Eye on Credit Markets. Part 1: Little Beta, Lots of Alpha

“How will the credit markets perform if the Federal Reserve Board chooses to taper over the next year or so?” asked Sivan Mahadevan, Head of U.S. Credit Strategy and Global Credit Derivatives Strategy at Morgan Stanley. He posed this question to members of the Global Association of Risk Professionals on November 21, 2013. Here, “tapering” refers to a gradual lessening of asset purchases. As the first of two speakers in a webinar presentation, Mahadevan summarized the credit markets to date: “little beta, lots of alpha.” Investment grade assets have had a good rally this year. “The higher yields go, the […]

Modeling Sovereign Risk. Part 1: Emerging Markets

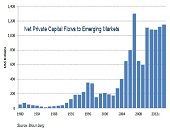

“Country-specific factors such as government debt and the sovereign credit rating change slowly but global aggregates such as the risk appetite change quickly, thus leading to confusion the part of observers,” said Michael Rosenberg, Foreign Exchange Consultant, Bloomberg and author of Currency Forecasting: A Guide to Fundamental and Technical Models of Exchange Rate Determination. He was the first of two speakers to address a GARP webinar audience on September 12, 2013. Much of Rosenberg’s talk focused on the sovereign credit risk of emerging markets (EM), because the accelerating flow of net private capital into EM from 1980-2014 has been unprecedented. […]

The State of the Credit Markets: Part 2. Global Trends

“Political uncertainty creates a bimodal distribution of risk, which is very difficult for the markets to price,” said Seth Rooder, Global Credit Derivatives Product Manager for Bloomberg, and the second of two speakers at the Global Association of Risk Professionals (GARP) webinar on November 15, 2012. (Click here to view Part 1.) Rooder was referring to the first of five main themes in global risk trends, as he sees them. They are: (1) Economic and political uncertainty (2) Slowing global growth (3) Central Bank (CB) intervention (4) Continuing low yields (5) Increased regulation Ever since the financial crisis of 2008, […]

Managing Risk Beyond Asset Class Diversification

“The ‘new normal’ in asset allocation must be forward-looking and driven by macroeconomics, said Sébastien Page, Global Head of Client Analytics, Executive Vice-President at PIMCO. He was addressing a CFA Society Toronto luncheon on October 15, 2012 in Toronto’s historic National Club. Traditionally, asset allocation focussed on diversifying according to asset class. In the ‘new normal,’ Page recommends diversifying across risk factors. “Think of asset class as simply a container of risk factors,” he suggested. He gave another metaphor in line with the luncheon crowd. “Think of risk factors as components like proteins, carbohydrates, and fats. An asset class would […]

Risk-Adjusted Performance Measurement. Part 2: Everything But the Kitchen Sink

The risk measures, both ex post and ex ante, that formed the hands-on component of the one-day workshop on risk-adjusted performance measurement at the CFA Society Toronto offices, are covered in greater detail by the book Practical Portfolio Performance Measurement & Attribution. The author (and workshop leader), Carl Bacon, gave the workshop participants a whirlwind tour on September 17, 2012. This continues a recap of the highlights begun in Part 1 of this posting. Simple risk measures are “stand-alone” for a given portfolio (e.g., variability and Sharpe Ratio), or they are calculated in conjunction with another benchmark or portfolio (e.g., […]

ETFs: Liquidity, Trading & Portfolio Implementation Strategies

When the CFA Society Toronto decides to hold an ETFs seminar in Toronto’s Hockey Hall of Fame, such as it did on the balmy evening of Sept 13, 2012, there is a competition for attention. The venue is full of items of interest to the die-hard fan, such as the shower sandals used by Alexander Ovechkin during the 2011 All-Star game. The lesser fan might stand there, equally transfixed, wondering what the secondary market for used shower sandals could be, even those of Alexander Ovechkin. The ETFs seminar had panel discussions covering three areas: market making, liquidity and trading; utilizing […]