“The new risk management role has a dual responsibility: to the organization, and to achieve business goals. When they contradict each other, the business profitability must come first,” said Boaz Galinson, VP and Head of Credit Risk Modeling and Measurement at Bank Leumi. He was the first of two speakers at a GARP webinar on leveraging risk analytics to drive competitive advantage held September 17, 2013.

Galinson referred to the Accenture 2011 Global Risk Management Survey of the 400 biggest corporations (including the 40 biggest banks). Of the respondents, 93 percent said that “sustainability of future profitability” was important or crucial to effective risk management. Nearly as many, 91 percent, said that “compliance with regulations” was important or crucial.

The risk to financial institutions is amplified by industry trends. For example, if the real estate sector risk worsens, so to does the financial health of the obligors.

“Risk management’s role is to provide information, analysis, and tools,” said Galinson. “It must be integrated into the business. It must not be left on the sidelines.”

Potential losses from the borrower depend on the expected loss and the unexpected loss, which depend on the probability of default, the exposure at default, and the loss given default. Galinson showed a typical credit loss distribution curve, with marginal probability of default as a function of loss. (See accompanying figure.)

Galinson remarked there is no easy single way to determine concentration risk. This type of risk meant that several “good” deals could turn sour in aggregate when they all stemmed from a single borrower, or even a single industry or geographic location.

He touched on risk ratings, which provide support for effective credit risk management and are used on a daily basis. Ratings can be used as benchmarks. Scenario stress testing can then be used on the portfolio as a whole to supplement many decisions made in an approximate way every day.

In response to a question from the audience, Galinson said that his department’s models adjust for the credit cycle through use of macroeconomic variables. “But you need enough history that includes downturns, to get a good representation of the effect.”

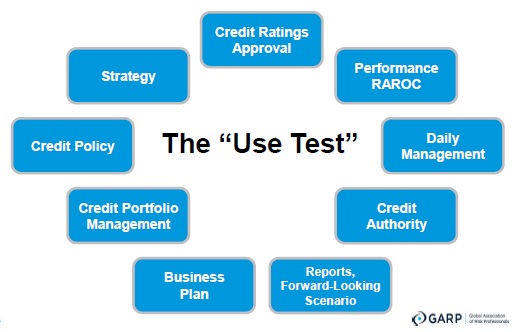

The “Use Test” diagram gave an overview of effective credit risk management in Galinson’s department. (See graphic.)

Consistency and interconnectivity are highly important considerations in the project architecture. There must be integration between solutions. He emphasized it is better to choose a vendor for “best fit” with one’s organization, rather than going with the “best of breed.”ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=672751&s=1&k=3874B84AEFF7E79F112C511423E6FFFC>