Comparing the stock prices of climate-friendly (“green”) companies versus non-climate-friendly (“brown”) companies, which type will give better performance? Has this prediction been changing over the past decade—and why? And what are the recent pressures?

On March 23, 2023, Michael Bauer, professor of economics at the University of Hamburg, delivered a webinar on green vs. brown stocks as part of the series of talks sponsored by the Federal Reserve Bank of San Francisco (FRBSF), titled the Virtual Seminar on Climate Economics. He reported results from a recent paper co-authored with three other economists appearing in the Journal of Climate Finance.

Bauer began with a sobering quotation from the Glasgow Financial Alliance for Net Zero: “Achieving [1.5 degrees] requires a whole economy transition. Every company, bank, insurer, and investor will need to adjust their business models, develop credible plans for the transition to a low-carbon, climate-resilient future, and then implement those plans.”

Although transitioning to a low-carbon economy is a challenging task, he believes that financial markets are the best tool to use. “They can efficiently allocate funding; they can manage the climate-related risks, and they provide information” for future economic decisions.

He said there are two broad types of climate risks that must be priced into financial markets: physical risks due to the direct effects of, say, flooding, wildfires, or other extreme weather events; and transition risks, which are based on the policies and regulations required to go to a low-carbon economy. Two examples he cited are: stranded assets and the collapsing real estate value of houses built near a coastline.

“It’s a big challenge to measure the exposure to these risks,” he said, noting that the field is evolving. “Carbon policies are changing, and companies are changing behavior. The empirical literature is growing quickly,” but there is still much work to be done.

To measure the relative “greenness” of companies, Bauer and co-authors Daniel Huber, Glenn D. Rudebusch, Ole Wilms used carbon dioxide (CO2) emissions as reported by companies They focused on “reported scope 1+2 emissions (levels and intensity).” They used tools from empirical asset pricing: portfolios and green factors. They report green performance over time, and “reconcile results with panel regressions.”

Citing Larry Fink’s predictions in 2020, Bauer said the ESG industry was expected to outperform. Market observers were surprised when “brown stocks [had] higher expected returns.” That propelled a deep dive into data. Certain methodological choices could be responsible for differing results, so they compared results using different methods.

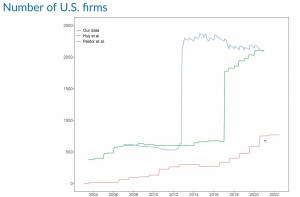

As well, the choice of datasets had a distinct bearing on results. This figure shows the jumps in dataset size “due to data providers getting more firms on board.” The data sets were of short duration, extending only from 2004 to 2022.

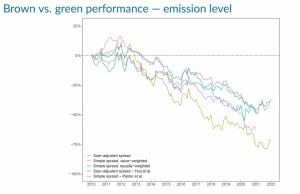

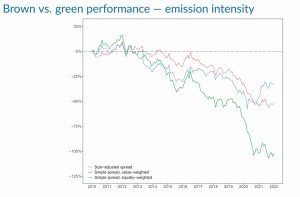

Bauer et al. looked at emission levels and at “intensity” which is the ratio of emissions to sales.

They had three different definitions for the spread between green and brown stocks in a portfolio: simple, equal-weight, and size-adjusted spreads.

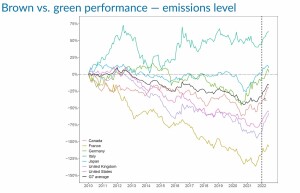

The results for the G7 countries, broken down by country, provided a colourful chart. One line is very different, showing no outperformance for green stocks. “Italy is the G7 outlier, and we don’t yet know why,” he said.

The graph shows a change in shape around 2022. “Brown stocks outperformed due to the Ukraine war and the recent global energy crisis,” he said. “This led to high demand and profitability for oil & gas and the defense sector.”

Conclusions

Bauer and co-authors concluded there was “substantial green outperformance in the U.S.” and in “most” G7 countries. Their findings did not depend on the choice of factor method or the measure of greenness. After adjusting for risk, the outperformance was somewhat smaller, but still present.

They found “no evidence for [a] carbon premium,” i.e., a higher expected return on brown stocks. Such stocks “have lower average realized returns than green stocks.”

Bauer noted that shocks to the economic system were “unusually important” due to the short duration of the sample datasets. The results were consistent with “initially small carbon premium and large, unexpected, persistent increase in climate change concerns favoring green stocks.”

“Shifts in green investor demand,” he concluded, “have dominated any potential carbon premium.” ♠️

The graphs are from Michael Bauer’s presentation.

The visuals are from SK Group, the East Vision, and Crestline. Permission pending.

Click here to find out about the FRBSF Climate Seminar Series.

Click here to read the paper the webinar is based on, “Where is the Carbon Premium? Global Performance of Green and Brown Stocks,” by Michael D. Bauer, Daniel Huber, Glenn D. Rudebusch, Ole Wilms in J. Climate Finance.