Storms, floods, fires, drought: what are the potential hazards threatening the physical assets of different regions? Furthermore, how can we estimate the magnitude of physical risk of each of these under a climate change scenario?

“We’ve built infrastructure for certain weather patterns,” said Rohan Hamden, “but now it no longer fits with the weather we are experiencing.” Hamden is the founder and CEO of XDI, the Cross-Dependency Initiative, a company focused on Cross Dependency Analytics to estimate the physical risk to assets of many kinds of hazards.

He was invited to share his expertise in physical risk data, modeling, and reporting in a webinar on February 22, 2022, sponsored by the Global Association of Risk Professionals (GARP).

Hamden described the key inputs and outputs of a successful physical risk assessment. “We look at all the assets, their locations, and weather extremes,” he said. That gives a basic risk assessment. To model climate change, “we force the weather predictions forward under a climate-change scenario,” he said.

His company has a list of ten hazards an asset must face: extreme heat, coastal inundation, extreme wind, soil movement, forest fire, freeze/thaw cycle, hurricane, convective storm, erosion/landslip, and flood, both pluvial & fluvial. “We have not added permafrost to the list,” he said, “because not enough scientific data exists.”

“We need to test the assets while creating the model,” he said. The physical construction of the built environment is of paramount interest. “What materials were used? How do they respond? How do the structures themselves respond?” For example, low-rise versus high-rise buildings are affected differently by the hazards.

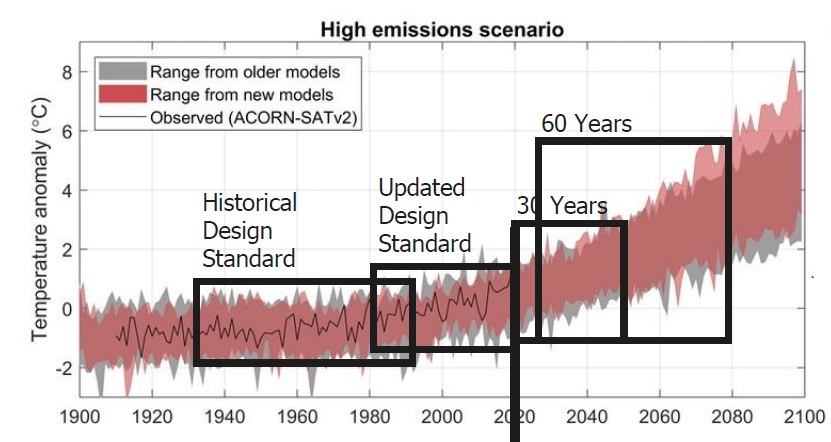

XDI is science-based and makes probabilistic calculations. The challenge is to be making decisions for long-lived assets under times with increasing uncertainty. A 30-year asset, for example, is a big investment decision. “We will be facing serious weather uncertainty so we will have a bigger envelope of possible values.” The high-emission climate change scenario is the most conservative approach.

Methodology

Hamden described the 7 stages of the “climate risk engine” that XDI uses:

1. The location of each asset is precisely defined. “Location matters.”

2. The baseline extreme event frequency is calculated.

3. The extreme event frequency recalculated—under climate change scenarios.

4. Extreme events are matched with relevant contextual information (flood maps, vegetation maps, wind zones, planning boundaries, etc.)

5. Each asset’s construction type, elements, and materials are defined.

6. Risk engines calculate the failure probability and percent variance for each element and material for each hazard every year until the year 2100.

7. Outputs are made available in a variety of formats to support decision making.

Context Layers

The XDI calculations rely on high-resolution spatial data that provides information about the asset-level local context.

“It’s important to understand context layers,” Hamden said. “For example, an asset might be located in a high fire zone, but there might be no vegetation to carry the fire.” Subsidence is another instance where context layers are important, i.e., the soil and clay content.

The models have over 120 individual asset types within 11 classes as shown, including airports and wastewater plants.

Physical Risk Assessment

Hamden gave an overview of stepping through the physical risk assessment of an asset.

The basic method evaluates the physical climate risk to a built asset anywhere in the world, providing it was built in 1990 or later. The detailed analytics can be viewed online or downloaded as a report, and he showed sample output.

In a realistic scenario, the asset owners might be testing and modifying the asset on the fly. “There are multiple adaptation pathways to mitigate risk from coastal inundation,” he noted. For example, to counteract flooding damage, some assets might be raised one metre higher. Or sandbags might protect other assets. XDI provides a means to visualize the effect of the adaptations. The risk manager can calculate the technical insurance premium over time for assets with and without adaptation options.

Types of Analyses

He described some large single-site analyses done, such as the Beacon Shopping Centre in Eastbourne, England. This involved micro-testing of a large area. At each node, the points of failure had to be assessed.

Linear asset analysis is a technique useful for roads, pipelines, railway tracks, etc. It’s typically carried out at a resolution of 50 to 100 m.

Hamden touched on multiple asset analysis and noted, “the XDI Globe interface provides maps of aggregated risk indicators.”

His firm also conducts company intelligence analysis. “XDI has comprehensive databases of company assets that are owned and leased—and thus can analyze almost any company in the world with or without the involvement of that company.”

XDI carries out benchmarking studies, where it “compares companies against a basket of thousands of listed and unlisted peers.” He emphasized that “a major focus of company-level analysis is on quantifying business disruption and productivity loss.”

Climate-Adjusted Hazard Data

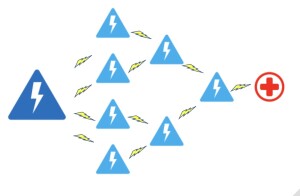

Understanding cross-dependency is a big issue for XDI. “We always consider supply chains” in the assessment, Hamden said. “Critical infrastructure is highly interdependent.” He gave an example of the Townsville floods in 2019, when the Australian government made “pre-emptive” shutdowns of the roadways during fire season. “How will this affect local businesses? How will the government react to other hazards?”

Hamden said they offer unique cross-dependency analysis. “Cross Dependency Testing identifies supply chain risks for assets. Services such as roads, rail, power, communications and water can all fail,” he noted, “leading to losses at invested or owned sites.”

It’s important to manage the complexity of interconnected risks at scale. As well, planners must assess supply chain redundancy—and build internal redundancy if needed.

Hamden closed the webinar with a quick look at current regulatory expectations for assessing and disclosing physical risks and how they could evolve moving forward.

For risk professionals to successfully manage climate change risks, it’s crucial to understand both the technical risk assessment process, the interconnectivity of risks, and the changing disclosure expectations for these risks. ♠️

Click here to access the most recent PDF version of the GARP report: Third Annual Global Survey of Climate Risk Management at Financial Firms 2021.

Click here to read a PDF version of the March 2022 paper by the U.S. Federal Reserve Board, “How are Businesses Responding to Climate Risk?”.

Three figures in this blog are reproduced from the XDI presentation by Rohan Hamden. Permission pending.