From state-owned enterprises to the Covid-19 pandemic, issues in China affect the Canadian investment environment and capital flow decisions. Given China’s ascendance in the global economy, what is the best strategy to ride the wave upward, too? What are potential danger areas?

The following is the second half of a report on the webinar “New World Order: How China’s Rising Affects Investment Strategy” held on June 15, 2020, and sponsored by the CFA Society Toronto. Three panellists were interviewed by Tanya Lai, Managing Director, Public Equities, of the Investment Management Company of Ontario (IMCO).

Lai noted there was increased scrutiny of China ADRs. [An American depositary receipt (ADR) is a form of equity security that simplifies foreign investing for American investors.] She asked what the investment risk and opportunities might be.

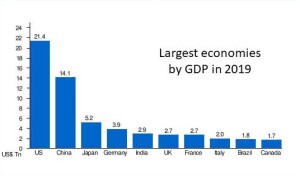

Barry McInerney, President and CEO, Mackenzie Investments, said the events of the past year mean “we will see more diversification and decentralization of supply chains.” China wants to have a fully formed capital markets sector, but they are about twenty years behind developed economies. “Short-termism permeates the Chinese stock market,” he said. “Less than 20 percent of corporate financing is effected through stock issuance.” Consumer spending occupies a much greater share of the economy in the US than in China.

McInerney said that recently some Chinese companies have been delisted, or threated with delisting, in the US. He thinks these companies will turn around and list in stock markets in Hong Kong and Singapore.

John McCallum, Former Cabinet Minister and Canadian Ambassador to China, and Senior Strategic Advisor at McMillan LLP, said that decoupling of the Chinese and American economies may move the two global powers closer to a cold war situation. The recent example of non-collaboration for pandemic response shows just how difficult it is for countries to put aside their differences and tackle a common threat.

McCallum said that, if Joe Biden is elected as the next president, “that would be good for Canada and NATO” but maybe not for China, since both Democrats and Republicans think China is a problem. But “at least the response to China would be more rational.”

Lai asked the panellists how sustainable they thought the Communist regime would be in China.

“Ten, fifteen years ago, people thought that China would become more democratic,” McCallum said. “But right now, we see President Xi Jinping remans very strong and there’s no sign of regime change.”

Gordon Houlden, Director of the China Institute, and Professor at University of Alberta said that he had a formative experience in the USSR shortly before its regime change. “It looked very strong, but 18 months later, it was gone.” The regime has two things it must do well: provide economic growth and stand up for China internationally.

Houlden noted there were two ways that a regime is toppled: through a popular uprising, “unlikely, because they spend more on internal surveillance than on external.” The second way to topple the regime is through a struggle at the top. “Some people were extremely unhappy when Xi Jinping removed term limits from Chinese government.”

Lai asked about dry powder: “Does China have enough room to extend credit over the next decade?”

McInerney said that China has a unique composition of emerging markets and a large modern urban middle class. The Chinese are serious about their containment of the pandemic. They are providing a sizable monetary and fiscal stimulus. “They are focussed on the infrastructure” and are working hard to get a diversified economy.

Inflationary growth looms on the horizon. Houlden described how that could come about. If the US began to impose sudden, strenuous trade rules, this would cause inflationary pressure. “Supply chains take years to grow.” If companies in the developed world must switch to India and Vietnam, costs would go up because there is a lack of infrastructure and trained personnel.

“What other countries could step in?” Lai asked.

“Think: scale,” Houlden said. “Vietnam, South Korea, Malaysia: these all have infrastructure problems.”

McInerney said that Canada is unique in having access to both the number 1 and number 2 economies. “There are fantastic opportunities.” It’s important to “cut through the noise.” Canadian businesses should try to keep going despite the political flare-ups.

In closing, Houlden said that, if we can have a better relationship with China, the opportunities are there. “The US is not a problem-free trading partner, either – just look at the softwood lumber.” Asia is the centre of the global economy now – but we need to settle political issues such as the detention of Meng Wanzhou.

In closing, McInerney emphasized there were opportunities for Canadian investors. “The big pension funds plan to double their investment in China to 15 percent by the mid-2020s.” He urged every investor to “put a separate element in your portfolio for China – if only for the diversification benefit.”

McCallum reminded the audience that a huge issue remains with the case of “the two Michaels.” Bifurcation is not good. The whole world is facing the possibility of deep recession. Economic conflict will make things worse. “Given the world is in a difficult situation, there’s more incentive not to let this US-China thing get any worse.” ♠️

Click here to read Part 1 of the report on the New World Order webinar.