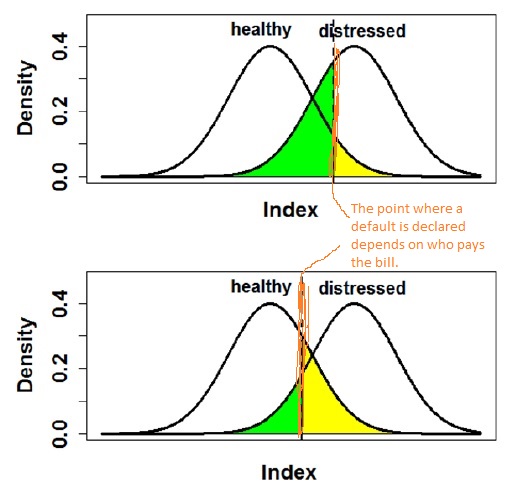

“Rating biases affect how we think about methodologies,” said Elliot Noma, Managing Director at Garrett Asset Management. “A rating agency paid by the issuer will likely give the firm the benefit of the doubt,” whereas a rating agency paid by the investor might want to more stringently evaluate the firm. “Both evaluations have the risk of error” due to bias.

Noma was speaking about evaluation of credit risk as part of the webinar presentation “Monitoring Risk While Pursuing High Returns” on March 7, 2013 organized by the Global Association of Risk Professionals (GARP). He began by dividing non-structured credit exposure into three main types: non-financial corporates, sovereign, and banks. For each type of exposure, there are different evaluation considerations.

Noma recommended Altman’s Z-score as a good starting point for non-financial corporates. “It’s a quantitative technique that can be paired with qualitative measures,” he said, showing a chart with bond equivalent ratings of AAA and B for Z-scores of 8.15 and 4.15 and many credit levels in between. Alternatively (or in conjunction with these values), an analyst could look at distance-to-default in the KMV approach.

“Now: what’s so different about the banks and the sovereigns?” Noma asked. The sovereigns have a different set of levers to control issues, for starters. They can impose more taxes; they can print more money. He touched briefly on three strategies to assess sovereign credit risk: a top-down macro-economic analysis based on debt service ratio, investment ratio, growth of money supply and other variables; credit default swap (CDS) spreads; or a bottom-up economic analysis based on evaluating the probability default of a large pool of companies.

Banks differ from the non-financial companies because they are so highly leveraged. Noma referred to a 2006 study by Halling and Hayden on bank failure prediction. He listed 11 indicators that were found to be significant (see slide 12 of his presentation). In response to a question from the audience (“how could a bank actually use this information?”), Noma suggested building a model that uses the 11 parameters, with weightings according to the significance of each parameter to the specific bank.

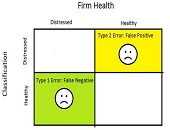

The whole point of discussing methodologies to evaluate credit risk is to be able to distinguish the healthy banks/countries/corporations from the distressed. On the topic of distinguishing the two, Noma had some words of warning. Errors will occur, and it is important to bear in mind which way the errors will tend to go (the bias). As the accompanying diagrams from his talk show, there will be false positives and false negatives in applying methodologies to the real world.

Who is paying the rating agency? Usually the issuer pays the credit rating agency, and thus it is inclined to “give the firm the benefit of the doubt.” That could have a material effect in determining where the point of default is declared.ª

Go to Part 2.ª

The webinar presentation slides can be found at: http://www.garp.org/risk-news-and-resources/webcasts/on-demand-webcasts.aspx