What is happening in emerging markets? Are there areas where an informed investor can make a profit? What are the pitfalls to avoid?

On November 22, 2022, the CFA Society of Toronto hosted a virtual webinar, “Rethinking Emerging Markets: The Case for Growth & How to Capture It.” The speaker was Kevin T. Carter, the founder and Chief Investment Officer of EMQQ Global.

Carter began by providing his background. “I pray toward Omaha,” he quipped, because he considers himself an active “value” investor first and foremost, along the lines of “the oracle of Omaha,” Warren Buffett. Carter has collaborated with Princeton economist Burton Malkiel for more than 20 years. Malkiel is the author of A Random Walk Down Wall Street, now in its 12th edition, which argues that asset prices typically exhibit signs of a random walk and that an investor cannot consistently outperform market averages.

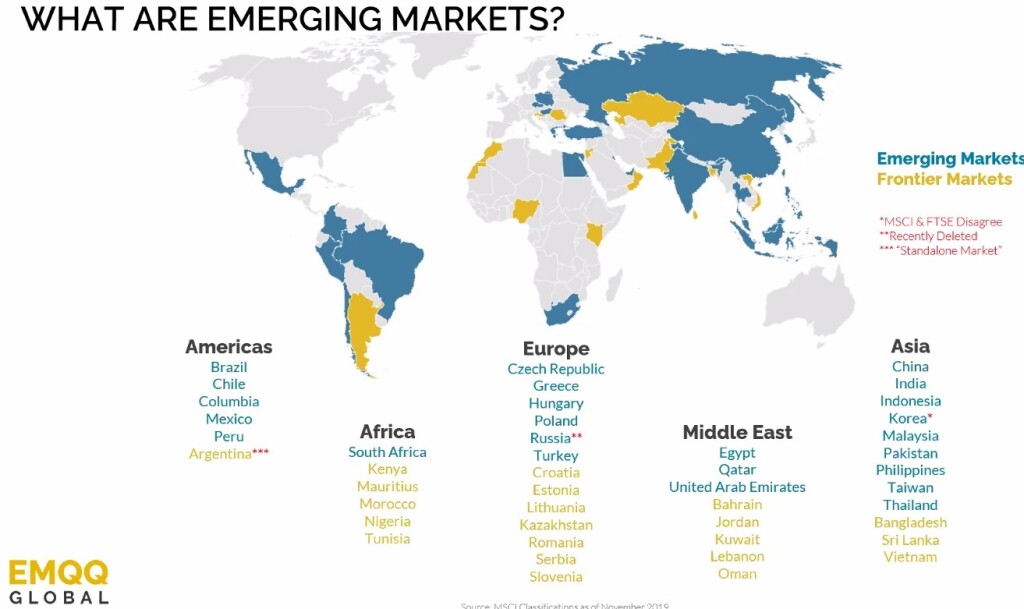

What, exactly, are the emerging markets (EM)? They are markets that have some characteristics of a developed market, but do not fully meet the standards of it. What countries have Ems? “Eighty percent of the world is emerging markets,” Carter said, providing a map with the EM countries on it.

The conditions and technologies born in Silicon Valley have now spread, evolved, and matured worldwide, creating billions of digital natives in all corners of the globe. But now these persons want to have the goods and services they see on the internet. Charts from The Economist showed the EMs have 80 percent of the global mobile phone subscriptions but make less than 50 percent of global retail sales. Consumer spending is about 25 percent of global spending.

“The rise of the consumer class in developing nations is THE story,” Carter said. The consulting firm McKinsey & Company calls the situation “the biggest growth opportunity in the history of capitalism.”

Carter cautioned the audience not to dive into any old EM investment. “There are problems with traditional emerging markets… most of the companies are owned by state-owned enterprises (SOEs).” These are owned and controlled by the government and suffer from conflicts of interest, inefficiencies, poor corporate governance, and widespread corruption.

“Earnings give value, but the SOEs do not care about earnings,” Carter said.

He cited the example of the scandal of Brazilian SOE Petrobras that was owned by corrupt politicians. As well, in South Korea, many high-profile corruption scandals involving senior chaebol executives and politicians have occurred over the years.

The Evolution of Emerging Markets

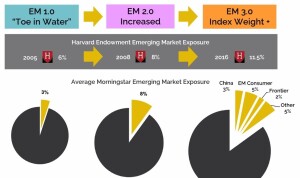

Carter has years of experience with EMs. “As familiarity and allocation grows, so does the variegated approach.” He has seen them evolve from “toe in water” to an “increased” investment level, and now to the “consumer ETF” approach.

He began with stock picking and settled on five typical consumer stocks, among them snack foods, sneakers, “the Craigslist of China,” and Mercado, which he called “the Amazon of Brazil.”

“We had incredible growth margins,” he said.

The Great Confluence

Carter identified three “mega trends”:

- Increased consumption, especially via the smartphone.

- Most of the world “is getting their computer today.”

- Most of the world will be joining the internet.

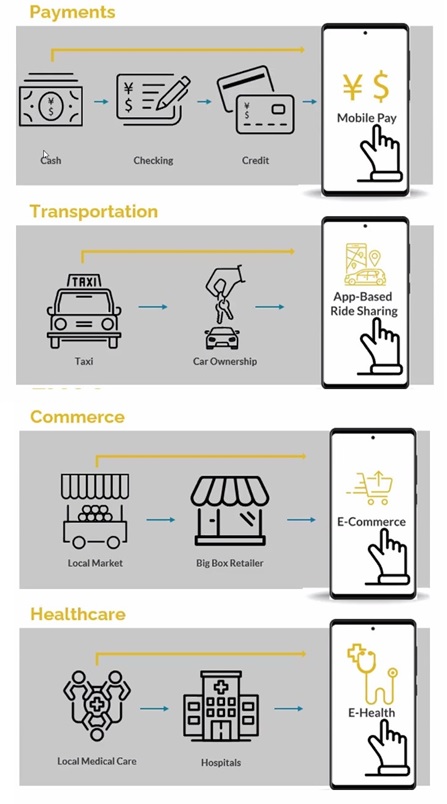

He explained the developed world had to progress through certain stages, such as making payments using cash, then moving to a cheque-based system, then moving to credit cards. Now, they largely use “mobile pay.”

In EMs, they are able to “leapfrog,” i.e., skip intermediate steps. Last year, they made payments via cash. This year, they use mobile pay.

Another example is in the area of commerce. Developed nations used to have many small, local markets. Over time, they developed big-box retail stores. And now, E-commerce is predominant. In EMs, they can leapfrog from a local-markets system to E-commerce.

The Third Wave

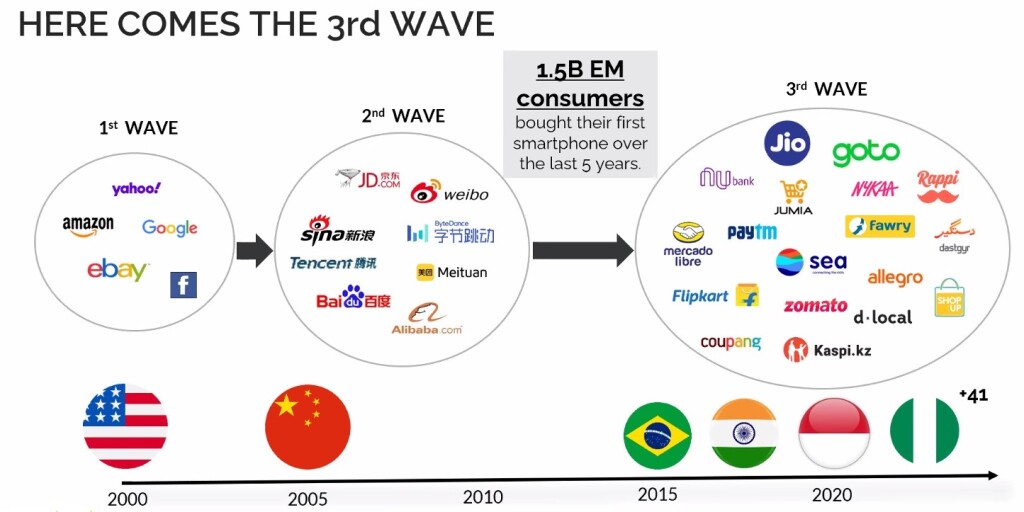

In the year 2000, the darlings of the stock market were the American tech stocks Yahoo, Amazon, Google, eBay and Facebook. The second wave, in approximately 2006, saw attention shift to Chinese companies Tencent, Weibo, Alibaba and others. The third wave will see Brazilian, Indian, South Korean, and Nigerian companies take off.

Here’s an enlargement of the logos of those companies that will come to prominence.

A Virtuous Cycle

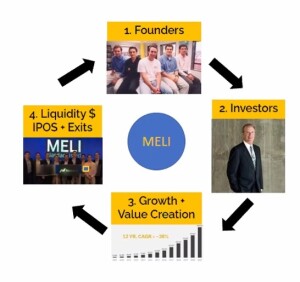

In the EM internet sector, Carter sketched out the virtuous cycle that he sees occurring time and again:

- The founders have an idea.

- They find investors who are willing to back the founders.

- The companies are successful and grow, and create value.

- The investors attain liquidity through IPOs and exit the start-up.

- Repeat as needed.

He drilled into a particular example of such a company, Mercado Libre (stock symbol MELI).

After his presentation, Carter handled a Q & A session. Audience members raised concerns about geopolitical risk, exchange rate risk, and environmental risk. ♠️

All figures are from the webinar; permission is pending.