How will climate change affect investment decisions, going forward? Are investment professionals well informed on climate risk and transition risk?

“Around the world, nations are committing to net-zero emissions targets of greenhouse gases,” said Richard MacGillivray, Senior Director at CFA Institute. “What are the implications of these commitments for the value and performance of companies in the real economy?”

The 2024 Global Risks Report tabled by the World Economic Forum (WEF) polled risk managers on the biggest global threat to sustainability. Over the next two years, respondents said the top risk is misinformation and disinformation. However, over the next ten years, however, they said the number one risk would be extreme weather events.

Indeed, recent storms are growing more severe in loss of life and property.

On September 9, 2024, MacGillivray welcomed an audience of hundreds to a webinar to describe how the organization of Chartered Financial Analysts will address the growing demand with a Climate Risk, Valuation, and Investing Certificate.

Policy levers drive and support the net-zero commitments, an alphabet soup of new regulations, in particular Sustainable Finance Disclosure Regulation (SFDR), a sustainability regulation from the European Union; International Sustainability Standards Board (ISSB) S1 and S2; and Corporate Sustainability Reporting Directive (CSRD) a sustainability reporting regulation in the European Union.

“Regulators are trying to achieve improved outcomes for their societies and people,” he said, “serving the greater good of society” through addressing the physical impacts of climate change and managing the transition to a low-carbon economy.

This can be done on several fronts:

- Improved functions of capital markets.

- Directing capital towards sustainable ends (e.g. SFDR)

- Improving disclosure of climate-relevant data by companies

- Reducing greenwashing

- Protecting investors (who supply the capital)

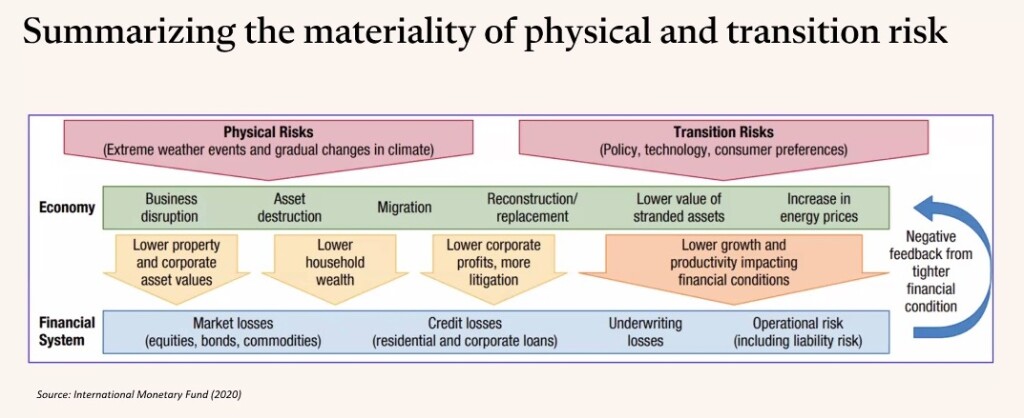

Climate impacts both financial materiality and environmental and social materiality.

“Physical risk from climate change can be expressed in financial terms,” MacGillivray noted. Recent macroeconomic estimates by Bilal and Kanzig find that 1֯ C of increase in global temperature will reduce the world GDP by 12 percent. To put it another way, WEF estimates the physical risk “is costing the worlds $16 million per hour.”

“Physical risk from climate change can also be expressed in future financial terms,” MacGillivray said, citing research from the Potsdam Institute for Climate Impact Research that looked at damage to farming, infrastructure, productivity, and health.

Sustainability practices are material at a company level; climate issues are material. “Unpacking the characteristics of physical risk,” he said, “is the challenge for investors seeking to understand the impact of physical risk.” He noted such risks are diverse, increasing, geographically specific, non-stationary, non-linear, systemic, and potentially self-reinforcing.

As a nation shifts to a low-carbon economy, another type of risk has an impact on the value and performance of assets: transition risk. This includes regulatory risk from climate-related policies, market risk, legal and reputational risk as companies seek to rebrand themselves, and technology risk due unforeseen technological change.

“During the transition period,” he said, “stranded assets may occur when existing infrastructure and resources lose most or all of their value.” Now that UK power plants are no longer using coal, the worth of a coal mine has dropped.

The figure below shows the materiality of physical and transition risk through its effect on the economy and financial system.

There’s heavy investor focus on understanding the risk—and opportunity—of climate change. Financial solutions exist in areas such as adaptation financing. The CFA Institute will train members to understand emissions targets, how to price the quantified emissions, how to evaluate the emissions efficiency, and how to determine other aspects of a net-zero economy.

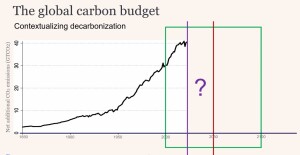

The new certification will teach what the global carbon budget is, and how it relates to a firm’s value.

It will help with help with financial risk management, because it will discuss modeling climate change.

The key questions for the global carbon budget, and how it relates to value are:

- How fast, and by how much, do we need to cut emissions?

- How do we break down a global carbon budget at the country, sector, and individual organization levels?

- How much CO2e is a company responsible for?

- What level of emissions reduction is required by each company?

- How will a shift to a low-carbon economy impact business performance?

“Climate science and climate-change modelling is highly complex,” he said, and for this reason climate scenarios are used in modeling. These are hypothetical representations of future climates.

Modeling gives a context for understanding the global carbon budget, and how decarbonization might affect the economies of different countries.

A wide range of climate scenarios is available to finance professionals, many of them in the public realm. MacGillivray cited three sources for scenarios: IPCC, Network for Greening the Financial System (NGFS), and International Energy Agency (IEA).

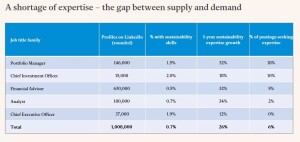

“One of the barriers to achieving improved sustainability,” he noted, “is the shortage of expertise.” The chart below of LinkedIn finance professionals showed only about 1 percent list sustainability skills in their profiles. However, the jobs being offered seek such expertise in 6 percent of the listings (rising to a high of 18 percent, for Portfolio Managers).

Clearly, accreditation with the new Climate Risk, Valuation, and Investing Certificate will give finance professionals a step up in the competitive job market. ♠️

Most visuals are from the webinar. Permission pending.

The wrecked houses photo with headline is from EcoWatch.

The concept for the materiality diagram is from Greenstone Data Solutions.