Every day, more investors are converting their portfolios to socially responsible investing (SRI). But does being a socially responsible investor mean you will take a hit on performance?

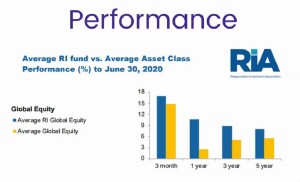

“Over the last five years, responsible investments have done at least as well as the traditional portfolio,” said Tim Nash, a fee-for-service financial planner who spoke at the webinar “Investing in the Greater Good” on August 18, 2020, sponsored by Questrade. Nash is the founder of Good Investing and blogs as The Sustainable Economist. He is also the lead researcher for Ethical Markets Green Transition Scoreboard research report, which details more than $10.3 trillion of private investments in the global green economy.

“Most people are couch-potato investors,” Nash said. “They’ve selected their portfolio and they want a really good reason before they’ll make the change.”

“An investor should consider that environmental, social, and governance (ESG) data provides another lens to the investing choice,” he said. He showed information on ESG ratings from two sources. “The ESG index can be turned into ETFs.” Exchange traded funds (ETFs) are highly popular for low overhead costs.

First, he showed the Morgan Stanley Capital International (MSCI) ratings for ESG. These are red-yellow-green codes for companies, with the colour depending on how well they fit the ESG criteria. The criteria are broad, with categories for corporate governance, privacy, human capital development, among others. For the criterion “supply chain labour standards,” Nash said, Apple Inc would have failed on this count during the sweatshop suicide scandal.

Another criterion – “controversial sourcing” – refers to the use of “conflict minerals” from violence-plagued regions such as Democratic Republic of Congo.

Second, he showed Sustainalytics ratings for ESG. Nash pointed out the two ratings companies had differing views of Apple Inc. Sustainalytics, recently bought by research firm Morningstar Inc, ranks Apple as “average” in its ESG compliance.

Nash named off several of a “huge variety” of ETFs: XEN, XESG, XCSR, DRMC, DRFC, and ESGA. “Each of these funds uses a different methodology.”

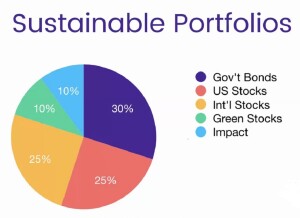

He showed what a typical SRI portfolio might look like.

For a long time, “the fundamental assumption was that SRI means you will sacrifice on performance,” he said. Over Q1 and Q2 2020, “SRI did very well because these funds have less allocation to the energy sector.”

Research has shown that high ESG scores correlate with lower cost of capital, equity, and debt.

Nash recommended the book by Bob Willard, The New Sustainability Advantage: Seven Business Case Benefits of a Triple Bottom Line. Willard makes the business case for sustainable companies. “They are more efficient, more productive, and more innovative.”

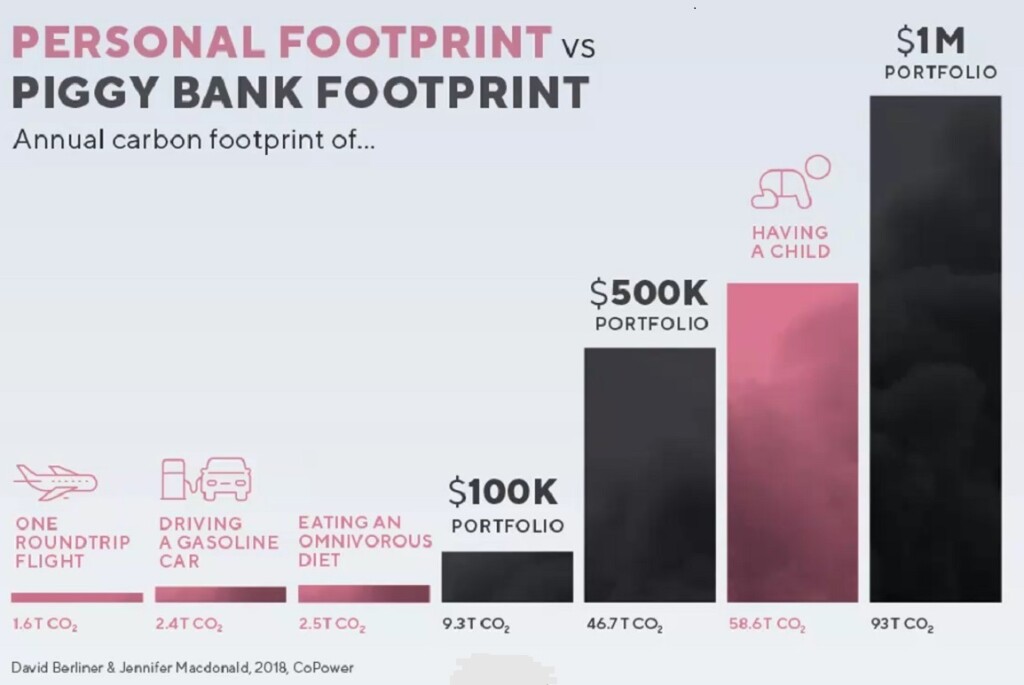

There are ethical dimensions to everything we do. Environmental impact can be quantified by the carbon footprint.

He showed a comparison of the annual carbon footprint for different activities, including an average airplane trip, having a child, and investing portfolios of $10,000 versus $100,000. (The chart is adapted from David Berliner and Jennifer Macdonald, CoPower.)

Nash urged the audience to “learn the metrics of social responsibility and get to know the tools to track them, so that you can gauge the social responsibility of your investments for yourself.”

“My dream,” he said, “is a virtuous cycle where people invest in companies they believe in.”

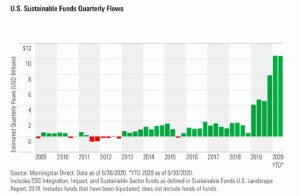

According to change theory, things usually start off slowly, and then as more interest develops, the pace of change quickens. That’s what happened in the U.S. in 2019 – the flow into sustainable funds accelerated from about $20 billion per year and now is hit to reach $4,000 billion (or $4 trillion) per year by the end of this year.

He attributed much of the upswing to pension funds. These are large institutional investors that nowadays often have a mandate from the membership to invest in an ethical fashion.

To build green ETFs, Nash recommended investors look at investments in renewable energy and sustainable development. “Water will be big,” he said, noting that municipalities must invest in water infrastructure.

Nash said he feels a personal mission “to help one million people invest intentionally.” He has faced resistance. “When I started 10-15 years ago, people thought I was nuts.” Yet now he is mainstream. The Responsible Investing Association shows SRI outperforms ordinary funds. Even Jim Cramer on Mad Money (a very mainstream financial show) proclaims “fossil fuels are dead.”

“There’s been an incredible shift in psychology,” Tim Nash concluded. “People used to think responsible investments always underperformed – that was the mindset.” Now, he helps investors see they can have both SRI and make money at the same time. ♠️

Click here to visit Good Investing. (The graphics in this posting are from Good Investing.)

Click here to visit The Sustainable Economist, where Tim Nash blogs.

Click here to visit the Responsible Investing Association of Canada.