The new guidelines on credit impairment at U.S. banks regulate the estimation and reporting of the current expected credit loss (CECL). But what are they really about?

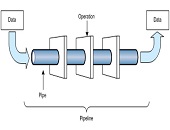

“CECL is all about setting up a data pipeline,” said Krish Ray, CECL Implementation Lead at SAS. He was the second of three speakers at a webinar panel titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018.

Ray categorized the key challenges of CECL implementation as: models, data, business, governance, and sustainability.

Smaller banks might lack modelling expertise and “may have to turn to vendor models.” Financial experts have worked for years on systems and processes to satisfy the Comprehensive Capital Analysis and Review (CCAR) test and the Dodd-Frank Act Stress Test (DFAST). Reusing CCAR/DFAST models is not always possible because these models were designed for previous rules based on point-in-time snapshots, as opposed to a fixed cohort evolving through time (the vintage model).

“CECL is not purely a reporting exercise,” Ray said. He suggested many iterations and adjustments may be required in the process of getting a reasonable CECL estimate. “The system input needs to allow for business intervention.” Thus, governance processes must be developed.

Datasets are often inconsistent due to: changes in source systems; the use manual entry systems; or legacy data from acquisitions. Possibly the required data has not been stored at the frequency, or with the historical depth, needed for model development. Furthermore, data rationalization efforts complicate sourcing and timelines. “A bank might use vendor data at the start and, over time, transition to their own data,” Ray said.

“CECL is more than a regulatory checkbox.” To get buy-in from stakeholders, Ray suggested, “you need to have a value-add. Can the business clients use the [CECL set-up] for other things they are doing?” Additionally, it’s desirable to integrate CECL into credit decisioning, and stress testing. But “how much should you try to bite off initially?” he asked.

CECL is a brand-new process involving Risk, Finance, IT, and Treasury departments. To get buy-in from multiple teams, you need to have a good governance structure. “Many institutions are hesitant to disrupt current processes,” he noted, and the process is thus not likely to succeed.

Lastly, in order to have a sustainable process, a bank needs to have a sturdy post-implementation support model in place. Although CECL is largely a data pipeline, it is also about the care and maintenance of the pipeline. ª

Click here to read about the first panellist’s presentation.

Click here to read about the third panellist’s presentation.

Click here to view the GARP Webcast- CECL: Managing Through the Implementation Headwinds.