“More consideration must be made for regulatory capital changes that focus on small but potentially devastating risks or risk factors,” said Peter Went, VP, Banking Risk Management Programs at GARP. He was speaking about Basel III and its impact on modelling regulatory capital at a webinar on January 29, 2013, organized by the Global Association of Risk Professionals to discuss model risk management.

Went mentioned three developments in the Basel III that directly impact capital models and model risk in regulatory capital determination. First, Basel III introduces a risk-invariant leverage ratio of 3 percent in recognition that models may be biased. Second, there is an increased reliance on quantitative models. For example, in market risk, the Stress VaR (Value at risk) is calculated using a complex, non-linear formula. In credit risk, the CVA (credit valuation adjustment) capital charge is also detailed and non-linear. Finally, there are changes to refine the internal governance systems to enhance firm-wide oversight and risk controls impacting capital modeling.

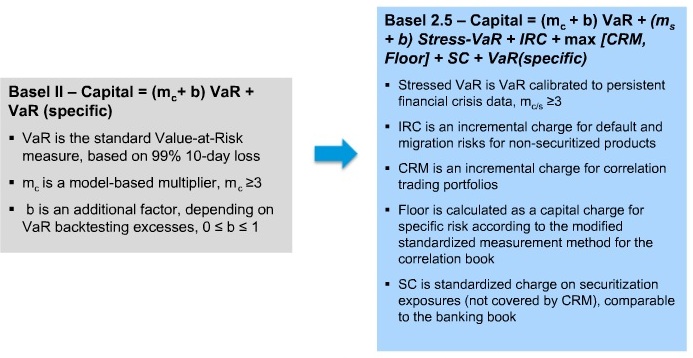

Went gave a specific example of the increase in complexity on going from Basel II to “Basel 2.5” (see accompanying diagram). The risk measure for capital includes a value-at-risk (VaR) term (Basel II) and an incremental risk charge (IRC) and a comprehensive risk measure (CRM), the latter two both new to “Basel 2.5”.

The complexity of models has changed the considerations for financial stress testing and the stressed VaR output. Stress testing must mirror a 12-month period of extended financial disruption. Backtesting stress models is nearly impossible.

There are further questions to be answered, for example: does “disruption” only refer to that instrument or does it apply to the entire economy? Another question concerns the “historical period”: how is it chosen and what implications can be drawn from it?

Went outlined some major changes to capital standards that become effective as of January 2013. New models must encompass CVA, exposure to financial institutions, and collateral management. The functional form of the CVA differs markedly, depending on whether an internal measurment method (IMM) is employed.

Went closed his section with a final example of how dramatically model risk has increased. Counterparty credit risk treatment in Basel I was “simple risk weights.” The Basel II treatment carried capital for counterparty default under the credit risk framework. Now, under Basel III, financial institutions must incorporate historical data in the model. As any modeller knows, the more “moving parts” to a model, the more the gears can get stuck. ª

Go to Part 3. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=533238&s=1&k=2165B761844CD72D3D28DD8CA8818258>