Markets

How are strategic priorities in energy markets shifting? What are the risk management implications? “Geopolitical risks have worsened and technological innovation is causing more disruption,” said Medy Agami, senior partner and vice-chairman at Ben-Roz and Associates and co-founder of the consulting firm Opimas. He was the sole presenter of the webinar “Energy Market Strategy and Risk Playbook: How to prosper amid a wave of disruptive innovation, geopolitical uncertainty, market volatility & exponentially growing risk landscape in 2018 & beyond” sponsored by the Global Association of Risk Professionals (GARP) on August 7, 2018. “There are five main forces acting on fundamentally shifting markets,” […]