When it comes to new regulatory requirements for advanced models in financial stress testing, are banks meeting expectations?

Over the past two years, relatively good progress has been made in financial models and managing data for stress testing, said Tom Kimner, Director of Global Risk Operations at SAS, “but less progress has been made in technology and reporting.” He was the second of two panellists at a webinar on September 22, 2015, sponsored by the Global Association of Risk Professionals (GARP). He was presenting the findings from a survey report, “Stress Testing: A View from the Trenches,” that was jointly sponsored by SAS and GARP.

“Technology was perceived as lagging in the key areas of reporting and analysis,” Kimner said. Most financial institutions (FIs) have hired people, but they have spent time ensuring good data quality and governance. Forty percent of the FIs have not reached “a level of maturity in terms of data integration.”

At the majority of FIs, financial models for stress testing were perceived as being at a “mature” or “highly mature” stage in terms of model inventory, development, implementation, and execution. However, they were at “immature” stages of model validation and model governance.

Kimner noted that “reporting that provides linkages across risk model data, macroeconomic data and balance sheet data” is at an immature stage in the majority of FIs.

“The people brought in are strong,” he said. Respondents felt their people had the right capabilities and enough expertise in the majority of FIs. “Technology is the laggard, though.”

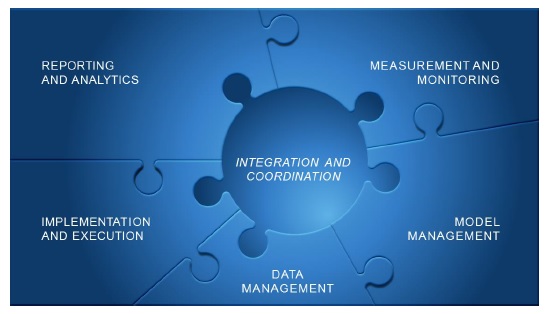

Kimner presented an overview of the stress testing framework. Governance covers all areas: model development and implementation; and data and model staging, data sourcing, and data validation and aggregation. Finally, it covers the consolidation of both the data and model “worlds” and reporting of stress test results.

He identified “key areas of readiness for future changes” in stress testing. (See figure.)

“Anecdotally, we hear that regulators want to test and see if companies can run stress testing scenarios” with quick turnaround.

Kimner urged audience members to “look beyond regulatory compliance” for stress tests. FIs can use scenarios during “the decision round for the business. You could on-board different portfolios.”

Data integration is still a weak point. “When you move away from compliance, [in order to] do that more dynamically, you need to improve technology” as well as “cross-coordination between groups.”

High visibility items seem the most urgent to take care of—such as whether a report appears on schedule. “It’s not until you want dynamic capabilities that the execution speeds come into play,” he said. And for that, technological improvements are a must-have. ª

Click here to read about the first presentation.

Click here to view the webinar presentation. Tom Kimner’s portion includes slides 14 to 24.

Click here to view the report “Stress Testing: A View from the Trenches”.