Alternative Mutual Funds 2

“SEC’s mission is to protect investors and support responsible capital formation,” said Raymond Slezak, Assistant Regional Director at the Securities and Exchange Commission (SEC). He was the second of three presenters at the GARP-sponsored webinar held February 17, 2015, on Alternative Mutual Funds: Risk Governance Under SEC Security. Liquid alternative mutual funds were “listed as a priority” as early as 2013, he said, because “any time there’s rapid growth” or “concern about the dynamics of money managers moving into an area,” it attracts SEC interest. As a metaphor about the regulatory thought about the new funds, Slezak repeated a quotation […]

Alternative Mutual Funds 1

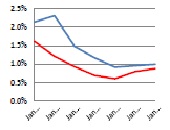

Alternative mutual funds have been experiencing a growth “nothing short of phenomenal,” said Amy Poster, Director of Financial Services Advisory at Berdon LLP, “and this has not escaped the notice of the Office of Compliance Inspections and Examinations (OCIE).” She was the first of three speakers in a webinar about alternative mutual funds held on February 17, 2015, and sponsored by the Global Association of Risk Professionals (GARP). She pointed to a 2014 Barclays study, Developments and Opportunities for Hedge Fund Managers in the ’40 Act Space , that estimated assets controlled by liquid alternative funds would reach between $USD […]

Stress Testing Mortgages. Part 2

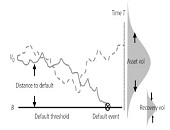

The team of Scott L. Smith, Jesse Weiher, and Debra Fuller at the Federal Housing Finance Agency (FHFA) use specialized financial models to estimate potential losses. They carried out empirical tests of countercyclical shocks using four different models of mortgage credit risk. This posting continues a February 4, 2015, presentation by Scott L. Smith to an audience of financial risk managers at Global Association of Risk Professionals (GARP). Two models were devised at FHFA, and two are commercially available credit models: one, called Black Knight (formerly LPS-AA), and the other called ADCO Loan Dynamics. The estimated losses were converted to a capital […]

Stress Testing Mortgages. Part 1

“One needs to be careful and not over-reliant on any one model,” said Scott L. Smith, Associate Director for Capital Policy at the Federal Housing Finance Agency (FHFA). He was referring to the financial models used by major financial institutions to estimate potential losses. On February 4, 2015, he was presenting a GARP-sponsored webinar on countercyclical stress tests to set capital requirements. Smith explained how credit risk is measured for mortgages, and described a way to embed stress testing that uses countercyclical concepts. He and colleague Jesse Weiher, Senior Economist at FHFA, performed dynamic stress testing that was adjusted to […]

Cyber Risks: 5 Core Capabilities

Integration of cybersecurity into an organization’s risk management framework is “still in the hunter-gatherer state,” said Yo Delmar, VP, Governance Risk & Compliance (GRC) at MetricStream. She was the second of two presenters at the December 16, 2014, webinar on cybersecurity organized by the Global Association of Risk Professionals. Cyber risks are currently incorporated into existing risk management and governance processes in an ad hoc fashion that is “unorganized and fragmented,” Delmar said. “There is quite a bit of work to do to get to a rationalized state” that would permit management of such risks. “Most companies have the vision […]

When Data Is Sparse. Part 2

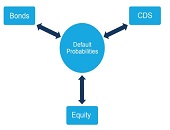

It’s difficult to model sovereign credit risk for emerging markets using structural models such as the Merton model because “calibration is always an issue,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma, continuing a theme during the second half of his webinar on December 2, 2014. During the first half, he showed how the probability of default can be used as a common link among the asset classes of interest (bonds, swaps, and equities). In the second half, he focused more on sovereign credit risk. Calculation of sovereign risk could be done directly, “but […]

When Data Is Sparse. Part 1

When modelling risk in emerging markets, are you hampered by sparse data? “Relationships between different asset classes can help measure the sovereign risk in emerging markets,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma. He was sole presenter at a webinar on December 2, 2014, sponsored by the Global Association of Risk Professionals. When modelling global multi-asset class portfolios, “aggregation can be challenging,” said Stamicar, because the FX rates must also be taken into consideration—the subject for another day. His talk focussed on three asset classes: equity, fixed income, and credit portfolios. Infrequent data, […]

Public vs Private Banks in India and China

“Public sector banks perform worse than private banks In India whereas there is no significant performance difference for the two sectors in China,” said Dr. Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He gave an overview of operational performance and credit risk trends in Banking in Emerging Markets, and was the third of three webinar panellists on November 20, 2014, organized by the Global Association of Risk Professionals. For both countries, Singenellore compared government-owned banks with private sector banks. The terminology is different: India has public sector undertakings (PSU) banks whereas China has state-owned […]

“Expect More Niche Customer Targeting”

In India and China, “large state-owned banks often have a significant constraint on their ability to manage liabilities,” said Professor Moorad Choudhry from the Department of Mathematical Sciences at Brunel University and author of Principles of Banking. He was the second of three panellists at the webinar Banking in Emerging Markets held on November 20, 2014, organized by the Global Association of Risk Professionals, and his role was to describe “operational realities.” The 2018 advent of new Basel III rules for capital and liquidity requires 100 percent compliance with new rules on the liquidity coverage ratio (LCR) and the net […]