What kinds of financial institutions are scrambling to comply with new regulatory requirements for financial stress testing?

In 2015, the Global Association of Risk Professionals (GARP) conducted its first industry survey to see how banking institutions worldwide were coping with more stringent regulations. They produced a report, “Stress Testing: A View from the Trenches,” and on September 22, 2015, two panellists presented their findings during a webinar to members of GARP.

“Institutions on the whole are purposefully addressing the challenges,” said Jeff Kutler, Editor-in-Chief of Risk Intelligence at GARP. “There has been significant progress in data, modeling, and scenario management.” The two areas where performance gaps are greatest were technology and reporting.

But first, it’s important to understand who gave feedback. Kutler, the first panellist, gave a “snapshot” of the 389 respondents, representing a range of financial institutions (FIs), that responded to the survey on advanced stress testing.

Two-fifths of respondents represented commercial banks; only ten percent were from asset management FIs. Other respondents were from retail banks (15 percent), investment banks (13 percent) or FIs that carried out “all of the above” (21 percent). They were about evenly split between systemically important financial institutions (SIFIs) and non-SIFIs.

Thirty percent of the FIs had less than $10 billion assets under management; 23 percent had over $500 billion; the remainder were in between. Two-thirds of the FIs put the responsibility for stress testing on the Chief Risk Officer (CRO); 14 percent put the responsibility on the Chief Financial Officer (CFO).

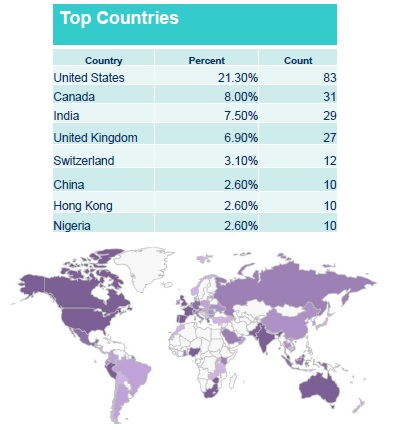

The FIs were distributed among developed nations—and also among developing nations such as India (29 FIs) and Nigeria (10 FIs). The analysis ranked countries by number of respondents to the survey, with the U.S. first. The accompanying table shows the countries that had 10 respondents or more (out of the total of 389), and there were about 60 other countries with nine or fewer respondents.

The persons who responded on behalf of the FIs were split nearly evenly between management and those who carry out the stress testing. One-quarter of them work in the department of Enterprise Risk Management; one-fifth work in the department of Credit Risk.

A little over half of FIs had 1 to 10 full-time employees who did financial stress testing. Ten percent reported over 100 employees working on stress testing.

Kutler then handed the discussion over to the second panellist.ª

Click here to read about the second presentation.

Click here to view the webinar presentation. Jeff Kutler’s portion is slides 4 to 13 inclusive.

Click here to view the report “Stress Testing: A View from the Trenches”.