“Deleveraging takes a long time, and it is painful,” said Philippe Ithurbide, Global Head of Research, Analysis and Strategy at Amundi Asset Management. In the second part of his presentation to the CFA Society Toronto on November 19, 2013, he discussed solutions to European financial difficulties. Deleveraging must be helped along in order to shorten the time and reduce negative socioeconomic impacts. “Never in history have we seen the deleveraging of all the players at the same time.”

“Banking credit is faltering everywhere in the euro zone,” said Ithurbide. Euro zone bank credit is still highly fragmented by nation, with Germany and France leading the way for bank credit growth increases to households, and for credit for house buying. Market watchers hope the Asset Quality Review planned by the European Central Bank (ECB) will ease lending.

Ithurbide believes small to medium enterprises in Southern Europe are burdened by too-high interest rates. “With the deflationary pressures in Spain, real rates are rising,” he said. A new program from the ECB to support credit must address the key question: can banks actually transfer the low rates to the loans they are making to small to medium enterprises? For Portugal, Spain, and Italy he doubts that such transfer can happen.

“With deleveraging still on track, Southern banks will continue to buy government bonds, and this should prevent a rise in bond yields,” said Ithurbide.

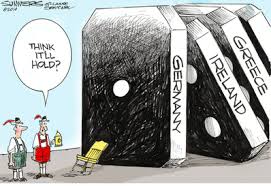

The picture is that of a Europe moving out of recession into sluggish growth. Ithurbide shared thumbnail projections for six nations. (1) Germany has strong growth momentum, with a virtuous cycle underway. (2) the rebound in France is much more fragile (3) Italy is suffering a more severe recession than Spain (4) despite positive signs, Spain has many downside risks (5) Portugal has weak activity and fragile banks (6) Greece is in better shape but problems are still pending.

The European economic climate calls for the maintenance of low short-term interest rates for at least three years. He cautioned that “low bond yields” does not mean “stable” or “decreasing”; in fact he predicts bond yields will increase in the coming quarters.

Ithurbide summarized solutions necessary for the euro zone problems. “Reduce intolerable constraints in the current environment,” was the first suggestion. He thought regulators were too busy trying to prevent a crisis “while we are in the middle of a severe one!”

Ithurbide said the ECB may have to consider unconventional measures to sustain the credit market. It’s vital to improve confidence in the economy. “Denmark is a champion in this,” he noted. “It’s important to maintain discipline but not reduce deficits.” The ECB surprised markets earlier this year by increasing interest rates, because they are starting to fear deflation.

Once the financial stress lessens, governments should begin to make deep structural reforms. Ithurbide said these measures does not need to include pension reform, because the age of retirement is going to increase in most countries, to 66 or 67 years of age.

Ithurbide believes the European banking union must be successfully completed “because it conveys credibility, transparency, and confidence.” It will ensure a mechanism to quickly address recapitalization problems.

In the context of macroeconomic developments, Ithurbide briefly touched on the Amundi investment strategies, which are covered in detail in a recent white paper.

In closing, Ithurbide urged the countries of the euro zone to hasten economic recovery. They must reduce public expenditures; they must reduce labour-related taxes; and they must improve competitiveness. It is especially important to implement reforms giving long-term sustainable answers. ª

The research paper at Amundi Asset Management related to this talk can be found at: http://research-center.amundi.com/