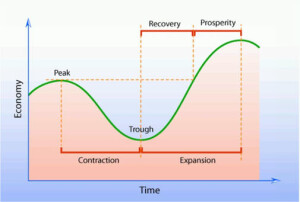

What is the cost of a disaster? What is the cost of the business cycle? Economically speaking, how do business cycles compare with disasters?

The cost of business cycles and the gain to be had from stabilization policy is a highly controversial topic in macroeconomics. Some believe the welfare gains from stabilizing the business cycle are extremely low and therefore not worth the effort.

“Depression prevention and stabilization policies are central to the discipline of macroeconomics,” conclude the authors of recent research published by the Federal Reserve Bank of San Francisco. “Extreme and costly events are not the only reason for stabilization policy. This is because disasters are everywhere.” The article, “Disasters Everywhere: The Costs of Business Cycles Reconsidered,” appeared at the FRBSF website in April 2020 and was co-authored by Oscar Jorda, Moritz Schularick, and Alan M. Taylor.

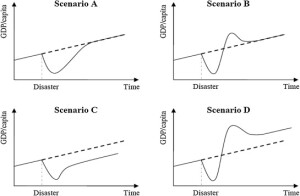

Economists view a natural disaster not merely as a natural event, but as a combination of a natural hazard, such as a pandemic, with a human system, such as a city, that suffers damages due to the hazard. A disaster involves direct and indirect losses, market and non-market losses, and consumption and output losses. Economists have a variety of ways to determine the consequences of a disaster, such as the response of prices or the propagation of impacts through the supply chain. GDP per capita over time is another way to measure losses.

In early 2020, due to the outbreak of the coronavirus pandemic, the world’s economies were experiencing one of the largest and most sudden declines in stock markets. It is this type of disaster that justifies large equity premiums in the stock market, and provides good reason for a stabilization policy. The authors of this paper go one step further. They point out that, when looked at in terms of loss profiles, “all business cycles are highly asymmetric and resemble mini-disasters.”

“Consumers experience considerable welfare losses from peacetime recessions,” they write. “Because the depth and duration of recessions are unknown and cause deviations from trend growth that can last for extended periods, households would be happy to insure against them.”

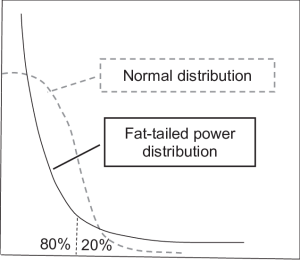

Asymmetry does “not just appear in the extreme disasters—the wars, revolutions, financial crises, etc. considered by previous research,” they state. “Fat tails and persistence also appear in ‘normal recessions:’ there are disasters everywhere.”

Their research uses a comprehensive macro-historical database that includes “all advanced economies since 1870.” They propose “a new empirical framework for accurately estimating and calibrating a growth process.” They run simulations on the the estimated consumption growth process using various parameter configurations to assess welfare losses due to peacetime business cycles.

The size of the welfare loss that they report is “up to 15 percent of consumption for cycles in the past three decades.” They conclude stabilization policies are important, not just for major events, but to cope with the business cycle in general. ♠️