On October 24, 2023, the International Energy Agency (IEA) released its annual report, World Energy Outlook (WEO), to an international audience.

The agency states that the energy world “remains fragile but has effective ways to improve energy security and tackle emissions.” Agency analysts looked at how close the countries of the world are to meeting the objectives of the Net Zero Emissions by 2050 (NZE) Scenario, which limits global warming to 1.5 °C, a goal signed by many countries and often referred to as the Paris Agreement. [As of March 2021, 194 states and the European Union have signed the agreement.] In their analysis, the authors of the WEO report used the Stated Policies Scenario (STEPS), which is based on the latest policy settings of each nation, including energy, climate, and related industrial policies.

Some of the immediate pressures from the global energy crisis have eased, but energy markets, geopolitics, and the global economy are unsettled and there’s a risk of further disruption. Against this complex backdrop, the emergence of a new clean energy economy, led by solar photovoltaic (PV) technology and electric vehicles (EVs), provides hope for the way forward. This year’s WEO report provides a “strong evidence base” to guide the choices that face energy decision makers in pursuit of transitions that are rapid, secure, affordable, and inclusive.

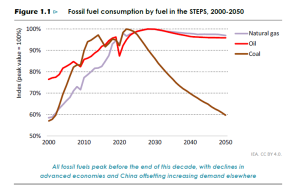

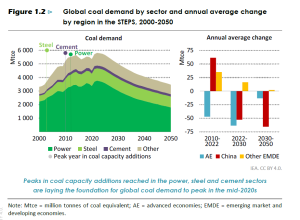

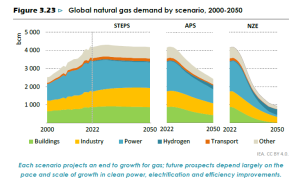

The release of this report made business headlines throughout the world because the IEA stated that the world is on track to see all fossil fuels peak before 2030. One outcome of the global energy crisis may be to signal the beginning of the end of the fossil fuel era: the momentum behind clean energy transitions is now sufficient for global demand for coal, oil, and natural gas to all reach a high point before 2030.

“Policies supporting clean energy are delivering,” says the report, “as the projected pace of change picks up in key markets around the world.” Although demand for fossil fuels has been strong in recent years, there are signs of a change in direction.

China has changed the energy world, but now China is changing. China has a massive role in shaping global energy trends; this influence is evolving as its economy slows and its structure adjusts, and as clean energy use grows. Momentum behind China’s economic growth is declining and potentially fossil fuel demand will decrease if it slows further.

New dynamics for investment are taking shape. The end of the growth era for fossil fuels does not mean an end to fossil fuel investment, but it weakens the rationale for any increase in spending. Simply cutting spending on oil and gas will not get the world on track for the NZE Scenario; the key to an orderly transition is to scale up investment in all aspects of a clean energy system.

To move faster, development needs must be met in a sustainable way. The global peaks in demand for each of the three fossil fuels mask important differences across economies at different stages of development. Clean electrification, improvements in efficiency, and a switch to lower- and zero-carbon fuels are key levers available to emerging and developing economies to reach their national energy and climate targets.

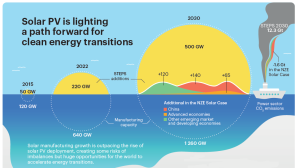

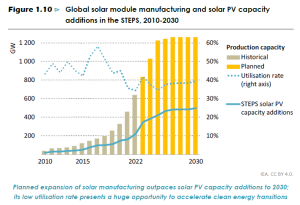

The WEO report states that ample global manufacturing capacity offers considerable upside for solar PV technology. Renewables are set to contribute 80 percent of new power capacity to 2030 in the STEPS, with solar PV alone accounting for more than half. Using 70 percent of anticipated solar PV manufacturing capacity would bring deployment to the levels projected in the NZE Scenario; effectively integrated, this would further cut fossil fuel use – first and foremost coal.

A wave of new LNG export projects is set to remodel gas markets Starting in 2025, an unprecedented surge in new LNG projects is set to tip the balance of markets and concerns about natural gas supply. This additional LNG arrives at an uncertain moment for natural gas demand and creates major difficulties for Russia’s diversification strategy towards Asia.

The future demands affordability and resilience. A tense situation in the Middle East is a reminder of risks in oil markets a year after Russia cut gas supplies to the European Union. The global energy crisis has focused attention on the importance of ensuring rapid, humane, and orderly transitions. Diversification and innovation are the best strategies to manage supply chain dependencies for clean energy technologies and critical minerals.

“We need to go much further and faster,” the report says, “but a fragmented world will not rise to meet our climate and energy security challenges.” Proven policies and technologies are available to align energy security and sustainability goals, speed up the pace of change this decade, and keep the promises of the Paris Agreement. “No country is an energy island, and no country is insulated from the risks of climate change. The necessity of collaboration has never been higher.” Fifty years after the 1973 oil crisis, the world has solutions to address energy insecurity that can also help tackle the climate crisis, and this report shows the way. ♠️

All visuals are from the World Energy Outlook 2023 report; permission is pending. Numbers remain on figures for easy look-up within the report.

Click here to access the 2023 annual report, World Energy Outlook.