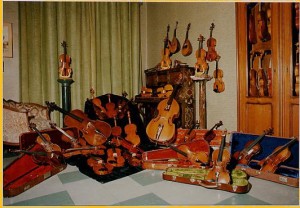

When Morty discovered my vacation plans this year included Cremona, that put a bee in his bonnet. Did I know it was the home of the famous Stradivarius workshop? Was I going there to check out violins? Yes and no, I said. My preference was to cycle along the Po valley and sip espresso near the Zodiac Tower.

“Maybe you should think twice about your visit,” Morty said. “I happen to have it on good authority that beautiful collectibles can be a solid component of your portfolio.”

“Please Morty, don’t make wild-eyed guesses about other people’s money,” I said. Especially not my money, but I didn’t say it aloud.

“I’m not kidding.” He pulled out a recent Financial Analysts Journal and pointed to the axis of a graph. “These researchers have looked price data that spans more than a century! On violins and all sorts of things!”

Well, I was hooked. (On reading the article, not buying a violin.) The authors have a knack for tracking down long-term data, as you will see below in my interview with Christophe Spaenjers.

Q: Your paper, “Investing In Emotional Assets” (Financial Analysts Journal, vol 70 no 2, p. 20, 2014), is about the long-term return on “collectors’ items” or emotional assets. What spurred your interest in this topic?

I have always had an interest in the arts and in the economics of culture, so when I had the opportunity to do a PhD in Finance on the topic of the art market, I did not hesitate. A bit later I teamed up with my co-author on this article, who is an expert on long-term asset returns.

Q: You write that “investors… wondering whether it makes sense to put money in collectibles should rely on scientific inquiry into the long-term track record of emotional assets.” Was it difficult to come up with data for collectibles for 1900-2012? Are there collectibles you wished you could have included, such as antique maps or books, but did not?

Of course, the data are not as easily accessible as data on recent stock prices, for example. Historical data on collectibles prices need to be gathered from a wide array of sources: archives of auction houses and dealers, publications containing price information, online databases, etc. So the data collection is often time-consuming and challenging (but can also be fun detective work).

In our research we have focused on collectibles for which there has been sufficient interest for a long time, and for which a relatively well-developed market has existed. Although we know of data that exist on books and coins, we have not used those data yet.

Q: Figure 1 in your paper shows the long-run return on the collectibles you chose (violins, art, stamps) is lower than the return on equities yet have been superior to the total return from government bonds and Treasury bills and gold. Was this a surprise to you?

Q: Figure 1 in your paper shows the long-run return on the collectibles you chose (violins, art, stamps) is lower than the return on equities yet have been superior to the total return from government bonds and Treasury bills and gold. Was this a surprise to you?

Not really. It would have been surprising if returns on collectibles exceeded those on equities. We know that equities have nicely compensated investors willing to take risks. Moreover, buyers of collectibles pay for the emotional pleasure associated with them, and the existence of a non-financial “dividend” must lower the expected financial returns.

On the other hand, it is probably not a surprise that collectibles have realized positive real returns either, at least before transaction costs, as prices follow the creation of (global) wealth.

Q: Although collectibles outperformed bonds, T-bills, and gold, you caution that there are “dangers and pitfalls” to such assets. Would you please elaborate?

Apart from the transaction costs (which can be very high!), illiquidity, and storage and insurance costs, there is also a number of unique risks. Volatility can be elevated— higher than is suggested by aggregated price indices—and prices are affected by changes in tastes and speculative fads. Finally, there is the danger of fakes and changes in attribution.

Q: If it’s not too personal, may we ask if your research has influenced your own investing behaviour?

Q: If it’s not too personal, may we ask if your research has influenced your own investing behaviour?

I occasionally buy a small piece of art or a bottle of wine, but never with the goal of reselling. I get sufficient utility from the non-financial returns! ª

Click here to view the article: “Investing In Emotional Assets” (Financial Analysts Journal, vol 70 no 2, p. 20, 2014)