Why Don’t ESG Ratings Agree?

ESG (environmental, social, and governance) investing has become a popular choice for many investors. But how reliable are the ratings of the agencies that evaluate stocks for their ESG performance? What kind of discrepancies or “ESG noise” is found among such ratings, and can this be reduced? On October 5, 2023, Roberto Rigobon, assistant professor at the Sloan School of Management at Massachusetts Institute of Technology (MIT), posed these questions during a webinar was part of the series of talks sponsored by the Federal Reserve Bank of San Francisco (FRBSF), titled the Virtual Seminar on Climate Economics. His webinar was […]

Monitoring Risk While Pursuing High Returns: The Importance of Being Quantitative

“A quantitative model provides a very different insight than a rating,” said Rajan Singenellore, Global Business Manager of Risk & Valuations at Bloomberg. Models are based on objective inputs and usually publicly available information, whereas ratings are based on subjective factors and inside information. Singenellore was speaking about quantitative models as the second part of a two-part webinar presentation “Monitoring Risk While Pursuing High Returns” on March 7, 2013 organized by the Global Association of Risk Professionals (GARP). “A quantitative model lets you understand risk drivers and sensitivities,” he said, such as the effects of input changes on default risk […]

Monitoring Risk While Pursuing High Returns: Who Pays the Piper?

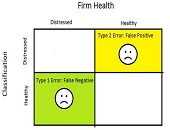

“Rating biases affect how we think about methodologies,” said Elliot Noma, Managing Director at Garrett Asset Management. “A rating agency paid by the issuer will likely give the firm the benefit of the doubt,” whereas a rating agency paid by the investor might want to more stringently evaluate the firm. “Both evaluations have the risk of error” due to bias. Noma was speaking about evaluation of credit risk as part of the webinar presentation “Monitoring Risk While Pursuing High Returns” on March 7, 2013 organized by the Global Association of Risk Professionals (GARP). He began by dividing non-structured credit exposure […]

Archives

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- August 2019

- June 2019

- April 2019

- March 2019

- February 2019

- January 2019

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2017

- November 2017

- October 2017

- June 2017

- May 2017

- April 2017

- March 2017

- December 2016

- November 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2011

- December 2010