“The capital consumption of credit counterparty risk has become an issue for banks,” said Rita Gnutti, Head of Internal Model Market and Counterparty Risk at Intesa Sanpaolo. She was the first of two speakers addressing the impact of regulatory developments on counterparty risk assessment. She spoke to a webinar audience arranged by the Global Association of Risk Professionals on June 27, 2013.

Gnutti first outlined the new Basel III regulatory framework of credit counterparty risk (CCR), then she described its calculation using internal model methodology (IMM), and third she described the computing and back-testing of CCR carried out by her firm.

“The paradigm used to be that too-big-to-fail banks were considered to be default-free,” Gnutti said, “but that is no longer the case.” The fair value of OTC derivatives considers bilateral credit valuation adjustment (CVA) and debt valuation adjustment (DVA), governed by new accounting rules IFRS-13.

Gnutti summarized the main changes to CCR capital requirements. All banks now deal with a new CVA capital charge. The IMM banks have an increased margin period of risk for some collateralized netting sets. “They must manage it in a more conservative way,” she said. For example, 10 days becomes a 20-day margin period of risk for netting sets with more than 5,000 deals, or in the case of prolonged disputes. A 2 percent risk weight must be applied to exposures of banks to central counterparties; the CVA charge is not applied to these exposures.

The IMM is the most sensitive but also the most complex methodology for determining the CCR capital charge. But “a huge advantage is that it allows banks to take into account netting and collateral agreements,” said Gnutti. For collateralized deals it requires “simulation of evolution in time of collateral along with exposure.”

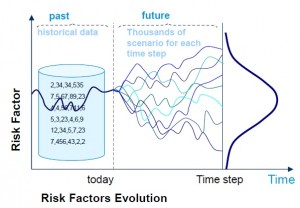

“Under IMM the exposure is calculated through Monte Carlo simulation that has to be approved by regulator,” she said.

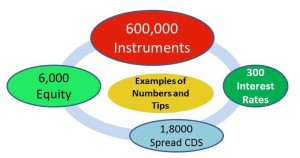

Risk factor and market data demands are significant; an integrated view of market and CCR models is crucial. She noted that “market data must be managed on a daily basis.”

Both actual risk figures and stressed numbers must be calculated as well as value at risk (VaR), incremental risk charge (IRC), stressed VaR, and a variety of other terms such as the effective expected positive exposure (EEPE). She emphasized the architecture had to be fully integrated with the front office system. As well, back-testing and model benchmarking had to be carried out.

As an example of calculating risk factors, Gnutti described three ways to look at the time evolution of collateral: (1) full simulation, which is computationally intensive; (2) Brownian bridge, through stochastic interpolation of mark-to-market values; and (3) a shortcut based on mark-to-market simulation.

Gnutti presented a case study of computing credit exposure for credit line monitoring.

The CVA capital charge through Basel is important because it applies to all exposures, both collateralized and uncollateralized. It can be hedged using credit default swaps (CDS). Most of the increase in capital charge for bilateral transactions comes from application of the new CVA capital charge, said Gnutti. It’s significantly lower when the advanced form of CVA can be applied.

Wrong-way risk occurs when the size of the exposure increases at the same time as the credit risk of the counterparty increases. Gnutti explained how its estimation is tied in with economic capital and the alpha multiplier.

Three levels of back-testing are carried out: for risk factors, mark-to-market, and exposure. The back-testing is done for different time periods (days, weeks, months) and these are carried out for both overlapping and non-overlapping periods. An example of back-testing was provided for interest rates and the 2008 financial crisis.

In conclusion, said Gnutti, there is a “trade-off between the cost of capital, the cost of hedging, and the cost of liquidity.”ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=642360&s=1&k=4741B1B9FCFC1290D1347FD8EA01B959