There is renewed focus on “pursuing small violations to prevent a culture where laws are not viewed as toothless guidelines,” said Amy Poster, Director for Risk and Regulatory Advisory Services at C & A Consulting LLC. She was the opening speaker in a four-part webinar panel titled “Fixing the Financial Industry’s Broken Windows” sponsored by GARP on March 11, 2014.

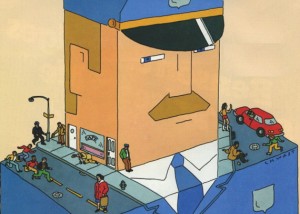

Poster opened with a quote from a speech by Mary Jo White, Securities and Exchange Commission Chair: “The theory is that when a window is broken and someone fixes it – it is a sign that disorder will not be tolerated. But, when a broken window is not fixed, it ‘is a signal that no one cares, and so breaking more windows costs nothing.’”

The attention to all infractions, both big and small, has led to changes in the enforcement landscape, with the US Attorney for the Southern District of New York (SDNY) is “leading the charge,” said Poster. She briefly outlined changes on rates of convictions, settlements, evidence, sentences, and whistleblower policy.

There have been many settlements to date, with the largest insider trading settlement, against SAC Capital, amounting to $1.2 billion. Disgorgement and penalties, which stood at $2.8 billion in 2011, have increased to $3.4 billion in 2013.

“Allowing evidence gathered through wiretaps has been a game-changer,” said Poster. Such evidence allowed SDNY to convict Raj Rajaratnam in the Galleon trading case.

“Allowing evidence gathered through wiretaps has been a game-changer,” said Poster. Such evidence allowed SDNY to convict Raj Rajaratnam in the Galleon trading case.

Insider-trading convictions since 2011 are 79 to 0, a “perfect record.” And those who go to prison are staying longer, with sentences now averaging 3 years.

Another game-changer in the field of catching insider trading, said Poster, was the FBI’s establishment of Operation Perfect Hedge, which would be talked about by the third panellist of the day.

Poster concluded her remarks by noting the big jump in reporting wrongdoing. This is connected to the new incentives and protection afforded by the Dodd-Frank Act in the form of the Whistleblower Program. In 2011, 334 whistleblowers came forth. In 2013, that number had skyrocketed to 3,238. The SEC paid out $14 million in 2013 (an average of less than $5000 per event). ª

Go to Part 2, the SEC perspective on Fixing Broken Windows. ª

Go to Part 3, the FBI perspective on Fixing Broken Windows. ª

Go to Part 4 (final), on reducing exposure to insider-trading investigations. ª

Click here to go to the GARP webinar presentation.

The illustration in this posting is from the 1982 article in the Atlantic Monthly on the broken window theory.