What is causing the current inflationary environment? How are financial risk managers (FRMs) coping with escalating prices and renewed demand? What are the best strategies for addressing unanticipated inflation—what should a risk manager recommend to hedge against inflation?

These and related questions led to a recent survey by the Global Association of Risk Professionals (GARP). “In June 2022, we surveyed 350 FRMs and found that most respondents expected inflation to remain high over the next year, followed by a significant reduction in the next five years,” said William May, Senior VP, Global Head of Certifications and Educational Programs, GARP. The survey results were presented at a webinar on July 20, 2022, in combination with a panel discussion by two experts about the current drivers of inflation and what can be done to mitigate its effects.

Economic Snapshot

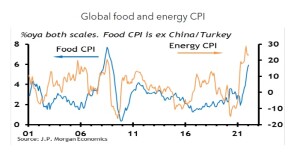

“Global inflation has reached its highest level in 40 years, leading to a plunge in consumer confidence,” said Joyce Chang, Chair Global Research, J.P. Morgan. She showed a graph of the change in food and energy prices over the past two decades.

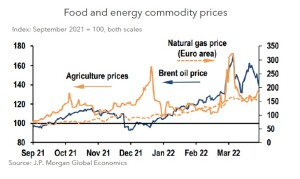

“Rising commodity prices squeeze purchasing power, due to the war in Ukraine,” Chang noted. “Agriculture inventories are critically tight. Prices will remain high due to fuel and shipping costs. Commodity shock is only part of the story.”

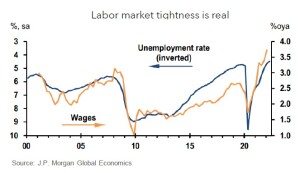

There is a tightness in the labor market. It hasn’t been growing at the same pace, decade over decade, which means that employers must offer better salaries. “The labor force participation has not gone up,” Chang said.

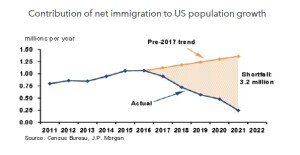

Furthermore, in the U.S., the rate of immigration has not kept pace with the expected shortfall in labor.

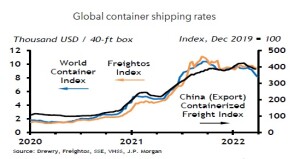

The supply of goods has drawn a great deal of attention in the past two years. “There’s a risk of lasting changes to global supply,” Chang said. There are the fuel costs of transportation, the labor costs of loading and unloading, and the geopolitical risks of maritime transport.

Inflation concerns “extend beyond commodities and labor cost pressures,” she noted. “Rent inflation could break 7 percent by early 2023.”

There is some good news. “Inflation expectations have narrowed from their widest levels, reflecting a reduced risk premium and higher credibility” that federal measures to fight inflation will have some effect. “Core inflation surprised once again in June,” she said, “but market-based inflation expectations were relatively unchanged.”

Some analysts are predicting a recession. Chang said that there is a “risk that this cycle will not end with a soft landing” due to “real tightness” in the labor market. The business cycle might speed up. Inflation could easily average 3-4 percent per year over the next decade.

“Commodity-linked assets provide a hedge,” Chang advised the audience of risk managers.

Inflation vs. Recession

“This is no ordinary inflation,” said Til Schuerman, partner at the management consulting firm Oliver Wyman. “We haven’t seen this type for 40 years, not since the Volcker years.” (During his tenure as chairman, Paul Volcker was widely credited with having ended the high levels of inflation seen in the U.S. throughout the 1970s and early 1980s.)

Schuerman reviewed the inflationary pressures: “Energy and food are real accelerants for inflation.” Not only that, but consumer behaviour exacerbates the situation. “There’s a whipsaw of consumer spending: as the economy continues to re-open, a shift back to services challenges labor markets.” As an example, he cited: “At the beginning of the pandemic, everybody wanted a Peloton [stationary bike]… now, with pandemic restrictions easing, up, everyone wants air travel.”

He agreed with Chang: “The U.S. labor market remains extremely tight, with an unemployment rate of 3.6 percent.” He said that supply chain constraints continue “as China sticks to its zero COVID policy.”

Furthermore, Schuerman said, “Energy and other commodities markets have experienced significant shocks in the wake of the Russian invasion of Ukraine.”

Schuerman indicated there are some “disinflationary pressures”: those due to the U.S. Federal Reserve Board, and those due to a shift in consumer spending.

“The monetary tightening means the Federal Reserve will be raising interest rates and significant tightening is expected in the next 18 months.”

The question remains: are we headed into a recession? “Perhaps we are already in one. The prognosis for the US is bleak,” Schuerman said. “The most recent Wall Street Journal survey of economists indicates a 44 percent probability of recession in the US in the next 12 months. Bloomberg suggests about 40 percent probability. We usually see numbers this high only when we are already in a recession.”

“The global outlook is similarly bleak,” he said. “Global growth forecasts have recently been revised downwards. The Organisation for Economic Co-operation and Development (OECD) slashed its forecast of global growth for 2022 from 4.5 percent to 3 percent. The World Bank revised growth estimates from 5.7 to 2.9 percent.”

Future Uncertainty

What’s a risk manager to do? “We remain in a period of tremendous uncertainty–with a lot of headwinds,” Schuerman said. “The uncertainty is reflected in the unusually wide range of forecasts across professional forecasters.”

“Stagflation and a long period of low growth,” he predicts. For financial risk managers, he advises, “This is a plausible and an important scenario to explore. It implies a long period of depressed asset prices.”

Hedge against Inflation

The GARP survey gives some indication of how financial institutions plan to cope, said May. “Roughly 30 percent of respondents reported that their firms use derivatives as a direct or indirect hedge against inflation risk,” he said.

Of those risk managers who use derivatives, May gave a breakdown of the instruments reported as most useful. At the top of the list is Treasury Inflation-Protected Securities (TIPS), followed by interest rate swaps.

Other takeaways from the survey are related to the impact of inflation on asset allocation, liabilities, and new business; and current perspectives on risk management lessons. ♠️

The graphs shown in this posting are from the GARP webinar. Permission pending.