Commercial Credit Analytics 1: Under-utilized Tools

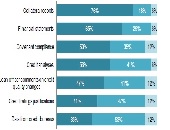

“There is a surprising under-utilization of common tools,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group, during a webinar organized by the Global Association of Risk Professionals on February 20, 2014. He was referring to a survey by Aite Group of about twenty North American commercial loan underwriting professionals (responses as at quarter end Q3 2012). O’Connell characterized the under-utilization as “surprising” because loan underwriting is such an important part of banking. O’Connell was formerly a loan underwriting and loans officer, and was clearly familiar with the details of commercial lending and its role in “Banking […]

Trading Book Capital: Repercussions of a Revised Framework

“Currently, there’s a large gap between models and the standardized approach. [The members of the Basel Committee] are trying to bring these back into line,” said Patricia Jackson, Head of Financial Regulatory Advice at EY (formerly known as Ernst & Young). She was the second of two speakers at a GARP-sponsored webinar on recently proposed changes to the trading book capital requirements. Strengthening the boundary between the banking book and the trading book “could have a significant impact,” Jackson said, because it will be harder to move positions. The change was made “to reduce arbitrage opportunities for placement with respect […]

Trading Book Capital: A Revised Framework

The proposed changes to trading book capital requirements are “a regulatory trade-off among the objectives of simplicity, risk sensitivity, and comparability,” said Mark Levonian, Managing Director and Global Head at Promontory Financial Group, and the first of two speakers at a webinar sponsored by the Global Association of Risk Professionals held February 11, 2014. Levonian acted as “tour guide” for the Basel Committee’s recently proposed changes to the trading book capital requirements. Highlights of the changes are: the revised standardized approach, more rigorous testing, and replacement of the value at risk (VaR) measurement with expected shortfall. “The perception from the […]

Pension Plan Risk, Old and New

“It’s not about volatility of returns; it’s about volatility of funded status,” said William da Silva, Senior Partner at AON Hewitt, a multinational company specializing in risk management and human resources. He was referring to financial risk management in the face of the developing pension crisis. He was the second of two speakers on the evening of January 30, 2014 at the GARP Toronto Chapter meeting held at First Canadian Place at King & Bay, Toronto. “It’s been a decade of pain,” da Silva said, noting that the median solvency ratio of pension plans had gone from a healthy 110 percent funded […]

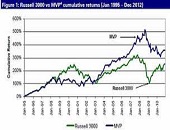

A Low Volatility Equity Strategy

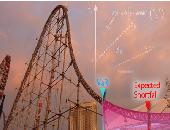

Despite conventional wisdom, “the returns on more volatile equities have not exceeded the historical returns on less volatile equities,” said Grant Wang, Senior Vice-President and Head of Research at Highstreet Asset Management in London, Canada. He was the first of two speakers at the GARP Toronto Chapter meeting held at First Canadian Place at King & Bay, Toronto on the evening of January 30, 2014. Wang began with a brief survey of the increased volatility in equity markets over the past several years: the 2001 tech bubble, the 2008 housing crash, and the 2011 European debt crisis. “VIX has posed […]

Stress Testing, Part 2: Data, the River

A common theme throughout contemporary financial stress testing is “data, the risky river,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group. He was the second of two speakers to address issues around data in stress testing in a webinar organized by GARP on January 28, 2014. The recent financial crisis has permanently altered the relationship between the central bank and all other financial institutions, said O’Connell. The central bank is now looking at them as potential customers for a line of credit, and thus must carry out due diligence including asking for proof that the financial […]

Stress Testing, Part 1: The Data Mountain

Demands by regulators for increased frequency of reporting and more granularity of data in financial stress testing “are creating a data mountain,” said Jon Asprey, VP Strategic Consulting, Trillium Software. He was the first of two speakers to address the issue of data in stress testing in a webinar organized by the Global Association of Risk Professionals on January 28, 2014. He contrasted the new demands with early (pre-financial crisis) days of Basel reporting, when the summary level was sufficient. The data mountain has a significant impact on financial institutions, creating “the month-end panic,” Asprey said, since reporting at most […]

Monetary Policy and Treasury Risk Premia: Part 2

After giving an overview (see Part 1), Paul Whelan, of the Imperial College London and formerly the European Central Bank, walked the audience through the mechanics of an award-winning paper on monetary policy at a webinar on January 16, 2014 sponsored by GARP. A shock, by its very nature, is non-routine. Therefore, “a good measure of monetary policy shocks should exclude systematic components,” Whelan said. Another challenge was to “distinguish between quantity of risk versus price of risk channels.” Use of the Taylor rule allowed the researchers to isolate the exogenous dynamics of monetary policy. The trio was able to […]

Monetary Policy and Treasury Risk Premia: Part 1

“Monetary policy makers want to control the long end of the yield curve,” said Paul Whelan at a webinar on January 16, 2014 sponsored by the Global Association of Risk Professionals. Whelan co-authored an article that won the 2013 GARP Award for best paper in financial risk management. “Monetary Policy and Treasury Risk Premia”, by Andrea Buraschi, Andrea Carnelli, and Paul Whelan, provides a quantitative analysis of the effect of monetary policy shocks on future bond returns. Buraschi is at the University of Chicago Booth School of Business and Imperial College London; Carnelli is at Imperial College London; and Paul […]

Basel, the Big Picture: Tackling Risk Aggregation & Reporting. Part 2

“What [should we] look for in a risk aggregation solution?” asked Renzo Traversini, Director of Europe, the Middle East and Africa & Asia-Pacific, Risk Management Center of Excellence at SAS. He was the second of two speakers at a GARP-sponsored webinar to discuss the recently released Basel paper, Principles for Effective Aggregation and Reporting of Risk Data. Traversini focussed on the “nuts and bolts” of how to aggregate and report risk data. SAS is one of the major suppliers of information technology (IT) solutions in financial risk management. Timeliness is crucial to a good reporting system. Traversini began by showing […]