Towards a Common Standard

Investors around the world are demanding consistent, high-quality reporting of environmental, social, and governance (ESG) data. Is there any global governing body for financial reporting that is up to the task? How can an organization ensure that sustainability reporting is comparable, consistent, and comprehensive? Furthermore, is the input from financial professionals welcomed? The answer, apparently, is “yes” on all three counts. On June 21, 2022, Josina Kamerling, member of the Value Reporting Foundation and the CFA Institute, welcomed an audience of hundreds to a webinar titled “Endgame: Will the ISSB become the comprehensive global baseline for sustainability disclosure?” She introduced the representative […]

Ethical Decision Making

Question 1. Do you think that one’s belief system triggers one’s actions? Or does one act and then justify one’s actions by changing one’s beliefs? Question 2. Is an effective leader one who adheres to a constant belief? Or is the effective leader one who adheres to “situational ethics”? These are two dilemmas that were explored in more depth on February 8, 2022, when Kevin Veenstra, Associate Professor at De Groote Business School at McMaster University, presented a virtual workshop on ethical decision making to members of the CFA Society Toronto. Veenstra’s research focuses on personality and unconscious motives and […]

The Achilles Heel of Banking

After last decade’s financial crisis, regulators introduced several new measures to reduce systemic risk in the financial system. How are the new safeguards working? What are the implications for future balance sheet structure? The CFA Society Toronto convened a panel of three experts on November 25, 2020, to discuss the new regulatory capital and liquidity frameworks and how they are reshaping the way Canadian banks approach the market. The webinar, including a Q&A session, was moderated by Nigel D’Souza, Investment Analyst, Veritas Investment Research. “There’s no doubt the financial crisis changed balance sheets,” said Bruce Choy, Managing Director (Former Risk […]

Quality in the time of Covid

There’s a wide range of “quality factor” investing out there. How can the investor distinguish between the variety of methods? More importantly, how can the investor select the best factor method for given economic conditions? To answer this question, a recent paper compared the variety of methods, and examined how each method performed under different market conditions. The paper, “What is Quality?”, by Jason Hsu, Vitali Kalesnik, and Engin Kose, won the Graham & Dodd 2020 award for the best paper published in the Financial Analysts Journal in 2019. To celebrate the achievement, the journal invited the authors of the […]

More Leaves than Grapes?

Who says the market on old books is in a downward spiral? Luca Pacioli wrote the definitive treatise Summa de Arithmetica, Geometrisa, Proportioni et Proportionalita and published it in Venice in 1494. On June 12, 2019, Christie’s put up one copy for auction. (The starting price was one million USD; it eventually sold for 1.2 million USD.) Experts estimate 120 copies of this book still exist. An image of a typical page, reproduced here, shows its type font is somewhat less readable than the modern accounting textbook. Summa de Arithmetica was widely read and used at the time. It contains real-life examples, […]

Recent SEC Enforcement

Given the trends that are emerging for enforcement by the U.S. Securities and Exchange Commission (SEC), what’s a risk manager to do? “Risk managers should use data and data analytics to identify patterns,” said Steven Hilfer, Managing Director in the Disputes & Investigations practice, Capital Markets at Navigant. He was the fourth and final speaker in a four-part webinar panel titled “SEC 2018 Enforcement Trends” sponsored by the Global Association of Risk Professionals (GARP) on July 25, 2018. He argued that the SEC is plunging ahead in the area of data analytics, and it expects companies “to identify patterns prior to being […]

New Dynamics in Energy Sector

How can financial risk be measured and managed in a volatile industry such as the energy sector? What are some of the common industry challenges? Due to low commodity prices and technological changes in the industry, there are new dynamics in the handling of financial risk management in the energy sector. Three speakers addressed specific changes in a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. “Sometimes the things we think we know, we don’t,” said Gordon Goodman of NRG Energy, the first of three speakers at the webinar. Goodman’s claim to fame is publication […]

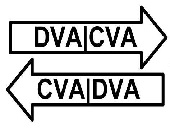

Clash of Titans

In the wake of the financial crisis, the two Titans that create accounting standards tried to hammer out agreement over how to account for impairment of loans. These bodies are the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB). “FASB and IASB share the same goal but unfortunately were not able to agree on the same standard,” said Emil Lopez, Director of Risk Measurement at Moody’s Analytics. FASB calls their impairment standard “current expected credit losses” (CECL) whereas IASB deals with impairment and expected losses in their International Financial Reporting Standards as IFRS 9. Lopez was […]

Move Beyond Spreadsheets

Is your firm ready? Financial institutions are seeking answers that will help them plan a roadmap for implementation of the new current expected credit losses (CECL) standard issued by the Financial Accounting Standards Board (FASB). “The runway looks long but firms need to start to prepare now,” said Anna Krayn, Team Lead for Impairment, Capital Planning and Stress Testing at Moody’s Analytics. She was the second of three panellists at the webinar “The Long Road to CECL” sponsored by the Global Association of Risk Professionals on September 8, 2016. “Now is the time to educate, organize and govern, quantify, and […]

Long Road, Many Challenges

Nothing like a financial crisis to show the rough spots in estimation of losses. “Credit losses weren’t being recognized on a timely basis,” and the impairment accounting models were complex and varied widely, according to Kevin Guckian, Partner, National Professional Practice at Ernst &Young. He was the first of three panellists at the webinar “The Long Road to CECL” sponsored by the Global Association of Risk Professionals on September 8, 2016. “FASB’s final standard should accelerate recognition of credit losses,” Guckian noted, referring to the current expected credit losses (CECL) standard newly adopted by the Financial Accounting Standards Board. He […]