“Board involvement is pivotal… It’s so much easier to get climate risk capability embedded,” said Jo Paisley, President of the Global Association of Risk Professionals (GARP). “Our survey found the vast majority of boards have oversight of climate-related risks and opportunities.” She was referring to the report titled Third Annual Global Survey of Climate Risk Management at Financial Firms available from the GARP website since September 2021.

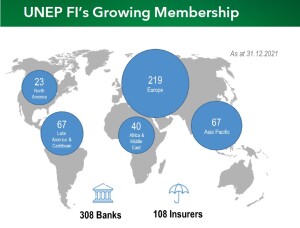

Paisley and two other panel members were part of the July 12, 2022, webinar to mark the publication of a joint report from GARP and the United Nations Environment Programme Finance Initiative (UNEP FI). The report is titled “Steering the Ship: Creating Board-Level Climate Dashboards for Banks” and is newly available from the UNEP FI website.

The joint report “is not an academic exercise but is useful in driving change. It is incredibly practical… [to have a] climate dashboard integrated into board metrics,” said David Carlin, TCFD Program Lead, UNEP-FI. “A dashboard takes knowledge across the industry and delivers it to leaders.”

In business, “dashboard” refers to a type of graphic that provides at-a-glance views of key performance indicators relevant to the goals of that business.

TCFD refers to the Task Force on Climate Related Financial Disclosures, a body created by the G20 Financial Stability Board to improve and increase reporting of climate-related financial information. The task force currently covers over 400 programs worldwide and has an ambition of net-zero emissions by 2050.

When it comes to climate risk, Paisley noted that corporate boards are a wide-ranging group and have many stakeholders. Some boards speak vaguely about “climate change” whereas others are firmly committed to net-zero emissions by a certain deadline.

“A dashboard is a sensible way to keep on top,” Paisley said and gave points on how to construct one. “The first stage is to ask what questions are most relevant… and what metrics are available.”

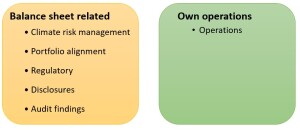

The survey asked about elements of a dashboard, and divided them into “balance sheet-related” and a company’s “own operations.”

When designing a dashboard, “know what you want to understand before you start,” Paisley urged.

In the UNEP FI report, climate risk drivers are divided into those due to physical risks and those due to transition risks.

• Physical risks arise from acute hazards — due to the increasing frequency and/or severity of extreme weather or weather-related events (for example, hurricanes, floods) — and from chronic hazards, which relate to long-term trends, such as rising sea levels and average temperatures.

• Transition risks can arise during the shift to a net-zero environment. For example, it occurs due to changing policy or regulations, legal risks, shifting supply and demand for goods and services, technological advances, and changing stakeholder expectations that give rise to reputational risks.

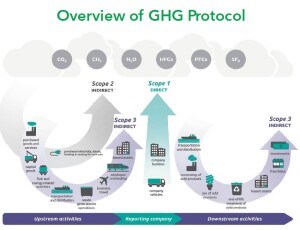

As an example of implementing dashboards, Maxine Nelson, Senior Vice-President GARP, summarized the greenhouse gas (GHG) emissions protocol across the value chain. She distinguished between “upstream” (such as business travel and leasing offices) and “downstream” (the bigger portion, including capital-financed emissions). “Financed emissions” refers to the emissions of clients to whom a bank (or other financial institution) provides capital.

Nelson said the survey showed “the biggest obstacle to constructing dashboards was the lack of data.” There were also issues with lack of international harmonization, costs of IT, and logistics such as how often to update the dashboard. Some companies found overlap with business continuity planning. She showed an example dashboard of “climate-related risk factors” from the Canadian financial services cooperative Desjardins.

Next she showed a heatmap of industry sectors, with green/amber/red coding for sensitivity to physical risk and transition risk.

“Portfolio alignment refers to the impact your balance sheet has on the climate,” Nelson said. This needs to be forward-looking, “and for the financed emissions, there aren’t that many measures.” She listed four typical measures:

- • Absolute emissions

- • Economic emissions intensity

- • Physical emissions intensity

- • Weighted average carbon intensity

Financial institutions need to examine their portfolios. “How ’green’ is your portfolio now? Are the companies you are lending to transitioning to net-zero? How are you engaging with those counterparties?” It’s not just climate risk; the measures of strategic and reputational risk will also be affected by a company’s perceived inaction on climate.

Nelson said the most common frequency of updating the dashboard is quarterly. But, how to express the quality of a loan on the books? She noted there are a few alignment metrics, such as:

- • Proportion of portfolio that is aligned (e.g. with net-zero target)

- • Size of divergence from a benchmark

- • Implied temperature rise of a portfolio

- • Progress toward implementing climate goals

Compliance-focused metrics are other items to monitor. “Are you keeping pace with regulators’ expectations?” Nelson said that more jurisdictions are mandating disclosures.

Paisley said climate risk is a component of scenario analysis at many firms. There are sustainable development goals (SDGs) that many companies consider. “Commitments to SDGs are good because you can report on progress toward these goals.”

She summarized the conclusions of the joint UNEP-FI and GARP report. “When it comes to creating dashboards, there is no ‘one size fits all.’” The company must decide which metrics are most meaningful. The stakeholders should set up a roadmap for how to manage climate risk. “No one has all the answers so let’s just get started.” ♠️

Click here to view the joint report by UNEP-FI and GARP, Steering the Ship: Creating Board-Level Climate Dashboards for Banks.

Click here to view the GARP survey, Third Annual Global Survey of Climate Risk Management at Financial Firms.