“Many people have misgivings about [contingent convertible bonds] because they just don’t know how to value them,” said George Pennacchi, Professor of Finance at University of Illinois. He was the second speaker at the November 29, 2012 GARP webinar on the subject of Call Option Enhanced Reverse Convertible (COERC) bonds. Click here to go to Part 1.

Pennacchi, along with Theo Vermaelen and Christian Wolff, co-authored a recent paper proposing a new type of cocobond. [Contingent convertible bonds, or “cocobonds,” are bonds that convert into equity when the market value of capital falls below a trigger level.] “The paper provides a model by starting with the underlying asset risk of a bank and endogenously valuing its bonds as well as its shareholders equity,” Pennacchi explained. “It allows us to derive the new issue yields or credit spreads on the bank’s bonds.”

The “most critical” component of their input assumptions, according to Pennacchi, was the ability to model sudden, extreme losses such as might happen during a financial crisis which is exactly when cocobonds are expected to perform, he said. The term structure of interest rates follows the Cox, Ingersoll, and Ross (1985) model.

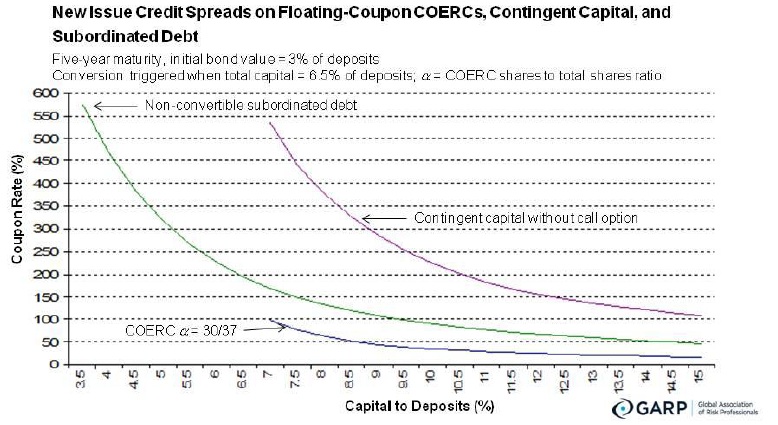

Pennacchi, Vermaelen and Wolff looked at three types of bank liabilities and the bank targeted a 10 percent capital-to-deposits ratio. (Targeted, not constrained.) They compared non-convertible subordinated debt, standard cocobonds, and the new COERC bonds.

Pennacchi emphasized the parameter that was the best diagnostic to valuing the COERC is “alpha,” defined here as the amount of shares that COERC investors would be entitled to receive upon conversion. Usually COERC investors don’t receive these converted shares , he said, “because the initial shareholders have the incentive to buy them back, and the more shares that the COERC investors are entitled to receive, the more likely the original shareholders will buy them back and the COERC investors will get back their par value.” The incentive is the fear of stock dilution.

Pennacchi noted that the issuing bank “must promise a sufficient number of shares to the COERC investor in order to ensure that the original shareholders will have an incentive to buy back those shares to avoid dilution.”

The COERC alpha has an inverse relation to risk. If the COERC “alpha” is high, the risk is low, therefore the new issue yield is low. “The more shares you promise to the COERC investor, the lower the yield at issue and that’s because they are more safe—the more likely the original shareholders are going to be ‘coerced’ to buy them back,” he said.

In his presentation, Pennacchi showed graphs of new issue yields versus the capital-to-deposit ratio for COERCs with different alphas (see figure). One graph in particular compared COERCs with regular cocobonds. A standard cocobond is more risky than a COERC, he said. Cocobonds are like an extreme case of COERC “where there is no dilution so [shareholders] have no incentive to buy back those shares.”

COERCs are less risky than non-convertible subordinated debt because of their “early exit mechanism,” he said, adding it may seem counter-intuitive because this is behaviour occurring when the bank is in failure.

The standard moral hazard problem is that banks have an incentive to raise the underlying asset risk in order to transfer value from the bondholders to the shareholders. This is what COERCs are intended to correct. “Because COERCs are almost default-free,” Pennacchi concluded, “the bank’s shareholders’ equity has the characteristic of unlimited liability and that … reduces the incentives to gamble.” ª

[LATER] As this posting was “in the works,” we were informed that a revised version of the COERCs paper is available. George Pennacchi wrote: “the main change is that we calibrated the model’s parameters to fit the general risks of three large U.S. bank holding companies: Bank of America, Citigroup, and JPMorgan Chase. We also added a section to show that COERCs are much less sensitive to manipulation compared to standard CoCo bonds. However, there are not qualitative changes from the earlier version or our presentation.” ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=502231&s=1&k=EEDD13E0AB7B5FFB095410681394F437>

The new version of the research paper it’s based on can be found at: http://business.illinois.edu/